Michigan Form 1353

What is the Michigan Form 1353

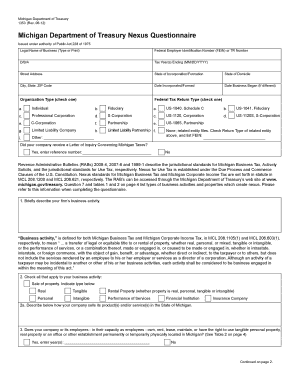

The Michigan Form 1353 is a specific document used for reporting various tax-related information to the Michigan Department of Treasury. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It typically pertains to the reporting of income, deductions, and credits, which can significantly impact tax liabilities. Understanding the purpose and requirements of this form is crucial for accurate tax filing in Michigan.

How to use the Michigan Form 1353

Using the Michigan Form 1353 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. Depending on your preference, you can submit the form electronically or via mail. Utilizing an electronic signature solution can streamline this process, ensuring that your form is submitted securely and efficiently.

Steps to complete the Michigan Form 1353

Completing the Michigan Form 1353 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including income statements and prior tax returns.

- Download the Michigan Form 1353 from the official state website or access it through a trusted eSignature platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income, deductions, and any applicable credits as instructed on the form.

- Review all entries for accuracy and completeness.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form either electronically through an eSignature solution or by mailing it to the appropriate state department.

Legal use of the Michigan Form 1353

The legal use of the Michigan Form 1353 hinges on compliance with state regulations governing tax reporting. This form must be filled out accurately and submitted by the specified deadlines to avoid penalties. E-signatures are legally recognized in Michigan, provided that the electronic signature solution used complies with the ESIGN Act and UETA. This ensures that the form holds the same legal weight as a traditional handwritten signature, making it a valid document for tax purposes.

Key elements of the Michigan Form 1353

Several key elements must be included in the Michigan Form 1353 for it to be considered complete and valid. These elements include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed reporting of all sources of income.

- Deductions and Credits: Accurate listing of any deductions or credits being claimed.

- Signature: A valid signature, either handwritten or electronic, is required for submission.

- Date: The date of signing must be included to establish the timeline of submission.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Form 1353 can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online Submission: Utilize an electronic signature solution to submit the form securely online.

- Mail Submission: Print the completed form and send it to the designated address provided by the Michigan Department of Treasury.

- In-Person Submission: Deliver the form directly to a local tax office if preferred.

Quick guide on how to complete michigan form 1353

Effortlessly Prepare Michigan Form 1353 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Form 1353 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and Electronically Sign Michigan Form 1353 with Ease

- Obtain Michigan Form 1353 and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize essential sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Michigan Form 1353 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 1353

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Form 1353?

The Michigan Form 1353 is a crucial document used for various administrative processes in Michigan. It is often required for compliance and documentation purposes. Understanding this form is essential for individuals and businesses operating within Michigan.

-

How can airSlate SignNow help with Michigan Form 1353?

airSlate SignNow simplifies the process of completing and signing the Michigan Form 1353. Our platform allows you to eSign documents quickly, ensuring that your submissions are timely and compliant. With customizable templates, you can easily create and manage your Michigan Form 1353.

-

Is airSlate SignNow affordable for businesses needing to file the Michigan Form 1353?

Yes, airSlate SignNow offers a cost-effective solution for businesses that frequently need to eSign documents like the Michigan Form 1353. Our pricing is flexible and designed to suit various organizational needs, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for Michigan Form 1353 signers?

With airSlate SignNow, users can enjoy features such as secure eSigning, document tracking, and customizable workflows for the Michigan Form 1353. These tools ensure a seamless signing experience while maintaining the integrity and security of your documents.

-

Can I integrate airSlate SignNow with other tools for Michigan Form 1353 management?

Absolutely! airSlate SignNow supports integrations with various applications, helping you streamline the management of the Michigan Form 1353. Whether you use CRM systems or document management software, our platform can enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for Michigan Form 1353 submissions?

Using airSlate SignNow for your Michigan Form 1353 submissions offers numerous benefits, including time-saving eSigning, reduced paper waste, and enhanced document security. Our platform also allows for easy collaboration, ensuring all necessary parties can sign without delays.

-

Is there customer support available for inquiries about Michigan Form 1353?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions related to the Michigan Form 1353. Whether you need help with the signing process or general inquiries, our support team is here to guide you every step of the way.

Get more for Michigan Form 1353

- What convinced steve to stop using smokeless tobacco form

- Employment verification form 5433959

- Hacienda pr estimulo form

- Wage deduction authorization agreement form

- Texas scholars form ector county independent school district ectorcountyisd

- Pre calculus worksheets with answers pdf form

- Sentencing practices in 13 states bjs ojp usdoj form

- Home care agreement template form

Find out other Michigan Form 1353

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy