Features of Farm Accounting Form

What are the features of farm accounting?

Farm accounting encompasses several unique features tailored to the agricultural industry. These features include:

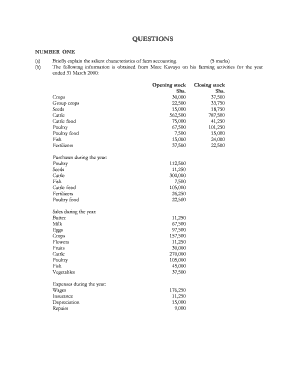

- Cost tracking: This involves monitoring expenses related to seeds, fertilizers, equipment, and labor, which are essential for profitability analysis.

- Income tracking: Recording income from crop sales, livestock sales, and government subsidies helps in assessing overall financial health.

- Inventory management: Keeping track of inventory, including livestock and harvested crops, is crucial for managing resources effectively.

- Tax compliance: Farm accounting must adhere to specific tax regulations, including deductions for equipment and land use.

Steps to complete the features of farm accounting

Completing the features of farm accounting involves a systematic approach:

- Gather financial records: Collect all financial documents, including receipts, invoices, and bank statements.

- Organize expenses and income: Categorize all financial transactions into relevant sections, such as operational costs and revenue sources.

- Utilize accounting software: Implement farm accounting software to streamline data entry and reporting.

- Review and analyze: Regularly assess financial reports to identify trends, profitability, and areas for improvement.

Legal use of the features of farm accounting

Understanding the legal aspects of farm accounting is essential for compliance and risk management. Key legal considerations include:

- Record retention: Maintain accurate records for a specified duration to comply with IRS regulations.

- Tax deductions: Ensure that all eligible expenses are documented and reported to maximize tax benefits.

- Financial reporting: Adhere to state and federal guidelines for financial reporting to avoid legal complications.

IRS guidelines for farm accounting

The IRS provides specific guidelines for farm accounting, which include:

- Schedule F: Farmers must report income and expenses on Schedule F (Profit or Loss from Farming).

- Depreciation rules: Understand the rules for depreciating farm assets to accurately report their value over time.

- Estimated taxes: Farmers may need to make estimated tax payments based on expected income to avoid penalties.

Examples of using the features of farm accounting

Practical examples illustrate how farm accounting features can be utilized effectively:

- Budgeting: A farmer can create a budget based on historical data to forecast future expenses and revenues.

- Profit analysis: By analyzing income and expenses, a farmer can determine which crops yield the highest profit margins.

- Loan applications: Accurate financial records are essential when applying for loans to expand farming operations.

Required documents for farm accounting

To effectively manage farm accounting, certain documents are essential:

- Receipts: Keep all receipts for purchases related to farming operations.

- Bank statements: Regularly review bank statements to reconcile accounts and track cash flow.

- Tax returns: Maintain copies of previous tax returns for reference and compliance.

Quick guide on how to complete features of farm accounting

Prepare Features Of Farm Accounting effortlessly on any device

Online document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Features Of Farm Accounting on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Features Of Farm Accounting stress-free

- Find Features Of Farm Accounting and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you wish to send your form, by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Features Of Farm Accounting and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the features of farm accounting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farm accounting PDF and why is it important?

A farm accounting PDF is a document that helps farmers manage their finances effectively by tracking income, expenses, and overall profitability. It is important because it provides a clear overview of financial health, allowing for better decision-making and operational efficiency.

-

How can airSlate SignNow improve my farm accounting PDF process?

airSlate SignNow streamlines your farm accounting PDF process by allowing you to easily create, send, and sign documents electronically. This eliminates the hassle of printing and scanning, making the entire workflow quicker and more efficient.

-

What features does airSlate SignNow offer for farm accounting PDFs?

airSlate SignNow offers features such as customizable templates for farm accounting PDFs, cloud storage, and user-friendly eSignature capabilities. These features enable you to manage your financial documents easily and ensure compliance with legal standards.

-

Is airSlate SignNow cost-effective for small farms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small farms looking to manage their farm accounting PDFs. With flexible pricing plans and a focus on providing value, it can fit various budget needs while enhancing document management.

-

Can I integrate airSlate SignNow with other software used for farm accounting?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and farm management software. This ensures that your farm accounting PDFs are easily accessible and can be synchronized with other tools you’re using.

-

How does eSigning work for farm accounting PDFs using airSlate SignNow?

eSigning with airSlate SignNow is straightforward. You can upload your farm accounting PDF, designate signers, and send the document electronically for signature. The process is secure and legally binding, making it an ideal choice for financial documents.

-

What are the benefits of using airSlate SignNow for farm accounting PDFs?

The main benefits of using airSlate SignNow for farm accounting PDFs include increased efficiency, reduced paperwork, and enhanced accuracy. By digitizing your accounting processes, you can save time and focus more on your farming operations.

Get more for Features Of Farm Accounting

Find out other Features Of Farm Accounting

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy