Arizona Individual Income Tax Forms 2022-2026

Understanding the Arizona Individual Income Tax Forms

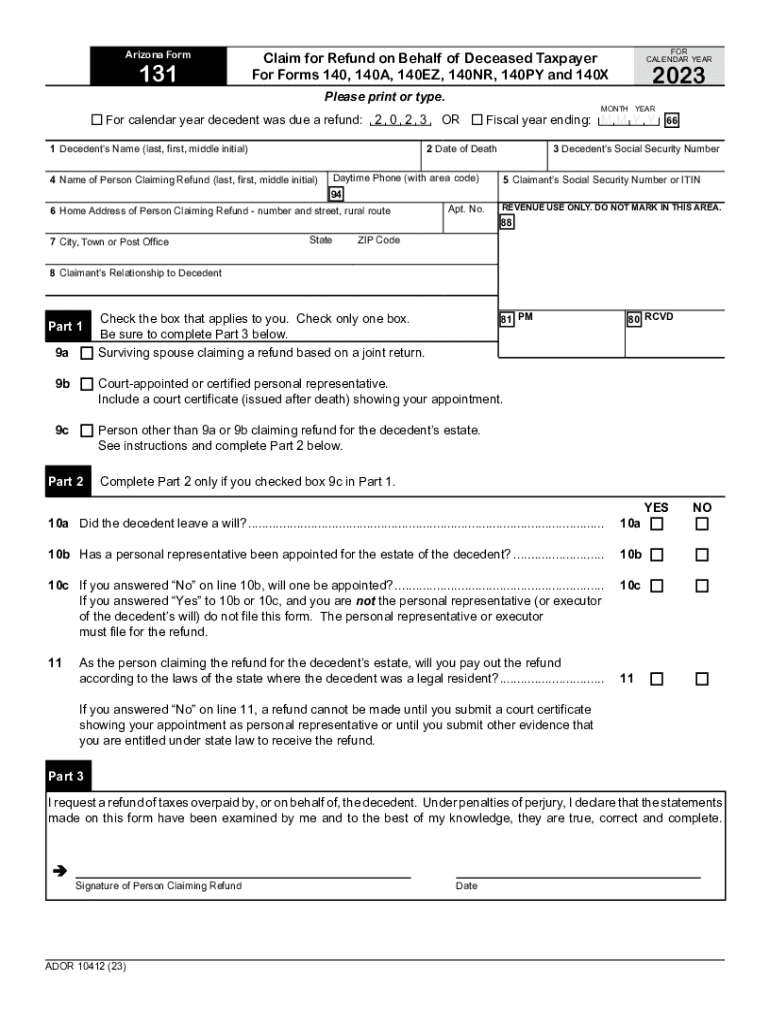

The Arizona Individual Income Tax Forms are essential documents used by residents to report their income and calculate their state tax obligations. These forms are specifically designed for individuals and can include various schedules and attachments depending on the taxpayer's situation. The primary form used is the Arizona Form 131, which serves as a foundational document for income reporting.

Steps to Complete the Arizona Individual Income Tax Forms

Completing the Arizona Individual Income Tax Forms involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Download the Arizona Form 131 from the Arizona Department of Revenue website or access it through a tax preparation software.

- Fill out the form by entering your personal information, income details, and any applicable deductions or credits.

- Review the completed form for accuracy to ensure all information is correct.

- Sign and date the form before submission.

How to Obtain the Arizona Individual Income Tax Forms

Taxpayers can obtain the Arizona Individual Income Tax Forms through various methods:

- Visit the Arizona Department of Revenue website to download the forms directly.

- Request physical copies of the forms by contacting the Arizona Department of Revenue.

- Access tax preparation software that includes the Arizona Form 131 as part of their offerings.

Key Elements of the Arizona Individual Income Tax Forms

Understanding the key elements of the Arizona Individual Income Tax Forms is crucial for accurate filing. Important components include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources, including wages and self-employment earnings.

- Deductions and Credits: Information on any deductions or tax credits that may apply.

- Signature Section: Required for validating the form submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Arizona Individual Income Tax Forms to avoid penalties. Typically, the deadline for submitting these forms is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may be available.

Form Submission Methods

Taxpayers have several options for submitting the Arizona Individual Income Tax Forms:

- Online Submission: Many taxpayers choose to file electronically through authorized e-filing services.

- Mail Submission: Completed forms can be mailed to the designated address provided by the Arizona Department of Revenue.

- In-Person Submission: Taxpayers may also submit their forms at local tax offices during business hours.

Quick guide on how to complete arizona individual income tax forms

Complete Arizona Individual Income Tax Forms seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without delays. Manage Arizona Individual Income Tax Forms on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to adjust and electronically sign Arizona Individual Income Tax Forms effortlessly

- Obtain Arizona Individual Income Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or shareable link, or download it to your computer.

Forget about misplaced files, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from your chosen device. Modify and electronically sign Arizona Individual Income Tax Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona individual income tax forms

Create this form in 5 minutes!

How to create an eSignature for the arizona individual income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 131 and how is it used?

The az form 131 is a critical document utilized for specific purposes, typically related to business operations and compliance in Arizona. By understanding its structure and requirements, users can efficiently complete and submit the form for various administrative processes.

-

How does airSlate SignNow help with filling out the az form 131?

airSlate SignNow simplifies the process of filling out the az form 131 by allowing users to easily input the necessary information into a digital format. This user-friendly platform ensures accurate completion and minimizes the chances of errors, making it ideal for business needs.

-

What are the pricing options for using airSlate SignNow with the az form 131?

airSlate SignNow offers a variety of pricing plans that cater to different business sizes and needs. Whether you're a small startup or a large corporation, you can find a cost-effective solution to manage the az form 131 and other documents efficiently.

-

Can I integrate other applications with airSlate SignNow when working on the az form 131?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to streamline your workflow. This means you can connect your existing tools to enhance the efficiency of managing the az form 131 and other documents.

-

What benefits does airSlate SignNow offer for managing the az form 131?

Using airSlate SignNow for the az form 131 provides numerous benefits, including ease of access, enhanced security, and fast processing times. This comprehensive solution empowers businesses to handle important documents with confidence while ensuring compliance.

-

Is electronic signing of the az form 131 legally binding?

Yes, electronic signatures created with airSlate SignNow are legally binding and comply with federal e-Sign laws. This means you can confidently use the platform to sign the az form 131 and ensure its validity for legal and business purposes.

-

What features does airSlate SignNow offer specifically for the az form 131?

airSlate SignNow provides features such as customizable templates, document tracking, and multi-party signing options, which streamline the process of managing the az form 131. These tools help users save time and improve collaboration among stakeholders.

Get more for Arizona Individual Income Tax Forms

- Hawaii 277 form

- Hawaii cna reciprocity application form

- Asthma action plan central cityk12iaus central city k12 ia form

- Group employee application form

- Idaho health care directive form

- Medical report on an adult in a child care facility form

- Cfs 597 form

- Nursing homesupportive living facility redetermination form

Find out other Arizona Individual Income Tax Forms

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now