Form 1113

What is the Form 1113

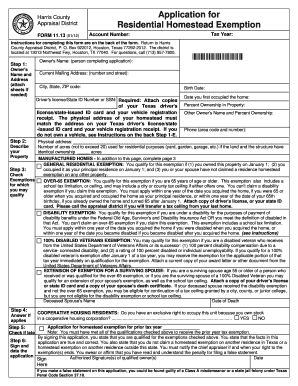

The Form 1113, commonly referred to as the Harris County Homestead Exemption Form, is a crucial document for homeowners in Harris County, Texas. This form allows eligible property owners to apply for a homestead exemption, which can reduce the amount of property taxes owed. The exemption is designed to provide financial relief to homeowners by lowering their taxable property value, thus decreasing their overall tax burden. Understanding the purpose and benefits of this form is essential for any homeowner seeking to take advantage of available tax savings.

How to use the Form 1113

Using the Form 1113 involves a straightforward process that begins with obtaining the form from the Harris County Appraisal District. Once you have the form, carefully fill it out, ensuring that all required information is accurate and complete. Key sections of the form may include personal identification details, property information, and eligibility criteria. After completing the form, submit it to the appropriate county office, either online or by mail, to initiate the review process for your homestead exemption application.

Steps to complete the Form 1113

Completing the Form 1113 requires several important steps:

- Download or request the Form 1113 from the Harris County Appraisal District.

- Provide your personal information, including your name, address, and contact details.

- Enter property details, such as the property address and identification number.

- Indicate your eligibility for the homestead exemption by answering relevant questions on the form.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the Harris County Appraisal District by the specified deadline.

Key elements of the Form 1113

The Form 1113 consists of several key elements that are essential for a successful application:

- Applicant Information: This section requires personal details of the homeowner, including name and contact information.

- Property Information: Homeowners must provide specifics about the property for which they are seeking an exemption.

- Eligibility Criteria: Questions that determine if the applicant qualifies for the homestead exemption, such as residency status and ownership details.

- Signature: A signature is required to validate the information provided and affirm the application.

Legal use of the Form 1113

The legal use of the Form 1113 is governed by Texas property tax laws. To ensure compliance, homeowners must submit the form by the designated deadline, typically by April 30 of the tax year. The form must be filled out accurately, as any discrepancies or false information can lead to penalties or denial of the exemption. Understanding the legal framework surrounding the form helps homeowners navigate the application process effectively and avoid potential legal issues.

Form Submission Methods

Homeowners can submit the Form 1113 through various methods, ensuring convenience and accessibility:

- Online Submission: Many counties, including Harris County, offer an online portal for submitting the form electronically.

- Mail: Homeowners can print the completed form and send it via postal service to the Harris County Appraisal District.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at the county office is also an option.

Quick guide on how to complete form 1113

Accurately complete Form 1113 on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, enabling you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly and efficiently. Manage Form 1113 on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Form 1113 effortlessly

- Find Form 1113 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure private details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1113 to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1113

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are HCAD popular forms?

HCAD popular forms refer to the commonly used documents related to property appraisal and taxation provided by the Harris County Appraisal District. airSlate SignNow supports these forms, making it easy for users to send and eSign them efficiently.

-

How can airSlate SignNow help with HCAD popular forms?

airSlate SignNow streamlines the process of managing HCAD popular forms by allowing users to create, send, and eSign documents securely. This improves efficiency and reduces the time spent on paperwork, ensuring that all tax-related documents are handled effectively.

-

What features does airSlate SignNow offer for handling HCAD popular forms?

airSlate SignNow offers features such as cloud storage, customizable templates, and robust analytics tailored to HCAD popular forms. These features facilitate a smoother workflow, enabling users to track the status of documents easily and ensure timely submissions.

-

Is airSlate SignNow cost-effective for managing HCAD popular forms?

Yes, airSlate SignNow provides a cost-effective solution for managing HCAD popular forms, making it accessible for businesses of all sizes. With competitive pricing plans, users can save money while improving their document management processes.

-

Can airSlate SignNow integrate with my existing software when using HCAD popular forms?

Absolutely! airSlate SignNow seamlessly integrates with various software that can be useful for HCAD popular forms. This allows for a cohesive workflow, ensuring that all aspects of document management are connected and efficient.

-

What are the benefits of using airSlate SignNow for HCAD popular forms?

Using airSlate SignNow for HCAD popular forms offers multiple benefits, including enhanced security through encrypted eSigning, reduced paperwork, and faster processing times. These advantages help businesses manage their documents more effectively and comply with regulations.

-

Is it easy to eSign HCAD popular forms with airSlate SignNow?

Yes, eSigning HCAD popular forms with airSlate SignNow is very user-friendly. The platform is designed to simplify the signing process, enabling users to complete their documents quickly from any device.

Get more for Form 1113

Find out other Form 1113

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF