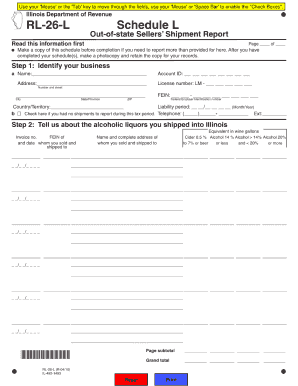

Illinois Form Rl 26 L Form

What is the Illinois Form RL 26 L Form

The Illinois Form RL 26 L is a specific document used for reporting and claiming certain tax exemptions related to property tax in the state of Illinois. This form is typically utilized by property owners who wish to apply for the General Homestead Exemption or other related exemptions. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and maximizing potential tax benefits.

How to use the Illinois Form RL 26 L Form

To effectively use the Illinois Form RL 26 L, you must first determine your eligibility for the exemptions it provides. Once eligibility is confirmed, you can obtain the form from the appropriate state or local government website. After filling out the required information, ensure that all sections are completed accurately to avoid delays in processing. Finally, submit the form according to the instructions provided, either online or by mail, depending on the submission options available in your locality.

Steps to complete the Illinois Form RL 26 L Form

Completing the Illinois Form RL 26 L involves several key steps:

- Gather necessary documentation, such as proof of ownership and identification.

- Download the form from the official Illinois government website or obtain a physical copy from your local tax office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form as instructed, either electronically or via postal mail.

Legal use of the Illinois Form RL 26 L Form

The Illinois Form RL 26 L is legally recognized for claiming property tax exemptions under state law. To ensure its legal validity, it must be filled out correctly and submitted within the designated deadlines. Compliance with the requirements set forth by the Illinois Department of Revenue is crucial, as improper use of the form could lead to penalties or denial of the requested exemptions.

Key elements of the Illinois Form RL 26 L Form

Key elements of the Illinois Form RL 26 L include:

- Property identification details, including address and parcel number.

- Owner information, such as name and contact details.

- Specific exemption types being claimed, with corresponding eligibility criteria.

- Signature and date fields to validate the submission.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Form RL 26 L can be submitted through various methods, depending on local regulations. Options typically include:

- Online submission via the Illinois Department of Revenue website, if available.

- Mailing the completed form to the designated local tax authority.

- In-person submission at local tax offices, where assistance may be provided.

Quick guide on how to complete illinois form rl 26 l form

Effortlessly Prepare Illinois Form Rl 26 L Form on Any Device

Online document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Illinois Form Rl 26 L Form on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Illinois Form Rl 26 L Form with Ease

- Find Illinois Form Rl 26 L Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Illinois Form Rl 26 L Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois form rl 26 l form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Form RL 26 L Form?

The Illinois Form RL 26 L Form is a specific tax form utilized for various reporting purposes in the state of Illinois. It serves as an essential document for businesses to fulfill their compliance requirements. By understanding this form, businesses can ensure accurate reporting and minimize potential issues with state regulations.

-

How can airSlate SignNow help with the Illinois Form RL 26 L Form?

airSlate SignNow provides an effective platform for businesses to easily fill out, sign, and send the Illinois Form RL 26 L Form securely online. With its user-friendly interface, you can streamline the process of completing this form, making compliance hassle-free. Additionally, the electronic signature feature ensures that your form is signed and submitted efficiently.

-

Is airSlate SignNow cost-effective for handling forms like the Illinois Form RL 26 L Form?

Yes, airSlate SignNow is a cost-effective solution for managing various forms, including the Illinois Form RL 26 L Form. With flexible pricing plans, businesses can select an option that best fits their needs while benefiting from features that save time and reduce administrative costs. Ensure you optimize your resources with SignNow's affordable solutions.

-

What features does airSlate SignNow offer for the Illinois Form RL 26 L Form?

airSlate SignNow offers a range of features tailored to assist with the Illinois Form RL 26 L Form, including customizable templates, e-signatures, and secure document storage. These features facilitate a more organized and efficient way to manage forms. The platform also provides real-time status updates, allowing users to track the progress of their submissions.

-

Can I integrate airSlate SignNow with other tools for the Illinois Form RL 26 L Form?

Absolutely! airSlate SignNow can seamlessly integrate with various applications and tools, enhancing your workflow for managing the Illinois Form RL 26 L Form. By connecting with your preferred CRM, accounting, or project management software, you can automate the process and synchronize your data efficiently.

-

What are the benefits of using airSlate SignNow for the Illinois Form RL 26 L Form?

Using airSlate SignNow for the Illinois Form RL 26 L Form offers numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. The platform ensures that your documents are encrypted and securely stored, while the electronic signatures speed up the approval process. Overall, it simplifies the entire workflow for completing this important form.

-

How do I fill out the Illinois Form RL 26 L Form using airSlate SignNow?

Filling out the Illinois Form RL 26 L Form using airSlate SignNow is straightforward. Start by selecting the appropriate template from the platform, and then input the required information into the designated fields. Once completed, you can easily add signatures and send the form digitally, ensuring that it's processed efficiently.

Get more for Illinois Form Rl 26 L Form

- Withdrawal of funds tn stars 529 program form

- Ss 6087 form

- Appraisal gap pilot program participant application form

- Lost report form

- Fire hydrant meter city of dallas form

- Houston housing authority form

- Applicants name harlingen school of health professions hcisd form

- Acknowledgment of responsibility and permission for dallasisd form

Find out other Illinois Form Rl 26 L Form

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later