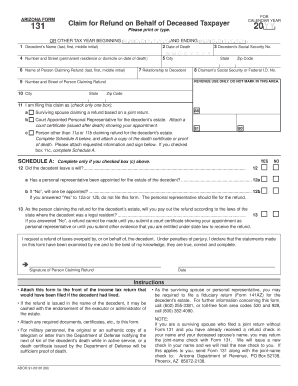

Arizona Form 131 2009

What is the Arizona Form 131

The Arizona Form 131 is a specific document used for tax purposes within the state of Arizona. It is primarily utilized by businesses and individuals to report certain tax-related information to the Arizona Department of Revenue. This form is essential for ensuring compliance with state tax laws and regulations.

How to use the Arizona Form 131

Using the Arizona Form 131 involves several straightforward steps. First, gather all necessary information and documents that pertain to your tax situation. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state agency. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form electronically.

Steps to complete the Arizona Form 131

Completing the Arizona Form 131 requires attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including income statements and expense records.

- Download the Arizona Form 131 from the Arizona Department of Revenue website or use a digital platform for easy access.

- Fill in the required fields, ensuring that all information is accurate and up to date.

- Double-check the form for any mistakes or missing information.

- Once satisfied, submit the form electronically or via mail, depending on your preference.

Legal use of the Arizona Form 131

The legal validity of the Arizona Form 131 hinges on compliance with state regulations. When filled out correctly and submitted on time, it serves as an official document for tax reporting. Utilizing an electronic signature can enhance the legal standing of the form, provided that it meets the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Key elements of the Arizona Form 131

Understanding the key elements of the Arizona Form 131 is crucial for proper completion. The form typically includes sections for personal identification, income details, deductions, and tax credits. Each section must be completed accurately to reflect your financial situation. Additionally, providing supporting documentation may be necessary to validate the information reported on the form.

Form Submission Methods

The Arizona Form 131 can be submitted through various methods, including:

- Online: Many users prefer to submit the form electronically through the Arizona Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the designated address provided by the state.

- In-Person: Some individuals may choose to deliver the form in person at local tax offices for immediate processing.

Quick guide on how to complete arizona form 131

Effortlessly complete Arizona Form 131 on any device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Arizona Form 131 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Arizona Form 131 effortlessly

- Find Arizona Form 131 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

No more lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Arizona Form 131 to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 131

Create this form in 5 minutes!

How to create an eSignature for the arizona form 131

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AZ Form 131 and its purpose?

The AZ Form 131 is a key document used for specific applications within Arizona, often related to business licensing or permits. Understanding its requirements and correct submission can streamline your processes and ensure compliance with state regulations. Using airSlate SignNow can simplify eSigning and submitting this form efficiently.

-

How can airSlate SignNow help with completing the AZ Form 131?

airSlate SignNow provides a user-friendly platform that allows you to complete and securely eSign the AZ Form 131 digitally. With our intuitive interface, you can fill in the required fields, upload necessary documents, and send them for signatures without any hassle. This digital solution saves time and minimizes errors in submission.

-

Is there a cost associated with using airSlate SignNow for the AZ Form 131?

AirSlate SignNow offers a cost-effective solution for managing documents like the AZ Form 131. We provide various pricing plans tailored to suit businesses of all sizes, ensuring you pay only for what you need. Additionally, our free trial allows you to explore our features before committing financially.

-

What features does airSlate SignNow offer for managing the AZ Form 131?

With airSlate SignNow, you can leverage features such as customizable templates, automated workflows, and real-time tracking for the AZ Form 131. These tools enhance the efficiency of document processing and ensure that all parties are kept updated throughout the signing process. Our advanced security measures also protect your sensitive information.

-

Can the AZ Form 131 be integrated with other software using airSlate SignNow?

Yes, airSlate SignNow supports various integrations with popular software and tools that can facilitate the handling of the AZ Form 131. Whether you use CRM systems, cloud storage, or project management platforms, our solution can streamline your workflow. This integration capability enhances productivity and keeps all your tools connected.

-

What benefits does using airSlate SignNow provide for filling out the AZ Form 131?

Using airSlate SignNow for the AZ Form 131 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. Our electronic signature technology ensures that your documents are legally binding and compliant with local laws. Additionally, you gain access to audit trails that provide proof of consent and completion.

-

Is airSlate SignNow user-friendly for completing the AZ Form 131?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible for users of all technical abilities. Completing the AZ Form 131 is straightforward; you can navigate our platform easily, ensuring that you can manage your documents without needing extensive training or technical support.

Get more for Arizona Form 131

- Please print this form and include with your shipment

- Stockton ports agree to partnership with pscballpark digest form

- Knights of columbus form 1295

- Application form palau national communications corporation

- Rodent surgical record by cage research a to z form

- Fatcahelp501internal revenue service form

- Ushpa safe pilot award application us hang gliding and ushpa form

- Phonak repair form

Find out other Arizona Form 131

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online