Ct Form Au 766

What is the CT Form AU 766

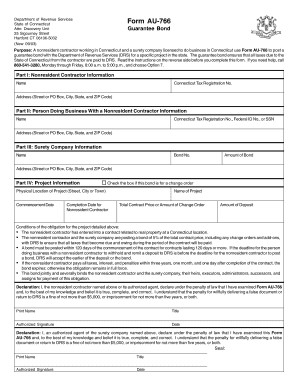

The CT Form AU 766 is a specific document used in Connecticut for various administrative purposes, often related to taxation and business operations. This form is essential for individuals and businesses to report specific information to the state. Understanding the purpose of this form is crucial for compliance with state regulations.

How to Use the CT Form AU 766

Using the CT Form AU 766 involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation that supports the information you will provide. Next, carefully fill out the form, ensuring that each section is completed according to the instructions provided. It is important to double-check your entries for accuracy before submission. Finally, submit the form through the designated method, whether online or by mail, to ensure it reaches the appropriate state department.

Steps to Complete the CT Form AU 766

Completing the CT Form AU 766 requires attention to detail. Follow these steps:

- Review the form to understand its requirements.

- Collect all necessary supporting documents, such as identification and financial records.

- Fill out the form, ensuring all sections are completed accurately.

- Check for any errors or omissions in your entries.

- Submit the form according to the guidelines provided, either online or via mail.

Legal Use of the CT Form AU 766

The CT Form AU 766 has legal implications, as it is used to report essential information to state authorities. Properly completing and submitting this form ensures compliance with Connecticut laws and regulations. Failure to use this form correctly may result in penalties or legal issues, emphasizing the importance of understanding its legal context.

Key Elements of the CT Form AU 766

The key elements of the CT Form AU 766 include personal identification information, details regarding the nature of the report, and any financial data that must be disclosed. Each section of the form is designed to capture specific information that is vital for state records. Ensuring that all key elements are accurately reported is essential for the form's validity.

Form Submission Methods

The CT Form AU 766 can be submitted through various methods, including online submission via the state’s official website, mailing a physical copy to the designated department, or in-person delivery. Each method has its own set of guidelines and timelines, so it is important to choose the one that best fits your needs while ensuring compliance with submission deadlines.

Quick guide on how to complete ct form au 766

Effortlessly Prepare Ct Form Au 766 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Ct Form Au 766 on any device using airSlate SignNow’s Android or iOS applications and enhance your document-related tasks today.

The easiest way to alter and electronically sign Ct Form Au 766 effortlessly

- Obtain Ct Form Au 766 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced files, monotonous form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Modify and electronically sign Ct Form Au 766 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct form au 766

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 766 and how does it work with airSlate SignNow?

Ct 766 is a specialized electronic signature solution that enhances document workflows. With airSlate SignNow, ct 766 allows users to easily send, eSign, and manage documents in a secure and efficient manner.

-

What are the key features of airSlate SignNow related to ct 766?

AirSlate SignNow offers features such as customizable templates, multi-user support, and real-time notifications that enhance the functionality of ct 766. These tools help streamline document management, making it easier for businesses to operate efficiently.

-

How much does airSlate SignNow cost for users of ct 766?

Pricing for airSlate SignNow varies depending on the plan you choose, catering to different business needs and sizes. Users interested in ct 766 can select from various subscription options, which offers a cost-effective solution for seamless document signing.

-

Is ct 766 secure for sensitive documents?

Yes, ct 766 ensures the highest levels of security for sensitive documents processed through airSlate SignNow. The platform employs advanced encryption and compliance with industry regulations, providing peace of mind for organizations handling confidential information.

-

Can I integrate airSlate SignNow with other tools while using ct 766?

Absolutely! AirSlate SignNow supports a range of integrations with popular applications and tools. This flexibility allows users of ct 766 to connect their existing workflows and maximize their productivity.

-

What benefits does airSlate SignNow offer to users of ct 766?

Using airSlate SignNow with ct 766 offers numerous benefits, including increased efficiency in document processing and improved collaboration among teams. This user-friendly platform helps businesses save time and reduce administrative burdens.

-

How can small businesses take advantage of ct 766 with airSlate SignNow?

Small businesses can leverage ct 766 through airSlate SignNow to simplify their document management and signing processes. The platform is designed to be cost-effective and easy to use, making it an ideal choice for companies looking to enhance their operations.

Get more for Ct Form Au 766

- Persuasive writing organizer julian high school form

- Application for ticket refund metra form

- Chicago teachers union sweatshirt form

- Chicago tempered glass form

- Payment south holland 482768584 form

- Camper information form skokie

- Illinois religious exemption form

- Illinois youth soccer association sanctioned tournament roster form

Find out other Ct Form Au 766

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself