Irs Gov Cp301 Form

What is the IRS Gov CP301

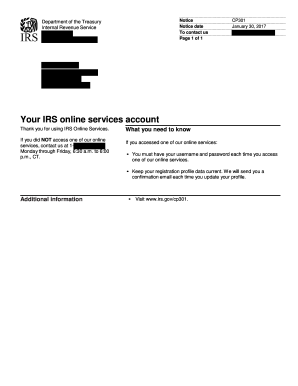

The IRS Gov CP301 is a notice issued by the Internal Revenue Service to inform taxpayers about specific actions or information regarding their tax accounts. This notice typically addresses issues related to tax returns, payments, or other compliance matters. Understanding the CP301 notice is crucial for taxpayers to ensure they are meeting their obligations and to avoid potential penalties.

How to Use the IRS Gov CP301

Using the IRS Gov CP301 involves carefully reviewing the information provided in the notice. Taxpayers should verify the details against their records to ensure accuracy. If the notice requests additional information or action, it is important to respond promptly. Utilizing digital tools like signNow can streamline the process of completing and submitting any required forms or documentation related to the CP301 notice.

Steps to Complete the IRS Gov CP301

Completing the IRS Gov CP301 requires attention to detail. Here are the key steps:

- Review the notice thoroughly to understand the information and requests.

- Gather any necessary documents that support your response or compliance.

- Fill out any required forms accurately, ensuring all information matches IRS records.

- Use a reliable eSignature tool like signNow to sign and submit your documents securely.

- Keep copies of all correspondence and submissions for your records.

Legal Use of the IRS Gov CP301

The IRS Gov CP301 notice has legal implications, as it serves as an official communication from the IRS. It is essential to treat this notice seriously and to comply with any requests made within it. Failure to respond appropriately could result in penalties or further action from the IRS. Utilizing electronic signatures through platforms like signNow ensures that your response is legally binding and compliant with relevant regulations.

Key Elements of the IRS Gov CP301

Key elements of the IRS Gov CP301 include:

- A clear statement of the issue or information being communicated.

- Specific actions required from the taxpayer, including deadlines.

- Contact information for the IRS, should further clarification be needed.

- Instructions on how to respond, including any forms that need to be completed.

Filing Deadlines / Important Dates

Filing deadlines related to the IRS Gov CP301 are critical. The notice will typically specify a deadline for responding or taking action. It is important to adhere to these deadlines to avoid penalties. Taxpayers should mark these dates on their calendars and ensure that all necessary documentation is submitted on time.

Quick guide on how to complete irs gov cp301

Complete Irs Gov Cp301 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Irs Gov Cp301 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest way to edit and eSign Irs Gov Cp301 with ease

- Find Irs Gov Cp301 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you want to distribute your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device you prefer. Edit and eSign Irs Gov Cp301 and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs gov cp301

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS gov CP301 notice?

The IRS gov CP301 notice is a letter sent to taxpayers when the IRS has reduced their refund or owes money. Understanding this notice is crucial for managing your financial obligations, especially if you are relying on digital document solutions like airSlate SignNow for tax documentation.

-

How can airSlate SignNow help with IRS communications?

airSlate SignNow allows you to easily eSign and send important documents securely, which can include responses to IRS notices like the IRS gov CP301. Our platform helps ensure that your replies are timely and organized, minimizing potential tax-related issues.

-

Are there any costs associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, making it a cost-effective solution for managing documents such as responses to IRS gov CP301. We strive to ensure you get the best features without compromising your budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and automated workflows. These tools can streamline your responses to notices like the IRS gov CP301, allowing for efficient handling of your tax correspondence.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Drive, Dropbox, and CRM systems. This integration makes it easy to manage documents related to IRS notices, including the IRS gov CP301, in one centralized location.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as responses to the IRS gov CP301, enhances your efficiency and ensures compliance. Our platform's user-friendly interface and secure eSigning capabilities provide peace of mind when managing your tax documents.

-

Is airSlate SignNow suitable for small businesses dealing with IRS notices?

Yes, airSlate SignNow is particularly beneficial for small businesses facing IRS notices like the IRS gov CP301. Our solution offers an easy-to-use platform for eSigning and sharing documents, helping small businesses stay compliant and organized without technical hassles.

Get more for Irs Gov Cp301

- 2020 form or 18 wc report of tax payment or written affirmation for oregon real property conveyance 150 101 284

- Alaska tobacco product manufacturer certificate of state of alaska form

- Instructions for 2017 alaska fisheries business tax annual return form

- Assigned id form

- Ihss san bernardino form

- Formsforentrytogreece

- Form 503 texas online

- Illinois llc merger form

Find out other Irs Gov Cp301

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure