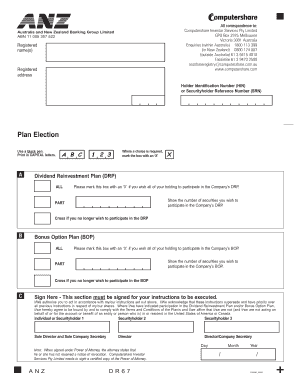

Anz Dividend Reinvestment Plan Form

What is the ANZ Dividend Reinvestment Plan?

The ANZ Dividend Reinvestment Plan (DRP) allows shareholders to reinvest dividends received from their ANZ shares into additional shares rather than receiving cash payments. This plan can be an advantageous option for investors looking to increase their shareholding without incurring additional transaction costs. By opting into the DRP, shareholders can benefit from compound growth over time, as the reinvested dividends can generate further returns.

How to Use the ANZ Dividend Reinvestment Plan

To utilize the ANZ Dividend Reinvestment Plan, shareholders must first ensure they are eligible and have registered for the program. This typically involves completing the ANZ DR67 form, which is the application for participation in the DRP. Once registered, dividends will automatically be reinvested in additional shares at the prevailing market price, allowing for seamless participation in the plan.

Steps to Complete the ANZ Dividend Reinvestment Plan

Completing the ANZ Dividend Reinvestment Plan involves several key steps:

- Review eligibility criteria to ensure you qualify for the plan.

- Obtain and complete the ANZ DR67 form, providing necessary personal and shareholding details.

- Submit the completed form to ANZ by the specified deadline to ensure participation in the upcoming dividend cycle.

- Monitor your account to confirm that dividends are being reinvested as intended.

Legal Use of the ANZ Dividend Reinvestment Plan

The ANZ Dividend Reinvestment Plan is legally recognized under U.S. law, provided that participants adhere to the relevant regulations governing dividend reinvestment programs. This includes compliance with securities laws and ensuring that all necessary documentation, such as the ANZ DR67 form, is correctly completed and submitted. Utilizing an electronic signature solution, such as airSlate SignNow, can enhance the legal validity of your application by ensuring compliance with eSignature laws.

Eligibility Criteria

To participate in the ANZ Dividend Reinvestment Plan, shareholders must meet specific eligibility criteria. Generally, this includes being a registered holder of ANZ shares and having a valid account with the company. Additionally, there may be minimum shareholding requirements or restrictions based on the type of shares held. It is advisable to review the terms of the plan to confirm eligibility before applying.

Required Documents

Participation in the ANZ Dividend Reinvestment Plan typically requires the completion of the ANZ DR67 form. This form requests essential information such as your personal details, shareholding information, and preferences regarding dividend reinvestment. It is important to ensure that all information is accurate and complete to avoid any delays in processing your application.

Form Submission Methods

The ANZ DR67 form can be submitted through various methods to accommodate shareholder preferences. Shareholders may choose to submit the form electronically via a secure online portal, or they can opt for traditional methods such as mailing the completed form to ANZ's designated address. In-person submissions may also be available at select ANZ branches, depending on local regulations and availability.

Quick guide on how to complete anz dividend reinvestment plan

Complete Anz Dividend Reinvestment Plan effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with the essential tools to create, edit, and electronically sign your documents swiftly and without complications. Manage Anz Dividend Reinvestment Plan on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Anz Dividend Reinvestment Plan effortlessly

- Locate Anz Dividend Reinvestment Plan and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers for that specific purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Anz Dividend Reinvestment Plan to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anz dividend reinvestment plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ANZ dividend reinvestment plan?

The ANZ dividend reinvestment plan allows shareholders to reinvest their dividends into additional shares instead of receiving cash payments. This plan can help investors grow their holdings over time without incurring brokerage fees, making it an attractive option for long-term wealth accumulation.

-

How do I enroll in the ANZ dividend reinvestment plan?

To enroll in the ANZ dividend reinvestment plan, shareholders must complete the necessary application form provided by ANZ. Once your application is processed, subsequent dividends will automatically be reinvested in additional shares, streamlining the investment process.

-

Are there any fees associated with the ANZ dividend reinvestment plan?

One of the major benefits of the ANZ dividend reinvestment plan is that it typically does not incur any brokerage fees for reinvestments. However, it's important to refer to the specific terms and conditions provided by ANZ for potential fees or tax implications.

-

What are the benefits of using the ANZ dividend reinvestment plan?

The ANZ dividend reinvestment plan offers several benefits, including the ability to grow your investment without additional costs, potential compounding of returns, and enhanced portfolio diversification. This plan is ideal for investors looking to maximize their returns over the long term.

-

Can I opt out of the ANZ dividend reinvestment plan at any time?

Yes, shareholders can opt out of the ANZ dividend reinvestment plan at any time by notifying ANZ in accordance with their guidelines. This flexibility allows investors to adjust their investment strategy as needed, depending on their financial goals.

-

Does the ANZ dividend reinvestment plan apply to all types of shares?

The ANZ dividend reinvestment plan generally applies to fully paid ordinary shares. It's advisable to check with ANZ or the plan documentation to confirm eligibility for specific share classes or securities.

-

How often are dividends reinvested in the ANZ dividend reinvestment plan?

Dividends are typically reinvested on the payment date specified by ANZ. This regular reinvestment schedule allows shareholders to continually increase their shareholdings with each dividend payment.

Get more for Anz Dividend Reinvestment Plan

Find out other Anz Dividend Reinvestment Plan

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document