Facility 222 DOC Form

What is the independent contractor worksheet?

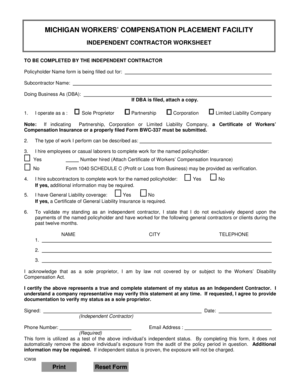

The independent contractor worksheet is a crucial document used by businesses and individuals to gather essential information about independent contractors. This form typically includes details such as the contractor's name, address, Social Security number or Employer Identification Number (EIN), and the nature of the services provided. It serves as a foundational tool for ensuring compliance with tax regulations and for accurately reporting payments made to contractors. In the context of the Michigan workers compensation placement facility, this worksheet is particularly important for determining eligibility and ensuring proper compensation placement for independent contractors.

Steps to complete the independent contractor worksheet

Completing the independent contractor worksheet involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the contractor, including personal identification details and the scope of work. Next, fill out the form carefully, ensuring that all sections are completed, including the contractor's tax identification details. It is also essential to review the form for any errors or omissions before submission. Finally, ensure that the contractor signs the worksheet to validate the information provided. This process helps maintain clarity and accountability in contractor relationships.

Legal use of the independent contractor worksheet

The independent contractor worksheet must adhere to specific legal standards to be considered valid. In the United States, it is essential that the form complies with federal and state regulations regarding independent contractor classification. This includes ensuring that the contractor meets the criteria set forth by the IRS and other regulatory bodies. Proper completion of the worksheet not only facilitates accurate tax reporting but also protects businesses from potential legal issues related to misclassification of workers. By utilizing a reliable solution like signNow, businesses can ensure that their documents are executed in compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Required documents for the independent contractor worksheet

When preparing to fill out the independent contractor worksheet, certain documents are typically required to ensure comprehensive and accurate information. These documents may include:

- W-9 form, which provides the contractor's tax identification number.

- Proof of identity, such as a driver's license or Social Security card.

- Contracts or agreements outlining the scope of work and payment terms.

- Any relevant business licenses or permits, if applicable.

Having these documents ready can streamline the completion process and ensure that all necessary information is captured accurately.

IRS guidelines for independent contractors

The IRS provides specific guidelines regarding the classification and reporting of independent contractors. According to IRS standards, an independent contractor is typically defined as a self-employed individual who offers services to clients under a contract. It is essential for businesses to understand the difference between employees and independent contractors to avoid misclassification. The IRS requires that all payments made to independent contractors be reported on Form 1099-MISC if they exceed a certain threshold. Familiarizing oneself with these guidelines not only aids in compliance but also helps in maintaining proper records for tax purposes.

Penalties for non-compliance with independent contractor regulations

Failure to comply with regulations regarding independent contractors can result in significant penalties for businesses. Misclassification of workers can lead to back taxes, fines, and legal fees. Additionally, businesses may be held liable for unpaid employment taxes and benefits if an independent contractor is incorrectly classified as an employee. It is crucial for businesses to ensure that they accurately complete the independent contractor worksheet and adhere to IRS guidelines to mitigate these risks. Regular audits and reviews of contractor classifications can also help maintain compliance and avoid potential penalties.

Quick guide on how to complete facility 222 doc

Manage Facility 222 doc seamlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Facility 222 doc on any system using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and electronically sign Facility 222 doc effortlessly

- Locate Facility 222 doc and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided specifically for this purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form retrieval, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Facility 222 doc and ensure excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the facility 222 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an independent contractor worksheet?

An independent contractor worksheet is a document used to outline essential information regarding payments and taxes for independent contractors. It helps both contractors and businesses track earnings, deductions, and necessary tax filings. Using airSlate SignNow, you can easily create and manage an independent contractor worksheet to streamline your paperwork.

-

How can I create an independent contractor worksheet using airSlate SignNow?

Creating an independent contractor worksheet with airSlate SignNow is simple and user-friendly. Just log in to your account, select the template for an independent contractor worksheet, and customize it to meet your needs. Once completed, you can eSign and share it with your contractors directly through the platform.

-

Is there a cost associated with using airSlate SignNow for the independent contractor worksheet?

Yes, airSlate SignNow offers a range of pricing plans tailored to business needs, starting with a free trial that allows you to explore its features. The cost will depend on the plan you choose and the various functionalities you require, such as managing independent contractor worksheets and other document-related tasks. Overall, it's a cost-effective solution for document management.

-

What are the key features of the independent contractor worksheet in airSlate SignNow?

The independent contractor worksheet in airSlate SignNow includes features like customizable templates, easy eSigning, and secure document storage. Additionally, you can automate reminders for due payments and manage document sharing with clients seamlessly. These features enhance efficiency and reduce the time spent on paperwork.

-

How does an independent contractor worksheet benefit my business?

Utilizing an independent contractor worksheet can signNowly benefit your business by ensuring accurate record-keeping and compliance with tax regulations. It simplifies the payment process for contractors, which in turn fosters positive working relationships. Moreover, using airSlate SignNow can help streamline these processes through its digital platform.

-

Can I integrate airSlate SignNow with other tools I use for managing independent contractors?

Absolutely! airSlate SignNow offers integrations with various business tools and platforms. You can connect it with your accounting software, project management apps, and CRM systems to create a seamless workflow when handling independent contractor worksheets and other documents.

-

Is airSlate SignNow suitable for small businesses managing independent contractors?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it particularly useful for small businesses managing independent contractors. Its affordable pricing and easy-to-use interface allow small business owners to handle their independent contractor worksheets without needing extensive resources or time.

Get more for Facility 222 doc

Find out other Facility 222 doc

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement