Mudra Loan Form Filling

What is the Mudra Loan Form Filling

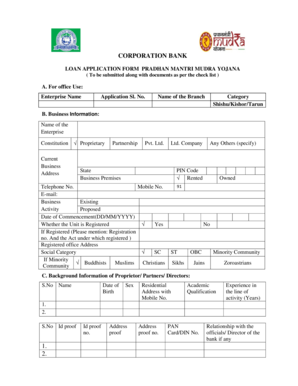

The Mudra loan form is a vital document for individuals seeking financial assistance under the Pradhan Mantri Mudra Yojana. This scheme aims to provide loans to small businesses and entrepreneurs in the United States, promoting self-employment and economic growth. The form captures essential information about the applicant, including personal details, business information, and financial requirements. Properly filling out this form is crucial for ensuring that the application is processed smoothly and efficiently.

Steps to Complete the Mudra Loan Form Filling

Filling out the Mudra loan application form involves several key steps to ensure accuracy and completeness:

- Gather Required Documents: Collect all necessary documents, such as identification, business plans, and financial statements.

- Personal Information: Fill in your name, address, contact details, and Social Security number.

- Business Details: Provide information about your business, including its name, type, and registration details.

- Loan Amount: Specify the amount of loan you are seeking and the purpose of the loan.

- Financial Information: Include details about your income, expenses, and any existing debts.

- Review and Submit: Carefully review the completed form for accuracy before submitting it online or in person.

Legal Use of the Mudra Loan Form Filling

The Mudra loan application form must be filled out in compliance with legal regulations to ensure its validity. Electronic signatures, when used, must adhere to the ESIGN and UETA acts, which govern the legality of digital signatures in the United States. This means that the completed form, once signed electronically, can be considered legally binding. It is essential to use a reliable platform for eSigning to maintain compliance and protect your information.

Required Documents

To successfully fill out the Mudra loan application form, specific documents are required. These may include:

- Identity Proof: A government-issued ID such as a driver's license or passport.

- Address Proof: Utility bills, lease agreements, or bank statements showing your current address.

- Business Plan: A detailed plan outlining your business objectives, strategies, and financial projections.

- Financial Statements: Recent bank statements, income tax returns, and profit and loss statements.

Form Submission Methods

The Mudra loan application form can typically be submitted through various methods, making it convenient for applicants. These methods include:

- Online Submission: Completing the form digitally and submitting it through the designated online portal.

- Mail Submission: Printing the completed form and sending it via postal service to the relevant financial institution.

- In-Person Submission: Visiting a local bank or financial institution to submit the form directly.

Eligibility Criteria

To qualify for a Mudra loan, applicants must meet specific eligibility criteria, which may include:

- Age Requirement: Applicants must be at least eighteen years old.

- Business Type: The business must fall under the micro, small, or medium enterprise category.

- Creditworthiness: A satisfactory credit history may be required to assess the applicant's ability to repay the loan.

Quick guide on how to complete mudra loan form filling

Effortlessly prepare Mudra Loan Form Filling on any device

Managing documents online has become increasingly favored by both businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents swiftly and without delays. Manage Mudra Loan Form Filling on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Mudra Loan Form Filling with ease

- Obtain Mudra Loan Form Filling and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using features that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and select the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Mudra Loan Form Filling and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mudra loan form filling

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mudra loan application form?

The Mudra loan application form is a document required for applying for a Pradhan Mantri Mudra Yojana loan. It is essential for businesses that need financial assistance to grow. Understanding how to fill the Mudra loan application form will help you provide accurate information, increasing the chances of loan approval.

-

How to fill the Mudra loan application form correctly?

To fill the Mudra loan application form correctly, gather all required documents such as identity proof, income proof, and business details. Ensure that you accurately complete each section, paying close attention to the guidance provided on the form. Knowing how to fill the Mudra loan application form ensures your application is processed smoothly.

-

What documents are required for the Mudra loan application?

To apply for a Mudra loan, you need several documents including your business plan, identity proof, address proof, and income proof. Familiarizing yourself with these requirements is essential to know how to fill the Mudra loan application form efficiently. Missing documents can delay your application process.

-

Can airSlate SignNow help with the Mudra loan application process?

Yes, airSlate SignNow offers tools that streamline the process of sending and signing documents, making it easier to complete your Mudra loan application form. By simplifying document management, you can focus more on ensuring accuracy in how to fill the Mudra loan application form rather than on the logistics.

-

What are the benefits of applying for a Mudra loan?

The Mudra loan offers several benefits, including access to funding without collateral, competitive interest rates, and flexible repayment options. Understanding these advantages can motivate you on how to fill the Mudra loan application form, as it enables you to highlight relevant information about your business needs.

-

Is there any cost associated with the Mudra loan application?

Applying for a Mudra loan typically involves no processing fees, making it a cost-effective option for entrepreneurs. However, it’s crucial to check with your bank or financial institution regarding their specific fees. Knowing how to fill the Mudra loan application form will help you avoid any unnecessary costs in the future.

-

How can I ensure my Mudra loan application is approved faster?

To ensure faster approval of your Mudra loan application, provide all required documents accurately and completely. Additionally, maintaining a strong credit profile and presenting a solid business plan can increase your chances of approval. Learning how to fill the Mudra loan application form well is crucial to present yourself as a trustworthy applicant.

Get more for Mudra Loan Form Filling

Find out other Mudra Loan Form Filling

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online