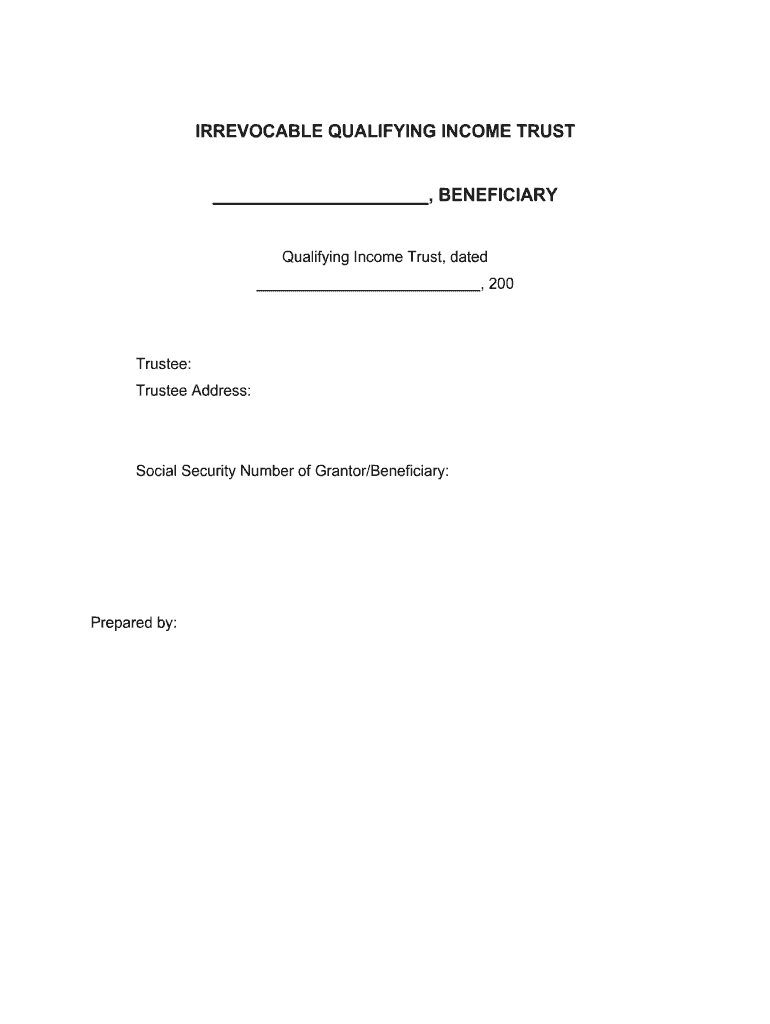

Fillable Florida Qualified Income Trust Form

What is the fillable Florida qualified income trust form?

The fillable Florida qualified income trust form is a legal document designed to help individuals manage their income in a way that meets Florida's Medicaid eligibility requirements. This form allows individuals to create a trust that can hold income above the state’s Medicaid limits while still qualifying for benefits. The trust typically allows for the income to be used for the benefit of the individual, ensuring that they can receive necessary medical care without exceeding income thresholds.

Steps to complete the fillable Florida qualified income trust form

Completing the fillable Florida qualified income trust form involves several key steps:

- Gather necessary information, including personal details and financial data.

- Fill out the trust form, ensuring all fields are completed accurately.

- Include the names of the trustee and beneficiaries, along with their addresses.

- Specify the terms of the trust, including how income will be managed and distributed.

- Review the completed form for accuracy and completeness.

- Sign and date the form in the presence of a notary public, if required.

Legal use of the fillable Florida qualified income trust form

The legal use of the fillable Florida qualified income trust form is crucial for ensuring compliance with state regulations. This form must be executed properly to be considered valid. It is important to adhere to Florida laws regarding trusts, which include specific requirements for the signing and witnessing of the document. Failure to follow these legal guidelines may result in the trust being deemed invalid, jeopardizing the individual’s eligibility for Medicaid benefits.

Key elements of the fillable Florida qualified income trust form

Several key elements are essential to the fillable Florida qualified income trust form:

- Trustee Information: The name and address of the individual or entity managing the trust.

- Beneficiary Details: Information about the beneficiaries who will receive benefits from the trust.

- Income Management: Clear instructions on how the income will be handled within the trust.

- Trust Terms: Specific conditions under which the trust operates.

- Signatures: Required signatures of the trustee and possibly witnesses or a notary.

How to obtain the fillable Florida qualified income trust form

The fillable Florida qualified income trust form can typically be obtained from various sources, including:

- State government websites that provide legal forms.

- Legal aid organizations that assist individuals with trust and estate planning.

- Attorneys specializing in elder law or estate planning.

Eligibility criteria for the fillable Florida qualified income trust form

To utilize the fillable Florida qualified income trust form, individuals must meet specific eligibility criteria. Generally, these criteria include:

- Being a Florida resident.

- Having income that exceeds the Medicaid eligibility limit.

- Intending to use the trust to qualify for Medicaid benefits while managing excess income.

Quick guide on how to complete fillable florida qualified income trust form

Complete Fillable Florida Qualified Income Trust Form smoothly on any device

Online document handling has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Fillable Florida Qualified Income Trust Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Fillable Florida Qualified Income Trust Form effortlessly

- Obtain Fillable Florida Qualified Income Trust Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Fillable Florida Qualified Income Trust Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable florida qualified income trust form

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is a Florida qualified income trust template?

A Florida qualified income trust template is a legal document designed to help individuals manage their income while qualifying for Medicaid. By using this template, you can ensure that your assets are treated properly under Florida’s Medicaid regulations.

-

How can I create a Florida qualified income trust template?

Creating a Florida qualified income trust template is simple with airSlate SignNow. You can customize the template to meet your specific needs and ensure compliance with state laws, making it easy to manage your income effectively.

-

What are the benefits of using a Florida qualified income trust template?

The primary benefits of using a Florida qualified income trust template include protecting your assets while pursuing Medicaid eligibility and ensuring that your income is properly structured. This can help reduce stress during the application process and provide peace of mind.

-

Is there a cost associated with the Florida qualified income trust template?

Yes, there may be costs associated with obtaining a Florida qualified income trust template, including legal fees or subscription costs for document creation tools like airSlate SignNow. However, utilizing these services often saves money compared to traditional legal assistance.

-

Can I eSign the Florida qualified income trust template?

Absolutely! airSlate SignNow allows you to eSign the Florida qualified income trust template securely and efficiently. This feature streamlines the signing process, making it more convenient and legally binding.

-

Are there integrations available with the Florida qualified income trust template?

Yes, airSlate SignNow offers various integrations that can enhance the use of your Florida qualified income trust template. You can seamlessly connect with other tools and platforms to manage your documents more effectively.

-

How does a Florida qualified income trust template affect my Medicaid application?

Using a Florida qualified income trust template can signNowly improve your Medicaid application process by ensuring that your income is structured in a way that complies with state regulations. This can help you qualify for benefits without losing your assets.

Get more for Fillable Florida Qualified Income Trust Form

- Financing statement amendment 497308294 form

- Legal last will and testament form for single person with no children kentucky

- Legal last will and testament form for a single person with minor children kentucky

- Legal last will and testament form for single person with adult and minor children kentucky

- Legal last will and testament form for single person with adult children kentucky

- Legal last will and testament for married person with minor children from prior marriage kentucky form

- Legal last will and testament form for married person with adult children from prior marriage kentucky

- Legal last will and testament form for divorced person not remarried with adult children kentucky

Find out other Fillable Florida Qualified Income Trust Form

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement