941 PDF 2005-2026

What is the 9 3 form?

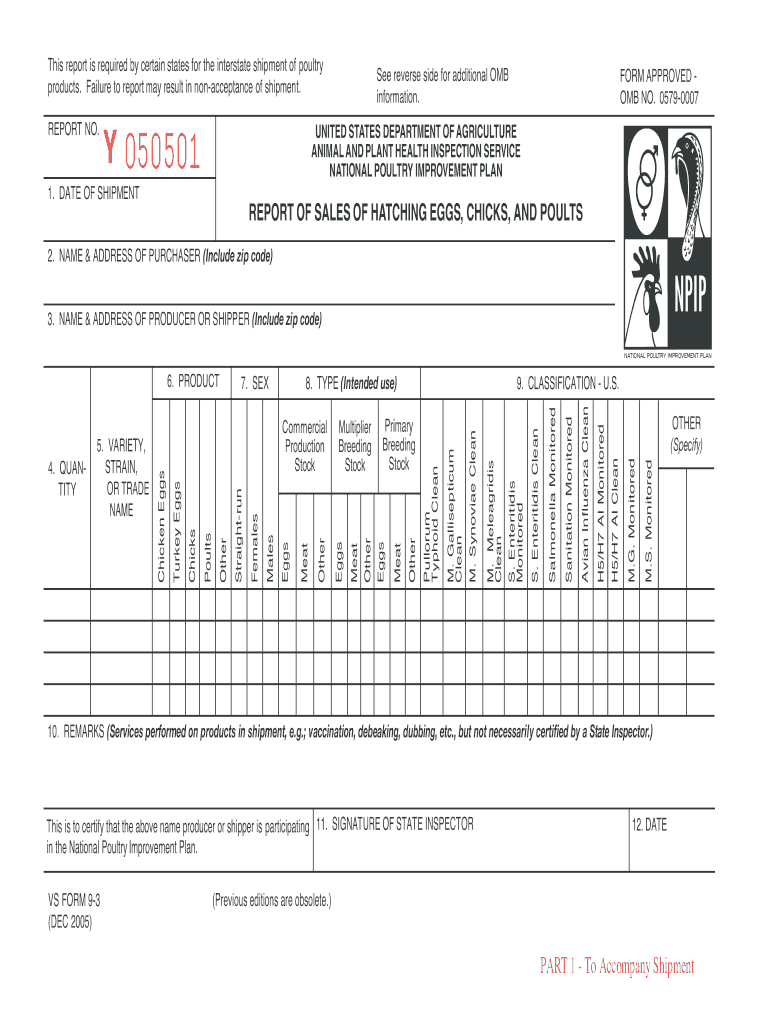

The 9 3 form, also known as the agriculture vs report, is a document used primarily in the agricultural sector to report sales and inventory of specific products, such as eggs and chicks. This form is essential for compliance with regulations set forth by the United States Department of Agriculture (USDA). It helps in maintaining accurate data regarding the production and sale of poultry, ensuring that agricultural businesses adhere to industry standards.

Steps to complete the 9 3 form

Completing the 9 3 form involves several key steps to ensure accuracy and compliance:

- Gather all necessary information regarding your sales and inventory.

- Ensure that you are using the most current version of the form, as outdated forms may not be accepted.

- Fill in all required fields, including details about the types and quantities of products sold.

- Double-check for any additional attachments or forms that may be required.

- Review the completed form for accuracy before submission.

Legal use of the 9 3 form

The legal use of the 9 3 form is crucial for agricultural businesses to avoid penalties and ensure compliance with federal regulations. This form must be submitted accurately and on time to the appropriate authorities. Failure to comply can result in fines or other legal repercussions. It is important to understand the specific requirements for your state, as these may vary.

Filing Deadlines / Important Dates

Filing deadlines for the 9 3 form can vary based on the reporting period and specific regulations. Generally, it is advisable to submit the form by the end of each quarter to ensure timely reporting. Keeping track of these deadlines is essential for maintaining compliance and avoiding late submission penalties.

Examples of using the 9 3 form

The 9 3 form is commonly used by poultry producers to report sales of hatching eggs, chicks, and poults. For instance, a poultry farm may use this form to document the number of eggs sold to hatcheries and the number of chicks sold to retailers. Accurate reporting helps in monitoring production levels and managing inventory effectively.

Who Issues the Form

The 9 3 form is issued by the United States Department of Agriculture (USDA). This federal agency oversees agricultural production and ensures that businesses comply with regulations regarding the sale and reporting of agricultural products. It is important for businesses to stay informed about any updates or changes to the form issued by the USDA.

Quick guide on how to complete vs form 9 3pdf

Explore the most efficient method to complete and sign your 941 Pdf

Are you still spending time preparing your official documents on paper rather than online? airSlate SignNow presents a superior option for completing and signing your 941 Pdf and related forms for public services. Our intelligent eSignature solution equips you with all the necessary tools to handle paperwork swiftly and in compliance with official standards - robust PDF editing, managing, securing, signing, and sharing features readily available within a user-friendly interface.

Only a few actions are needed to finish filling out and signing your 941 Pdf:

- Upload the fillable template to the editor using the Get Form button.

- Review what information is required in your 941 Pdf.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your information in the blanks.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure sections that are no longer pertinent.

- Hit Sign to create a legally binding eSignature using your chosen method.

- Add the Date next to your signature and complete your task with the Done button.

Store your completed 941 Pdf in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our service also offers versatile file sharing options. There’s no necessity to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

FAQs

-

How can I download a free PDF of any book?

Just Google it

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

Create this form in 5 minutes!

How to create an eSignature for the vs form 9 3pdf

How to create an eSignature for the Vs Form 9 3pdf in the online mode

How to make an electronic signature for the Vs Form 9 3pdf in Google Chrome

How to generate an electronic signature for signing the Vs Form 9 3pdf in Gmail

How to create an eSignature for the Vs Form 9 3pdf straight from your smartphone

How to create an eSignature for the Vs Form 9 3pdf on iOS

How to create an electronic signature for the Vs Form 9 3pdf on Android OS

People also ask

-

What is a 941 Pdf and how can airSlate SignNow help with it?

A 941 Pdf refers to the IRS Form 941 used for reporting employment taxes. airSlate SignNow simplifies the process of filling out and submitting your 941 Pdf by allowing you to electronically sign and send the document securely. With our user-friendly platform, businesses can ensure accurate submissions without the hassle of printing and mailing.

-

Is airSlate SignNow affordable for small businesses managing 941 Pdf forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses, making it an ideal solution for managing 941 Pdf forms. Our competitive rates ensure that you can efficiently handle your documentation needs without straining your budget. Plus, we provide a free trial so you can explore our features before committing.

-

What features does airSlate SignNow offer for managing 941 Pdf documents?

airSlate SignNow provides a range of features specifically designed for efficiently managing 941 Pdf documents, including customizable templates, automated workflows, and secure eSignature options. These features streamline the process, reduce errors, and save time, allowing businesses to focus on their core operations.

-

Can I integrate airSlate SignNow with other tools for handling 941 Pdf forms?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, such as Google Drive, Salesforce, and Dropbox, which enhances your ability to manage 941 Pdf forms. This integration allows for easy access and sharing of documents, making collaboration more efficient among team members.

-

How do I ensure my 941 Pdf documents are secure with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 941 Pdf. Our platform utilizes advanced encryption and secure cloud storage to protect your data. Additionally, all eSignatures are legally binding, ensuring compliance with industry regulations.

-

What are the benefits of using airSlate SignNow for 941 Pdf submissions?

Using airSlate SignNow for your 941 Pdf submissions offers several benefits, including increased efficiency, reduced paperwork, and quicker processing times. The platform’s intuitive interface allows users to complete and send forms with just a few clicks, helping businesses stay organized and compliant with tax regulations.

-

Can I track the status of my 941 Pdf submissions in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your 941 Pdf submissions. You can easily monitor who has viewed or signed the document, ensuring that you stay updated throughout the process. This feature enhances accountability and transparency for your business.

Get more for 941 Pdf

- Vtl acquisition vodacom app download form

- Shriram transport finance 15g form online submission

- Hicaps add provider 64632056 form

- Jukebox labels template microsoft word form

- Authorization letter for form 137

- Ocrg so form no 1 pdf download

- Dental inventory spreadsheet pdf form

- Limited liability company foreign form

Find out other 941 Pdf

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract