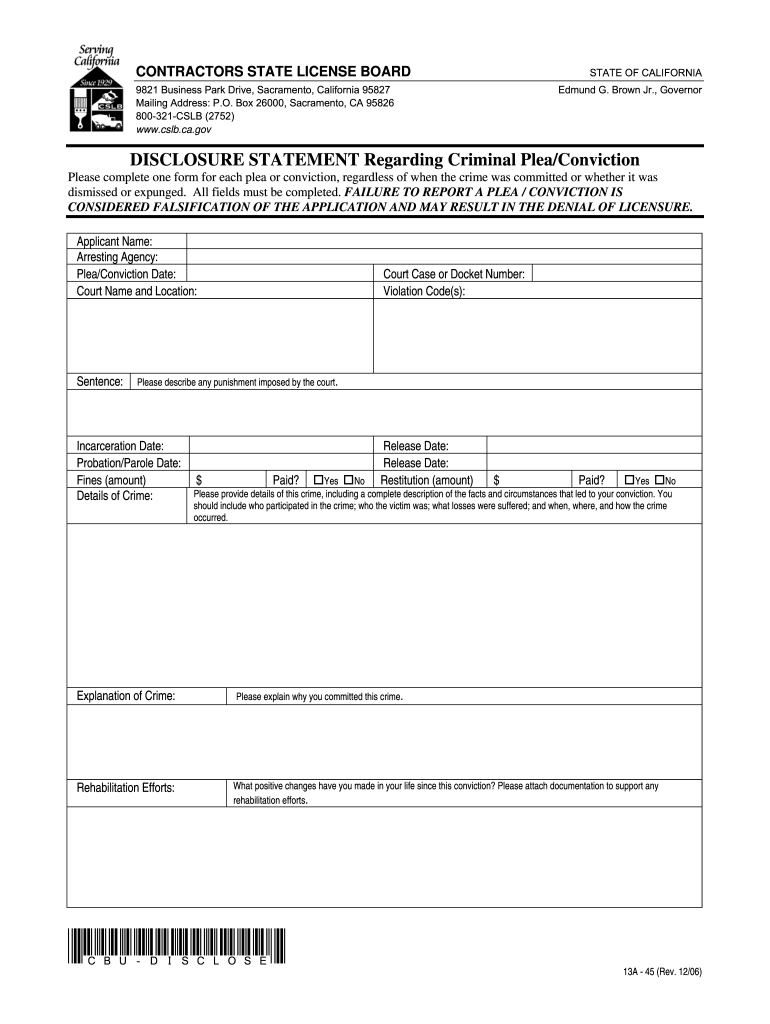

on Contractors Contractors State License Board State of California Cslb Ca 2006

What is the Contractors State License Board in California?

The Contractors State License Board (CSLB) is a regulatory agency in California responsible for licensing and regulating contractors in the construction industry. It ensures that contractors meet specific standards of competence and conduct, protecting consumers from unlicensed and unethical practices. The CSLB oversees various types of licenses, including general contractors, specialty contractors, and more, ensuring that all licensed professionals adhere to state laws and regulations.

How to Obtain a CSLB License in California

To obtain a CSLB license in California, applicants must follow a series of steps. First, individuals must meet the minimum experience requirements, which typically include four years of journey-level experience in the trade. Next, applicants must complete the application form and submit it along with the required fees. After processing the application, the CSLB will schedule an examination for the applicant. Upon passing the exam, the individual can receive their contractor's license, allowing them to legally operate within the state.

Steps to Complete the CSLB Application Process

The application process for the CSLB license involves several key steps:

- Gather necessary documentation, including proof of experience and identification.

- Complete the CSLB application form accurately.

- Submit the application along with the required fees.

- Prepare for and pass the required examinations.

- Receive your license once all requirements are fulfilled.

Legal Use of the CSLB License

Holding a CSLB license is essential for legal operation within California's construction industry. Licensed contractors are required to follow state regulations, ensuring that all work is performed safely and to code. Additionally, a valid CSLB license protects consumers by providing a means to verify a contractor's qualifications and accountability. Engaging in contracting work without a proper license can result in penalties, including fines and legal action.

State-Specific Rules for the CSLB License

California has specific rules governing the issuance and maintenance of CSLB licenses. These include requirements for continuing education, adherence to safety regulations, and compliance with local building codes. Contractors must also maintain liability insurance and a bond to protect clients. Understanding these state-specific rules is crucial for contractors to ensure ongoing compliance and avoid potential legal issues.

Examples of Using the CSLB License

Licensed contractors can engage in various construction activities, including residential and commercial projects. For example, a general contractor may oversee the construction of a new home, while a specialty contractor may focus on specific trades, such as plumbing or electrical work. Having a CSLB license allows these professionals to operate legally, bid on projects, and protect their clients through established standards and practices.

Quick guide on how to complete on contractors contractors state license board state of california cslb ca

Effortlessly Prepare On Contractors Contractors State License Board State Of California Cslb Ca on Any Device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage On Contractors Contractors State License Board State Of California Cslb Ca on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign On Contractors Contractors State License Board State Of California Cslb Ca with ease

- Search for On Contractors Contractors State License Board State Of California Cslb Ca and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign On Contractors Contractors State License Board State Of California Cslb Ca and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct on contractors contractors state license board state of california cslb ca

FAQs

-

I am planning to take the California Contractors State License exam. Are there any recommendations on how to study?

You can purchase material at the Contractor State License Services. If you don't want to spend too much, I recommend purchasing the Online Pratice Exams. They will send you a link to your email which you can access any time and take the mock tests they provide for you. The tests are not exactly word by word as what you will see on the actual exam but it's a great and cheap way to prepare if you're on a budget.

-

What are the requirements to be a Uber or Lyft driver in California? Can I drive with an out of state license, and and out of state license plate on my vehicle?

Highly doubtful. Uber and Lyft usually require an in-state driver's license, in-state license plates, and in-state insurance. I had to hold off joining here in Chicago for a few months until I got my Illinois plates, and I can't imagine any market in California is any different.Edit, 10 minutes later: I checked into a few different markets, and all of them require you to have California DL, plates, and insurance. So go get those first.

-

Uber will pay out a $20M settlement to end lawsuits filed by the state of California contesting the company's classification of its drivers as independent contractors and not full employees. What's your view on this?

It’s a good modern business ‘trick’ to classify people as independent contractors, so that the company does not have to offer benefits and the internal company support services to it’s contractor-employees. Microsoft had ‘contractors’ working for many years, and there was no difference between their work and the work of ‘regular’ MS employees. MS got sued and lost.An Uber driver has to use the UBER systems, rules, regs, etc… and can lease cars to use. I get why UBER would want these folks to be ‘contractors’ vs employees (e.g. they’re not supervised during work time…other than by tracking software)… but that’s true of truck drivers and a bunch of other folks who are pretty much ‘on their own’ on a daily basis.I think UBER paid rather than trying to win it’s questionable case in court.

-

I am currently an independent contractor, based out in california and shelling out more than 50% of my income as federal, state taxes and other statuatory deductions. What are best ways to save tax and how can I do it?

A2A - Well CA has a 13.3% tax for those with income over a Million. The Federal rate is 39.6%. for 52.9% so I guess I need to congratulate you on your success.Seriously, since your a sole proprietor I doubt very seriously that you are in a 50%+ tax bracket. How are you arriving at those percentages.As to deduction you need to keep track of everything that is business related.However, the starting point is how are you arriving at that percentage because I feel strongly that you are doing something wrong in you perception of this tax rate.

-

How do I determine whether I am an employee or a contractor if I work for a company in California, but I live out of state, and I fail the 3 question test for being a contractor?

Generally, applicable employment laws are those of the state in which an employee is working, rather than the state in which the employer’s headquarters are located.Consequently, you should look to the laws of your state of residence, rather than to California’s recently adopted ABC test[1], to determine whether you are an employee or an independent contractor.Footnotes[1] ABC Test for Employee Misclassification in California | Dana Shultz, Esq.

-

CA Reply to Franchise Tax Board Form re Tax Yr 2011: What income is stated in question 2 of section G? CA income only? Or out of state income?

The question asks for your gross income from all sources. If you had been a California resident in 2011, you would have filled out Schedule CA, and the amount that appears on line 22 in Column C is the amount that California considers to be your gross income, your total Federal income adjusted for differences between California law and Federal law. That number - the one you compute by filling out Part I of Schedule CA as though you had been a resident of California - is what you put on the Request for Tax Return. That includes all of the income you earned outside of California as well as any that you earned inside of California. If you want to simplify the process you can just put the amount from line 22 of your 1040 on the form, reduced by any taxable state tax refund on line 10 that you received from California in 2011, any unemployment compensation on line 19, and any taxable social security benefits on line 20(b). Those are the most common adjustments to California income. If you had a small business or earned capital gains, you might have to do a little more detailed computation, and at that point you're probably best served by consulting a professional.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the on contractors contractors state license board state of california cslb ca

How to generate an eSignature for the On Contractors Contractors State License Board State Of California Cslb Ca in the online mode

How to generate an eSignature for the On Contractors Contractors State License Board State Of California Cslb Ca in Google Chrome

How to make an electronic signature for signing the On Contractors Contractors State License Board State Of California Cslb Ca in Gmail

How to create an electronic signature for the On Contractors Contractors State License Board State Of California Cslb Ca right from your smart phone

How to generate an eSignature for the On Contractors Contractors State License Board State Of California Cslb Ca on iOS

How to make an eSignature for the On Contractors Contractors State License Board State Of California Cslb Ca on Android OS

People also ask

-

What is cslb california, and how does it relate to airSlate SignNow?

CSLB California stands for the Contractors State License Board in California. It regulates and licenses contractors in the state. airSlate SignNow offers solutions that can help contractors streamline their documentation processes, ensuring that they stay compliant with CSLB California requirements.

-

How can airSlate SignNow benefit businesses working with cslb california?

airSlate SignNow provides an efficient platform for eSigning documents, which is crucial for contractors dealing with contracts, permits, and applications required by CSLB California. By digitizing these documents, businesses can save time and reduce the risk of errors in their licensing processes.

-

Are there any pricing options available for airSlate SignNow users focused on cslb california?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you’re a small contractor or a large firm working with CSLB California, you can choose a plan that fits your budget while still gaining access to essential features and support.

-

What features does airSlate SignNow offer for CSLB California users?

airSlate SignNow includes features like document templates, bulk sending, and secure storage that are particularly useful for businesses interacting with CSLB California. These tools ensure that your documentation is not only compliant but also easy to manage and retrieve.

-

How does airSlate SignNow ensure compliance with cslb california regulations?

airSlate SignNow adheres to eSignature laws, ensuring that documents signed through the platform are legally binding. By using our service, contractors can confidently submit paperwork required by CSLB California and remain compliant with state regulations.

-

Can airSlate SignNow integrate with other tools for businesses dealing with cslb california?

Absolutely! airSlate SignNow integrates seamlessly with various applications that contractors may use while managing their projects related to CSLB California. This integration capability enhances workflow efficiency, allowing for better document management and communication.

-

Is airSlate SignNow easy to use for someone unfamiliar with cslb california requirements?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be familiar with the complexities of CSLB California requirements. Our intuitive interface and customer support ensure that all users can confidently navigate their document processes.

Get more for On Contractors Contractors State License Board State Of California Cslb Ca

- Cricket tournament form pdf 421768555

- Cnic form 6110 1

- Application for late registration in university form

- Etch handwriting assessment pdf form

- Eye drop schedule template form

- Canada student visa checklist pdf form

- Routine inspection checklist form

- Raymond school district school nurse summative evaluation form

Find out other On Contractors Contractors State License Board State Of California Cslb Ca

- Sign South Dakota NDA Mobile

- Sign Connecticut Claim Free

- Sign Virginia Claim Myself

- Sign New York Permission Slip Free

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement