T2 Corporation Tax 2010

What is the T2 Corporation Tax

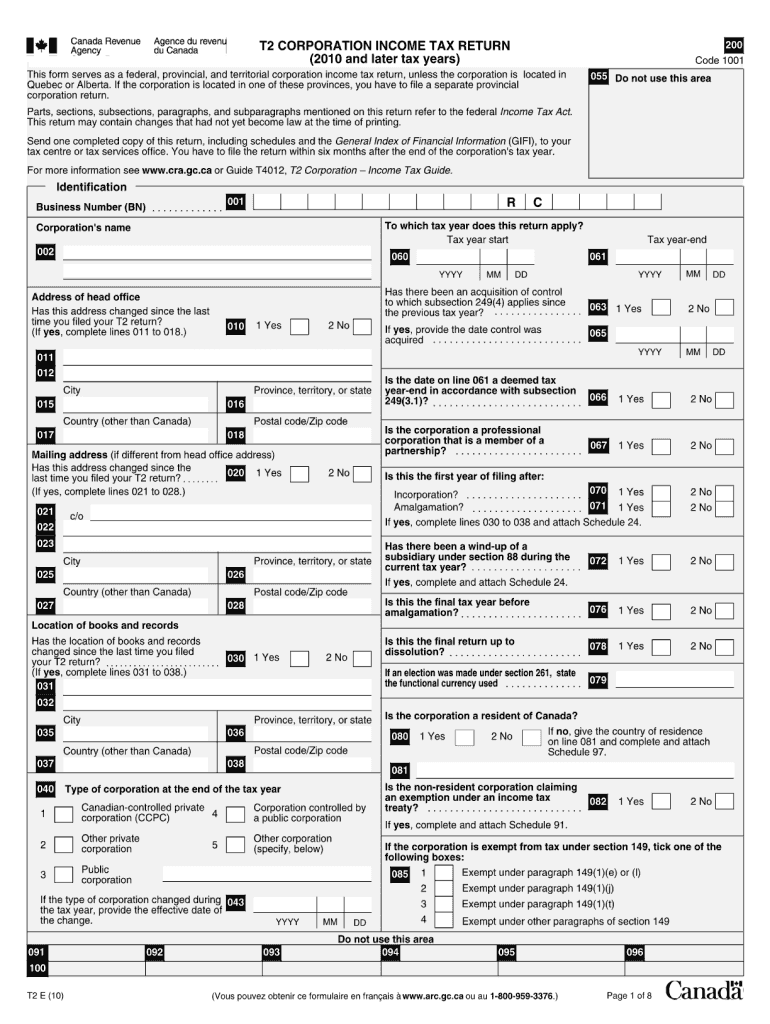

The T2 Corporation Tax is a tax return that corporations in Canada must file to report their income, calculate taxes owed, and claim deductions. This form is essential for Canadian corporations, including those operating in the U.S. but registered in Canada. The T2 return covers various aspects of corporate income, including revenue, expenses, and tax credits. Understanding the T2 Corporation Tax is crucial for compliance with Canadian tax laws and for accurate financial reporting.

How to complete the T2 Corporation Tax

Completing the T2 Corporation Tax involves several steps. First, gather all necessary financial documents, including income statements and receipts for expenses. Next, fill out the T2 form, ensuring all sections are completed accurately. Key sections include income, deductions, and tax calculations. After completing the form, review it for accuracy before submission. Utilizing digital tools can simplify this process, as they often include built-in calculations and error-checking features.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the T2 Corporation Tax. Generally, the T2 return is due six months after the end of the corporation's fiscal year. For example, if a corporation's fiscal year ends on December 31, the return is due by June 30 of the following year. It's essential to be aware of these dates to avoid penalties and interest on unpaid taxes.

Required Documents

To successfully file the T2 Corporation Tax, several documents are required. These include:

- Financial statements, such as balance sheets and income statements

- Receipts and invoices for all deductible expenses

- Information on any tax credits the corporation intends to claim

- Details of any capital gains or losses

Having these documents prepared in advance can streamline the filing process and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failing to file the T2 Corporation Tax on time can result in significant penalties. Corporations may face fines based on the amount of tax owed, and interest may accrue on any unpaid taxes. Additionally, non-compliance can lead to audits and further scrutiny from tax authorities. It is crucial for corporations to understand these risks and prioritize timely and accurate filing.

Digital vs. Paper Version

Corporations can choose to file the T2 Corporation Tax either digitally or via paper forms. The digital version offers advantages such as faster processing times and built-in error checks. In contrast, paper filing may take longer to process and can lead to delays in receiving any refunds. Many corporations find that using electronic filing systems enhances efficiency and reduces the likelihood of errors in their submissions.

Quick guide on how to complete t2 corporation tax

Complete T2 Corporation Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage T2 Corporation Tax on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign T2 Corporation Tax with ease

- Find T2 Corporation Tax and select Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Decide how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign T2 Corporation Tax to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2 corporation tax

Create this form in 5 minutes!

How to create an eSignature for the t2 corporation tax

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Canada T2 corporation income tax return schedule 97?

The Canada T2 corporation income tax return schedule 97 is a form used by Canadian corporations to report their income and calculate taxes owed. It ensures compliance with the Canada Revenue Agency (CRA) requirements. Properly filling out this schedule is essential for accurate tax reporting.

-

How can airSlate SignNow assist with preparing the Canada T2 corporation income tax return schedule 97?

airSlate SignNow simplifies the process of preparing the Canada T2 corporation income tax return schedule 97 by allowing users to create, edit, and share tax documents securely. Our platform facilitates smooth collaboration among team members and ensures that all necessary signatures are obtained efficiently. This can help save time and reduce errors in your tax preparation.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as document templates, e-signature functionality, and cloud storage to manage your tax documents, including the Canada T2 corporation income tax return schedule 97. These tools streamline your workflow by allowing you to store and edit documents seamlessly. Our platform enhances your team's productivity when handling documentation.

-

Is airSlate SignNow cost-effective for businesses preparing the Canada T2 corporation income tax return schedule 97?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes preparing the Canada T2 corporation income tax return schedule 97. By reducing paper usage and enhancing collaboration, companies can lower their operating costs. Plus, the ROI from efficient tax document management can justify the investment.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates with various accounting software solutions to facilitate the preparation of the Canada T2 corporation income tax return schedule 97. This integration allows for seamless data transfer between platforms, minimizing duplication of efforts and reducing the risk of errors during tax filing.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management enhances efficiency and accuracy when preparing the Canada T2 corporation income tax return schedule 97. The platform offers secure e-signatures, templates, and easy sharing options that streamline collaboration. By leveraging these features, businesses can ensure compliance and reduce the stress associated with tax season.

-

Is it easy to get support for using airSlate SignNow?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any issues related to the Canada T2 corporation income tax return schedule 97. Our support team is available via chat, email, or phone, ensuring you get the help you need promptly. Additionally, we offer resources and tutorials to help you navigate the platform effectively.

Get more for T2 Corporation Tax

Find out other T2 Corporation Tax

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now