Business Personal Property Department of Revenue Ky Gov 2022

What is the Business Personal Property Department of Revenue KY Gov

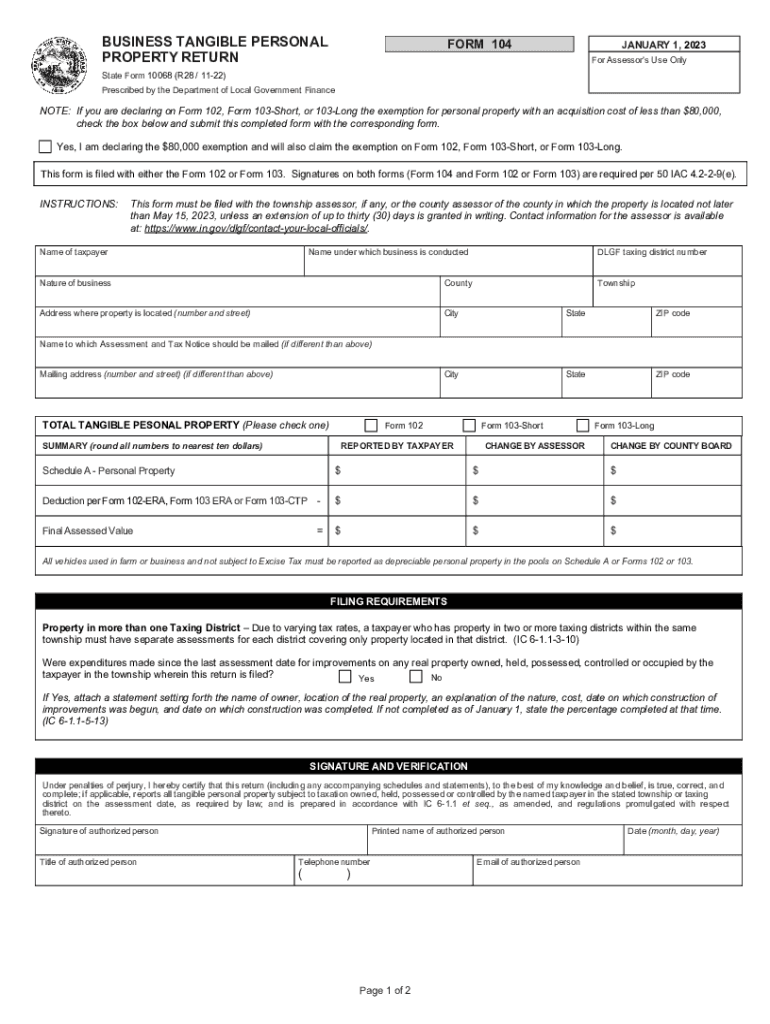

The Business Personal Property Department of Revenue in Kentucky is responsible for the assessment and taxation of personal property owned by businesses within the state. This includes tangible assets such as machinery, equipment, furniture, and inventory. Understanding this department's role is crucial for business owners to ensure compliance with state tax regulations and to accurately report their assets to avoid penalties.

How to use the Business Personal Property Department of Revenue KY Gov

To effectively utilize the services provided by the Business Personal Property Department of Revenue, businesses should familiarize themselves with the reporting requirements and deadlines. This involves gathering necessary documentation regarding all personal property owned and determining its fair market value. Businesses can access forms and guidelines through the department's official website, ensuring they have the most current information and resources available.

Steps to complete the Business Personal Property Department of Revenue KY Gov

Completing the requirements for the Business Personal Property Department involves several key steps:

- Gather all relevant documentation related to your business assets.

- Determine the fair market value of each asset.

- Complete the appropriate forms provided by the department.

- Submit the forms by the specified deadline, either online or via mail.

- Keep copies of submitted documents for your records.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of important filing deadlines to avoid penalties. Typically, the deadline for filing personal property tax returns in Kentucky is April 15 each year. However, businesses should verify any changes or extensions that may apply in a given year. Staying informed about these dates helps ensure timely compliance with state regulations.

Required Documents

When filing with the Business Personal Property Department, businesses must prepare several key documents, including:

- A completed personal property tax return form.

- Documentation supporting the valuation of assets, such as purchase invoices or appraisals.

- Any previous tax returns for reference.

Having these documents organized and readily available will streamline the filing process.

Penalties for Non-Compliance

Failure to comply with the filing requirements set by the Business Personal Property Department can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for business owners to adhere to the deadlines and accurately report their assets to avoid these consequences.

Quick guide on how to complete business personal property department of revenue ky gov

Complete Business Personal Property Department Of Revenue ky gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly and without complications. Handle Business Personal Property Department Of Revenue ky gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Business Personal Property Department Of Revenue ky gov without difficulty

- Locate Business Personal Property Department Of Revenue ky gov and then click Get Form to begin.

- Use the tools we supply to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Business Personal Property Department Of Revenue ky gov and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business personal property department of revenue ky gov

Create this form in 5 minutes!

How to create an eSignature for the business personal property department of revenue ky gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Personal Property Department Of Revenue ky gov?

The Business Personal Property Department Of Revenue ky gov is a governmental body that oversees the assessment and taxation of personal property owned by businesses in Kentucky. Understanding its functions can help businesses comply with state regulations and manage their tax obligations effectively.

-

How can airSlate SignNow assist with Business Personal Property Department Of Revenue ky gov forms?

airSlate SignNow provides an efficient platform for businesses to complete and eSign forms required by the Business Personal Property Department Of Revenue ky gov. This streamlines the process, ensuring that all necessary documents are submitted accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for managing documents related to the Business Personal Property Department Of Revenue ky gov. Each plan includes features that enhance document management and eSigning capabilities.

-

What features does airSlate SignNow offer for businesses dealing with the Department Of Revenue?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for businesses interacting with the Business Personal Property Department Of Revenue ky gov. These tools help ensure compliance and improve efficiency in document handling.

-

How does airSlate SignNow benefit businesses in Kentucky?

By using airSlate SignNow, businesses in Kentucky can simplify their interactions with the Business Personal Property Department Of Revenue ky gov. The platform enhances productivity by reducing paperwork and enabling quick eSigning, which is crucial for timely submissions.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various accounting and tax management software, making it easier for businesses to manage their obligations with the Business Personal Property Department Of Revenue ky gov. This integration helps streamline workflows and maintain accurate records.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents related to the Business Personal Property Department Of Revenue ky gov. Businesses can trust that their information is safe while using the platform.

Get more for Business Personal Property Department Of Revenue ky gov

Find out other Business Personal Property Department Of Revenue ky gov

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT