Sales and Excise Sales Use Tax Forms Tax Ri Gov 2021-2026

What is the Sales And Excise Sales Use Tax Forms Tax ri gov

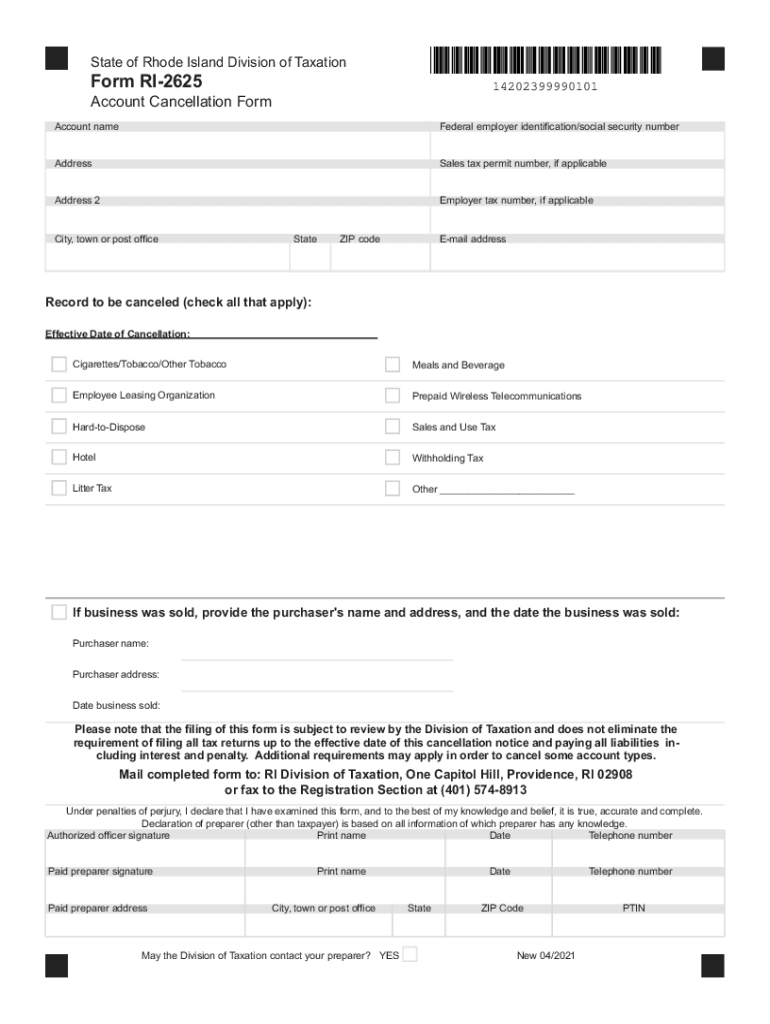

The Sales and Excise Sales Use Tax Forms available on tax ri gov are essential documents for individuals and businesses operating in Rhode Island. These forms are used to report and remit sales and use taxes to the state government. Sales tax is typically applied to the sale of goods and certain services, while use tax applies to items purchased outside the state but used within Rhode Island. Understanding these forms is crucial for compliance with state tax laws.

Steps to complete the Sales And Excise Sales Use Tax Forms Tax ri gov

Completing the Sales and Excise Sales Use Tax Forms involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including sales records and purchase receipts. Next, accurately fill out the required fields on the form, ensuring that all calculations are correct. After completing the form, review it thoroughly for any errors. Finally, submit the form by the designated deadline through the preferred submission method, whether online, by mail, or in person.

How to obtain the Sales And Excise Sales Use Tax Forms Tax ri gov

Obtaining the Sales and Excise Sales Use Tax Forms is straightforward. These forms can be accessed directly from the official tax ri gov website. Users can navigate to the forms section, where they will find downloadable versions of the required documents. It is important to ensure that you are using the most current version of the forms to avoid any compliance issues.

Legal use of the Sales And Excise Sales Use Tax Forms Tax ri gov

The legal use of the Sales and Excise Sales Use Tax Forms hinges on adherence to state regulations. To be considered legally binding, the forms must be completed accurately and submitted within the stipulated timelines. Utilizing a reliable platform for electronic signatures, such as signNow, can further enhance the legal standing of the forms by ensuring compliance with eSignature laws, including the ESIGN Act and UETA.

Key elements of the Sales And Excise Sales Use Tax Forms Tax ri gov

Key elements of the Sales and Excise Sales Use Tax Forms include specific sections that require detailed information about the taxpayer, the nature of the sales or use, and the total amount of tax due. It is essential to provide accurate figures, as discrepancies can lead to penalties or audits. Additionally, the forms typically require signatures to validate the information provided, which reinforces the legal authority of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Sales and Excise Sales Use Tax Forms are critical for compliance. Taxpayers should be aware of the specific dates set by the Rhode Island Department of Revenue for filing these forms. Missing a deadline can result in penalties and interest on unpaid taxes. It is advisable to mark these important dates on your calendar and prepare the necessary documentation well in advance.

Quick guide on how to complete sales and excise sales use tax forms tax ri gov

Prepare Sales And Excise Sales Use Tax Forms Tax ri gov effortlessly on any device

Online document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Sales And Excise Sales Use Tax Forms Tax ri gov on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Sales And Excise Sales Use Tax Forms Tax ri gov with minimal effort

- Find Sales And Excise Sales Use Tax Forms Tax ri gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Sales And Excise Sales Use Tax Forms Tax ri gov and ensure excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and excise sales use tax forms tax ri gov

Create this form in 5 minutes!

How to create an eSignature for the sales and excise sales use tax forms tax ri gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Sales and Excise Sales Use Tax Forms and how do they relate to Tax ri gov?

Sales and Excise Sales Use Tax Forms are crucial documents required for tax compliance in Rhode Island. They help businesses report sales and use taxes accurately and are governed by Tax ri gov regulations. Using airSlate SignNow can streamline the process of filling out these forms, ensuring accuracy and compliance.

-

How can airSlate SignNow simplify the process of managing Sales and Excise Sales Use Tax Forms?

airSlate SignNow offers an intuitive platform that enables businesses to create, send, and eSign Sales and Excise Sales Use Tax Forms easily. With its user-friendly interface, you can automate the workflow and reduce time spent on paperwork. This efficiency is particularly beneficial for businesses operating under Tax ri gov guidelines.

-

What features does airSlate SignNow provide for handling Sales and Excise Sales Use Tax Forms?

The platform offers comprehensive features such as customizable templates, secure eSignature options, and document tracking. These tools ensure you can manage your Sales and Excise Sales Use Tax Forms effectively while meeting Tax ri gov's requirements. Additionally, the easy integration with your existing systems enhances your overall experience.

-

Is airSlate SignNow cost-effective for small businesses needing to manage tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. It provides various pricing plans that cater specifically to different needs without compromising on features essential for managing Sales and Excise Sales Use Tax Forms under Tax ri gov. This makes it a viable option for optimizing tax processes without signNow financial strain.

-

How does airSlate SignNow ensure the security of my Sales and Excise Sales Use Tax Forms?

Security is a top priority for airSlate SignNow, which complies with industry-standard security protocols. Your Sales and Excise Sales Use Tax Forms are encrypted during transmission and storage, ensuring that sensitive information remains protected. This level of security aligns with the expectations set by Tax ri gov regulations, giving you peace of mind.

-

Can I integrate airSlate SignNow with my existing accounting software for managing tax forms?

Absolutely! airSlate SignNow seamlessly integrates with various accounting platforms, enabling you to synchronize your Sales and Excise Sales Use Tax Forms with your financial data. This integration is designed to enhance workflow efficiency and compliance with Tax ri gov, making your tax management process smoother.

-

What are the benefits of using airSlate SignNow for eSigning Sales and Excise Sales Use Tax Forms?

Using airSlate SignNow to eSign Sales and Excise Sales Use Tax Forms offers numerous benefits, including speed, convenience, and legal compliance. The platform allows for quick signatures from anywhere, reducing turnaround time signNowly. Given the need for accuracy in compliance with Tax ri gov, these advantages can greatly improve your tax documentation process.

Get more for Sales And Excise Sales Use Tax Forms Tax ri gov

Find out other Sales And Excise Sales Use Tax Forms Tax ri gov

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast