MAINE 1310ME Maine Gov State Me Form

What is the MAINE 1310ME Maine gov State Me

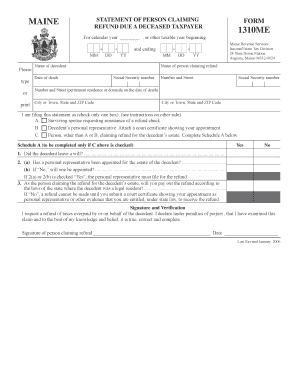

The MAINE 1310ME form is a tax document used by residents of Maine to report their income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it ensures compliance with state tax regulations. It includes sections for reporting various sources of income, deductions, and credits available to taxpayers in Maine. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

How to use the MAINE 1310ME Maine gov State Me

Using the MAINE 1310ME form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, complete the form by filling out your personal information, income details, and applicable deductions. Once completed, review the form for accuracy before submitting it. Utilizing electronic tools can simplify this process, allowing for easier data entry and eSigning capabilities.

Steps to complete the MAINE 1310ME Maine gov State Me

Completing the MAINE 1310ME form requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, such as W-2 and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Calculate any deductions you qualify for, such as standard or itemized deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring all required fields are completed.

Legal use of the MAINE 1310ME Maine gov State Me

The MAINE 1310ME form is legally binding when completed accurately and submitted in accordance with state regulations. It must be signed by the taxpayer, and electronic signatures are accepted if they comply with the relevant eSignature laws. Ensuring that the form is filled out correctly and submitted on time helps avoid legal issues and penalties associated with non-compliance.

Key elements of the MAINE 1310ME Maine gov State Me

Key elements of the MAINE 1310ME form include:

- Personal identification information, such as name and Social Security number.

- Income details from various sources, including wages, interest, and dividends.

- Deductions and credits that can reduce taxable income.

- Signature line for the taxpayer to certify the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The MAINE 1310ME form can be submitted through various methods. Taxpayers can file electronically using approved tax software, which often simplifies the process and allows for faster processing. Alternatively, the form can be printed and mailed to the appropriate state tax office. In-person submissions may also be made at designated state tax offices, providing an option for those who prefer face-to-face assistance.

Quick guide on how to complete maine 1310me maine gov state me

Complete MAINE 1310ME Maine gov State Me effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage MAINE 1310ME Maine gov State Me on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to edit and eSign MAINE 1310ME Maine gov State Me effortlessly

- Find MAINE 1310ME Maine gov State Me and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and eSign MAINE 1310ME Maine gov State Me and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine 1310me maine gov state me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to MAINE 1310ME Maine gov State Me?

airSlate SignNow is an eSignature solution designed to help users send and sign documents efficiently. By utilizing MAINE 1310ME Maine gov State Me, businesses can streamline their document workflows and ensure compliance with state regulations in Maine.

-

How much does airSlate SignNow cost for users in Maine?

Pricing for airSlate SignNow varies depending on the features selected. For customers interested in MAINE 1310ME Maine gov State Me, our plans offer cost-effective options that allow businesses in Maine to manage their document signing needs without overspending.

-

What features does airSlate SignNow offer for MAINE 1310ME Maine gov State Me?

airSlate SignNow offers numerous features such as customizable templates, cloud storage, and secure electronic signatures. These features are tailored for users under MAINE 1310ME Maine gov State Me, making it easier to complete and manage legal documents.

-

How can airSlate SignNow benefit businesses in Maine?

By leveraging airSlate SignNow, businesses in Maine can enhance productivity, reduce paper usage, and improve turnaround times. Utilizing MAINE 1310ME Maine gov State Me ensures that all eSigned documents comply with local regulations and legal standards.

-

Does airSlate SignNow integrate with other applications for MAINE 1310ME Maine gov State Me?

Yes, airSlate SignNow seamlessly integrates with various applications, maximizing efficiency for users in Maine. Whether it’s CRM systems or cloud storage solutions, our platform offers compatibility that suits MAINE 1310ME Maine gov State Me requirements.

-

Is airSlate SignNow secure for handling sensitive documents in MAINE 1310ME Maine gov State Me?

Absolutely! airSlate SignNow prioritizes security by employing encryption and robust authentication measures. This is especially important for businesses operating under MAINE 1310ME Maine gov State Me, ensuring all sensitive documents remain protected.

-

Can I use airSlate SignNow on mobile devices in relation to MAINE 1310ME Maine gov State Me?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users in Maine to send and sign documents on the go. This flexibility is especially beneficial for those working with MAINE 1310ME Maine gov State Me who need to manage their documents remotely.

Get more for MAINE 1310ME Maine gov State Me

- Florida birth certificate application form pdf 73783294

- Acknowledgement of debt template form

- Partners healthcare w2 form

- Stm1 form

- Da form 5521 11419517

- Husky prior authorization form medication

- Petal high school transcript request form 1145 hwy 42 petal ms

- Form 260 e limestone district school board

Find out other MAINE 1310ME Maine gov State Me

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF