Form Ri 2625 2015

What is the Form RI 2625

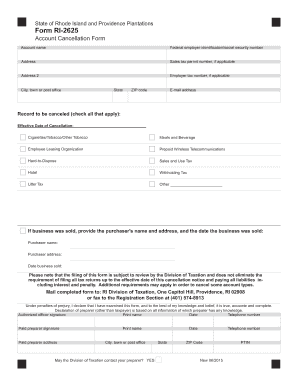

The RI Form 2625, commonly referred to as the Rhode Island Form RI 2625, is a document used for specific administrative purposes within the state of Rhode Island. This form is essential for individuals and businesses who need to comply with state regulations. It serves various functions, including reporting requirements and official notifications.

How to Use the Form RI 2625

Using the RI Form 2625 involves several steps to ensure proper completion and submission. First, gather all necessary information relevant to the form. This includes personal details, business information, and any specific data required by the state. Next, fill out the form accurately, ensuring that all fields are completed. After filling out the form, review it for any errors or omissions before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements set by the state.

Steps to Complete the Form RI 2625

Completing the RI Form 2625 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Step 1: Download the form from the official Rhode Island state website or obtain a physical copy.

- Step 2: Read the instructions carefully to understand the requirements and any specific details needed.

- Step 3: Fill in your personal and business information as required.

- Step 4: Double-check all entries for accuracy, ensuring no fields are left blank.

- Step 5: Sign and date the form, if required, to validate it.

- Step 6: Submit the completed form according to the guidelines provided.

Legal Use of the Form RI 2625

The legal use of the RI Form 2625 is governed by state regulations that dictate its proper completion and submission. When filled out correctly, the form can serve as a legally binding document. It is crucial to adhere to all instructions and requirements outlined by the state to ensure that the form holds up in legal contexts. This includes understanding any deadlines or specific filing methods that may apply.

Key Elements of the Form RI 2625

The RI Form 2625 contains several key elements that must be completed accurately. These include:

- Personal Information: Name, address, and contact details of the individual or business submitting the form.

- Purpose of the Form: A clear statement regarding the reason for submitting the form.

- Signature: A required signature that validates the information provided.

- Date: The date of submission, which may be relevant for compliance purposes.

Form Submission Methods

The RI Form 2625 can be submitted through various methods, depending on the specific requirements set by the state. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through the state’s official website.

- Mail: Printed forms can be mailed to the designated state office for processing.

- In-Person: Individuals may also choose to deliver the form directly to the appropriate office.

Quick guide on how to complete form ri 2625

Easily prepare Form Ri 2625 on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, edit, and eSign your documents without delays. Manage Form Ri 2625 on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The simplest way to modify and eSign Form Ri 2625 effortlessly

- Find Form Ri 2625 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and eSign Form Ri 2625 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ri 2625

Create this form in 5 minutes!

How to create an eSignature for the form ri 2625

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI Form 2625?

The RI Form 2625 is a crucial document used in Rhode Island for reporting purposes. It is essential for businesses and individuals who need to comply with state regulations. Understanding how to fill and submit the RI Form 2625 can streamline your document management process.

-

How can airSlate SignNow help with the RI Form 2625?

airSlate SignNow simplifies the signing and submission process for the RI Form 2625. Our platform provides an intuitive interface that allows users to easily upload, sign, and send documents electronically. This not only saves time but also ensures compliance with state guidelines.

-

Is there a cost associated with using airSlate SignNow for the RI Form 2625?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including handling the RI Form 2625. Our competitive rates ensure that you have access to a cost-effective solution for all your document signing needs. Check our website for detailed pricing options.

-

What features does airSlate SignNow offer for managing the RI Form 2625?

airSlate SignNow provides robust features, such as customizable templates, audit trails, and real-time tracking for the RI Form 2625. These features ensure that you can manage your documents efficiently and securely. Our platform is designed to enhance productivity while maintaining compliance.

-

Can I integrate airSlate SignNow with other tools to manage the RI Form 2625?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage the RI Form 2625 alongside your other business tools. Connectivity with CRMs and cloud storage solutions allows for a streamlined workflow and enhanced document management.

-

What are the benefits of using airSlate SignNow for the RI Form 2625?

Using airSlate SignNow for the RI Form 2625 provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. By opting for electronic signatures, you also minimize errors associated with traditional document handling. Additionally, our platform enhances the overall customer experience.

-

Is airSlate SignNow secure for handling the RI Form 2625?

Yes, security is a priority at airSlate SignNow. We utilize advanced encryption and security protocols to safeguard your documents, including the RI Form 2625. Our compliance with industry standards ensures that your information remains private and protected throughout the signing process.

Get more for Form Ri 2625

Find out other Form Ri 2625

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast