Ca Form 3536

What is the CA Form 3536

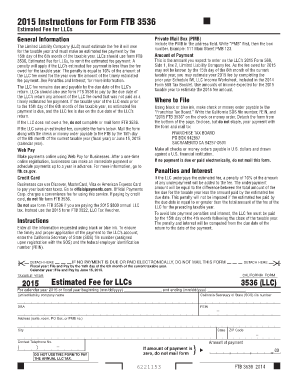

The CA Form 3536, officially known as the California Form 3536, is a tax-related document used by businesses and individuals in the state of California. This form is primarily utilized for making estimated tax payments for the current tax year. It is essential for taxpayers who expect to owe tax of five hundred dollars or more when they file their tax return. Understanding the purpose of this form is crucial for ensuring compliance with California tax regulations and avoiding penalties.

How to use the CA Form 3536

Using the CA Form 3536 involves several steps to ensure accurate completion and submission. Taxpayers must first determine their estimated tax liability for the year. This estimation is based on previous tax returns and expected income. Once the estimated amount is calculated, taxpayers fill out the form by entering their personal information, including their name, address, and taxpayer identification number. After completing the form, it can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the CA Form 3536

To complete the CA Form 3536, follow these steps:

- Gather necessary documents, including previous tax returns and income statements.

- Calculate your estimated tax liability for the year.

- Fill in your personal information on the form, including your name and address.

- Enter your estimated tax payment amount on the form.

- Review the completed form for accuracy.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the CA Form 3536

The legal use of the CA Form 3536 is governed by California tax laws. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. Taxpayers should ensure that they comply with all relevant regulations to avoid penalties. The form serves as a formal declaration of estimated tax payments, and proper submission is essential for maintaining good standing with the California Franchise Tax Board.

Filing Deadlines / Important Dates

Filing deadlines for the CA Form 3536 are crucial for taxpayers to note. Generally, estimated tax payments are due on specific dates throughout the year, typically in April, June, September, and January of the following year. It is important to adhere to these deadlines to avoid late fees and interest charges. Taxpayers should consult the California Franchise Tax Board's official calendar for exact dates and any updates regarding changes to the filing schedule.

Who Issues the Form

The CA Form 3536 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's tax laws and ensuring compliance among taxpayers. The FTB provides resources and guidance on how to complete the form, as well as information on payment options and deadlines. Taxpayers can access the form and related materials directly from the FTB's official website.

Quick guide on how to complete ca form 3536

Effortlessly Prepare Ca Form 3536 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-conscious alternative to conventional printed and signed forms, allowing you to obtain the necessary documents and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your files swiftly and without delays. Handle Ca Form 3536 on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

Efficiently Edit and eSign Ca Form 3536 with Ease

- Locate Ca Form 3536 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow portions of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs with just a few clicks from any device you choose. Modify and eSign Ca Form 3536 to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3536

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3536, and how can it be used with airSlate SignNow?

Form 3536 is a document used for specific compliance purposes in various sectors. With airSlate SignNow, you can easily upload, manage, and eSign form 3536, streamlining your document workflow and ensuring compliance with regulations.

-

Is airSlate SignNow a cost-effective solution for managing form 3536?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. It offers scalable pricing plans that cater to different needs, making it affordable to manage and eSign important documents like form 3536 without compromising on features.

-

What features does airSlate SignNow offer for managing form 3536?

AirSlate SignNow provides a variety of features for managing form 3536, including customizable templates, automated workflows, and secure eSigning capabilities. These features ensure that the entire process is smooth and efficient, allowing you to focus on your business.

-

Can I integrate airSlate SignNow with other tools and apps while using form 3536?

Absolutely! AirSlate SignNow offers integrations with various platforms such as Google Drive, Salesforce, and Zapier, enhancing your flexibility in managing form 3536. These integrations allow for seamless document transfer and eSigning, improving productivity.

-

What are the benefits of using airSlate SignNow for form 3536?

Using airSlate SignNow for form 3536 offers several benefits, including enhanced security, compliance, and ease of use. The platform ensures that your documents are securely stored and legally binding, providing peace of mind while handling important paperwork.

-

Is it easy to eSign form 3536 with airSlate SignNow?

Yes, eSigning form 3536 with airSlate SignNow is incredibly easy. Users can add their signatures, initials, and dates with just a few clicks, making the signing process quick and efficient for you and your clients.

-

How does airSlate SignNow ensure the security of my form 3536 documents?

AirSlate SignNow prioritizes security by employing encryption and secure cloud storage for your form 3536 documents. The platform complies with industry standards, ensuring that only authorized parties have access to sensitive information.

Get more for Ca Form 3536

- Journey management plan template pdf form

- Cara medical certificate format

- Last pay certificate for teachers pdf form

- Repossession paperwork form

- Business personal property department of revenue ky gov form

- Imm 1294 e application for study permit made outside of canada imm1294e pdf form

- Isp 1150 pdf service canada forms

- Cec nrca mch 12 a revised 0119 form

Find out other Ca Form 3536

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors