Sc 6096a 2010-2026

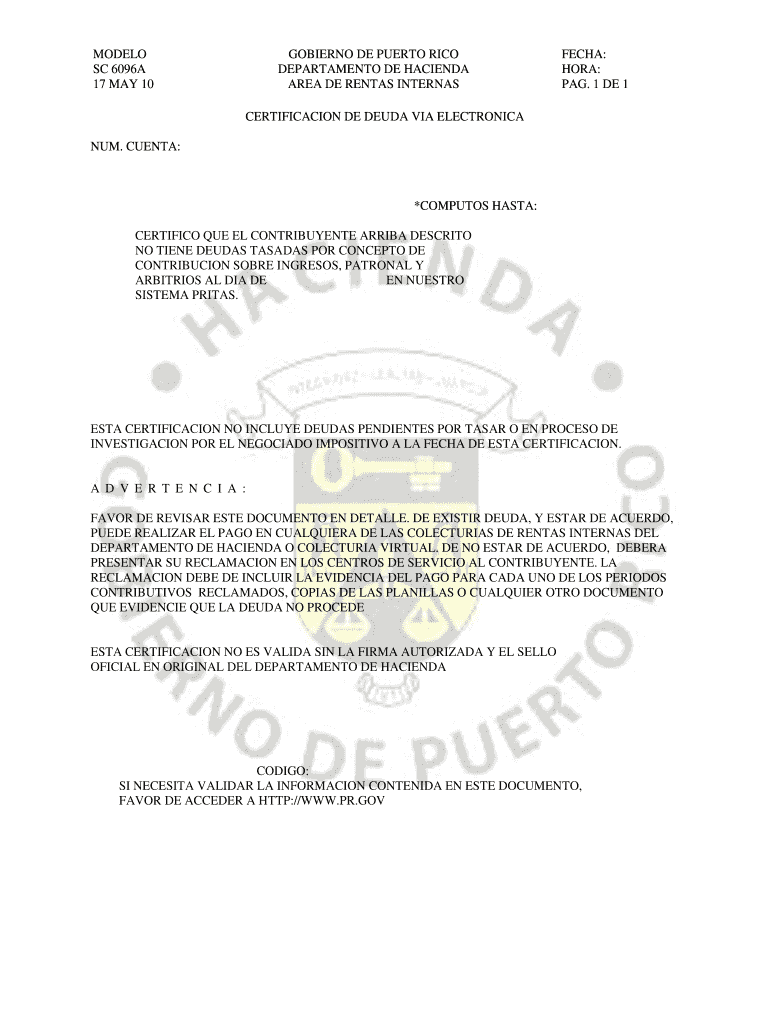

What is the SC 6096A?

The SC 6096A is a certification form used to confirm that an individual or entity has no outstanding debts with the tax authority. This document serves as an official statement indicating that all tax obligations have been met, which is crucial for individuals and businesses when applying for loans, permits, or other financial transactions. The SC 6096A is often required in various legal and financial contexts to demonstrate compliance with tax regulations.

How to Use the SC 6096A

Using the SC 6096A involves several steps to ensure that the certification accurately reflects your tax status. First, gather all necessary documentation related to your tax filings. This may include previous tax returns, payment receipts, and any correspondence with the tax authority. Next, complete the form by providing accurate information about your tax status and any relevant identification details. Once filled out, submit the SC 6096A to the appropriate tax authority for processing. It is advisable to keep a copy for your records.

Steps to Complete the SC 6096A

Completing the SC 6096A requires careful attention to detail. Follow these steps:

- Gather necessary documents, including tax returns and payment records.

- Fill out the form with your personal information, including name, address, and taxpayer identification number.

- Indicate your tax status and confirm that there are no outstanding debts.

- Review the form for accuracy and completeness.

- Submit the completed form to the relevant tax authority.

Legal Use of the SC 6096A

The SC 6096A is legally recognized as a valid certification of tax compliance. It can be used in various situations, such as applying for loans, obtaining business licenses, or participating in government contracts. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to legal penalties and complications with the tax authority.

Required Documents for the SC 6096A

To successfully complete the SC 6096A, certain documents are typically required. These may include:

- Previous tax returns to verify compliance.

- Payment receipts for any taxes owed.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready will facilitate the completion and submission of the SC 6096A.

Form Submission Methods

The SC 6096A can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online submission via the tax authority's official website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices.

Choosing the right submission method can help ensure timely processing of your certification.

Quick guide on how to complete dh sc6096a certificaci n de deuda de hacienda prgov

Your assistance manual on how to set up your Sc 6096a

If you’re uncertain about how to generate and submit your Sc 6096a, here are some concise guidelines to simplify tax processing.

To begin, you simply need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly intuitive and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to adjust information when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Sc 6096a in just a few minutes:

- Create your account and start editing PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to open your Sc 6096a in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes using airSlate SignNow. Please be aware that paper filing may increase return errors and delay refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

I’m shipping my product to Canada. How do I fill out a NAFTA Certificate of Origin? Are there other documents to be filled out?

Your shipment may need a NAFTA Certificate of Origin and a Shipper’s Export Declaration. To learn more about export documentation, please visit Export.gov to learn more.The U.S. Commercial Service’s Trade Information Center or the trade specialists at your local Export Assistance Center can also help answer these questions. Call 1-800-USA-TRAD(E) or find your local Export Assistance Center.International Trade Law includes the appropriate rules and customs for handling trade between countries. However, it is also used in legal writings as trade between private sectors, which is not right.This branch of law is now an independent field of study as most governments has become part of the world trade, as members of the World Trade Organization (WTO).Since the transaction between private sectors of different countries is an important part of the WTO activities, this latter branch of law is now a very important part of the academic works and is under study in many universities across the world.

-

How do I fill out the N-600 certificate of citizenship application if you already received a US passport from the state department and returned your Greencard as the questions seem to assume one is still on immigrant status?

In order to file N-600 to apply for a Certificate of Citizenship, you must already be a US citizen beforehand. (The same is true to apply for a US passport — you must already be a US citizen beforehand.) Whether you applied for a passport already is irrelevant; it is normal for a US citizen to apply for a US passport; applying for a passport never affects your immigration status, as you must already have been a US citizen before you applied for a passport.The form’s questions are indeed worded poorly. Just interpret the question to be asking about your status before you became a citizen, because otherwise the question would make no sense, as an applicant of N-600 must already be a US citizen at the time of filing the application.(By the way, why are you wasting more than a thousand dollars to apply for a Certificate of Citizenship anyway? It basically doesn’t serve any proof of citizenship purposes that a US passport doesn’t already serve as.)

-

How can I create an online certificate for membership? I want to send a link for members to just fill out and download.

ClassMarker will enable you to do exactly what you are wanting to achieve.With ClassMarker, you can create fully customized certificates.Options include:Portrait & Landscape CertificatesA4 & Letter sizesMultiple Font styles and sizesDrag and Drop Text and ImagesAdd extra Text fields and ImagesSelect different date display formatsAbility to create wallet sized certificatesYou can also now have Unique IDs, Serial Numbers, Course numbers and more included on your ClassMarker Certificates.If you choose for users to add their names, you can select for these to be automatically added to their certificates.Creating customized certificatesTo do as you have mentioned, you could create questionnaires/forms that you are wanting users to fill out (this can be done with a variety of different question types). You can ask for information such as name and/or email and additional ‘extra information’ questions that you can choose to make mandatory. If you like, you can choose to include these on the certificates as well.You will also be able to choose what your users see when they have finished completing their questionnaire. You can choose to not show any questions and answers but instead some customized feedback to thank your users for taking the time to fill out your questionnaire and any additional details you require, along with redirecting them elsewhere.Users will then click on the ‘certificate download’ button on their results page on-screen and/or have the results emailed to them which will also include the certificate download link so that they can download their certificate at a time that is convenient for them!You had mentioned you want to send a link to members - you can do this in ClassMarker by assigning your questionnaire to a link, in which you can then embed this directly into a page on your website or email them the link.You can check out ClassMarker’s video demo here:Online Testing Video Demonstrations

Create this form in 5 minutes!

How to create an eSignature for the dh sc6096a certificaci n de deuda de hacienda prgov

How to make an eSignature for the Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov online

How to create an electronic signature for your Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov in Google Chrome

How to generate an eSignature for signing the Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov in Gmail

How to make an eSignature for the Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov right from your smart phone

How to create an electronic signature for the Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov on iOS devices

How to make an electronic signature for the Dh Sc6096a Certificaci N De Deuda De Hacienda Prgov on Android OS

People also ask

-

¿Qué es la negativa de hacienda y cómo se obtiene?

La negativa de hacienda es un documento que certifica que no tienes deudas pendientes con la Agencia Tributaria. Para obtenerla, debes solicitarla a través de los canales oficiales de hacienda, asegurándote de estar al día con tus obligaciones. airSlate SignNow facilita la gestión de documentos necesarios para obtener esta negativa, haciendo el proceso más eficiente.

-

¿Cómo puede ayudar airSlate SignNow en el proceso de solicitud de la negativa de hacienda?

airSlate SignNow permite enviar y firmar electrónicamente todos los documentos necesarios para solicitar la negativa de hacienda. Con su interfaz amigable, puedes gestionar los trámites desde cualquier lugar, ahorrando tiempo y evitando errores en el proceso. Nuestra plataforma asegura que todas las firmas sean válidas y estén debidamente registradas.

-

¿Es seguro enviar documentos relacionados con la negativa de hacienda a través de airSlate SignNow?

Sí, airSlate SignNow utiliza tecnología de encriptación avanzada para proteger todos los documentos enviados, incluyendo la negativa de hacienda. La privacidad y seguridad de tus datos son nuestra prioridad, lo que garantiza que tus trámites se manejen de forma segura. Puedes confiar en que tu información estará protegida durante todo el proceso de firma.

-

¿Qué características ofrece airSlate SignNow que facilitan la obtención de la negativa de hacienda?

airSlate SignNow cuenta con herramientas como recordatorios automáticos, gestión de plantillas y seguimiento del estado de los documentos, que son clave para obtener tu negativa de hacienda sin inconvenientes. Además, puedes personalizar los flujos de trabajo según tus necesidades, optimizando el tiempo empleado en el proceso. Estas características te brindan control total sobre tus documentos.

-

¿Cuál es el costo de usar airSlate SignNow para gestionar la negativa de hacienda?

Los precios de airSlate SignNow son competitivos y varían según el plan elegido, permitiendo que las pequeñas y grandes empresas accedan a una solución económica para gestionar su negativa de hacienda. Ofrecemos diferentes planes para adaptarnos a tus necesidades, lo que te permite elegir la opción más adecuada sin comprometer la calidad del servicio. Visita nuestra página de precios para más detalles.

-

¿Puedo integrar airSlate SignNow con otras herramientas para facilitar la gestión de la negativa de hacienda?

Sí, airSlate SignNow se integra fácilmente con una variedad de aplicaciones y plataformas, lo que facilita la gestión de documentos relacionados con la negativa de hacienda. Esto te permite utilizar tus herramientas existentes mientras optimizas el flujo de trabajo. Las integraciones te permiten automizar procesos y mejorar la eficiencia en la gestión de tus documentos.

-

¿Qué beneficios obtengo al usar airSlate SignNow para la negativa de hacienda?

Al utilizar airSlate SignNow para gestionar tu negativa de hacienda, obtienes un proceso más rápido, ahorro en costos operativos y una reducción significativa en el uso de papel. La firma electrónica es legalmente vinculante, lo que te asegura que tus documentos serán aceptados por las autoridades. Además, nuestra fácil interfaz te permite manejar todo desde cualquier dispositivo, brindando flexibilidad y comodidad.

Get more for Sc 6096a

Find out other Sc 6096a

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy