It 2663 Instructions Form

What is the It 2663 Instructions

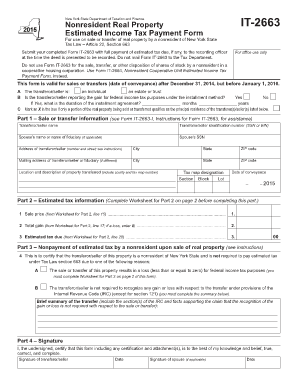

The It 2663 instructions refer to the guidelines for completing the It 2663 form, which is a document used in specific tax situations. This form is primarily utilized by individuals and businesses in the United States to report certain types of income or deductions. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and for accurate reporting to the Internal Revenue Service (IRS).

Steps to complete the It 2663 Instructions

Completing the It 2663 instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the income or deductions you are reporting. This may include previous tax returns, W-2 forms, or 1099 forms. Next, carefully read through the instructions to understand the specific requirements for each section of the form. Fill out the form systematically, ensuring that all information is accurate and complete. Finally, review your completed form for any errors before submission.

Legal use of the It 2663 Instructions

The legal use of the It 2663 instructions is crucial for ensuring that the information reported is valid and compliant with federal tax laws. The IRS requires that all forms submitted are completed accurately and truthfully. Failure to adhere to these guidelines can result in penalties or legal repercussions. Utilizing a reliable eSignature platform, such as airSlate SignNow, can help ensure that your submission is secure and legally binding, meeting all necessary regulations.

Filing Deadlines / Important Dates

Filing deadlines for the It 2663 form are critical to avoid penalties and ensure compliance. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline of April fifteenth. It is important to check for any updates or changes to these deadlines, as they can vary based on individual circumstances or changes in tax law. Marking these dates on your calendar can help ensure timely submission.

Required Documents

To complete the It 2663 instructions accurately, certain documents are required. These may include personal identification information, previous tax returns, income statements such as W-2 or 1099 forms, and any relevant receipts or records that support the deductions or income being reported. Having these documents organized and readily available will facilitate a smoother completion process.

Who Issues the Form

The It 2663 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and the information required for accurate reporting.

Quick guide on how to complete it 2663 instructions

Complete It 2663 Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional paper documents that require printing and signing, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage It 2663 Instructions on any gadget with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign It 2663 Instructions effortlessly

- Obtain It 2663 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal authority as a traditional handwritten signature.

- Review all details and click on the Done button to finalize your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign It 2663 Instructions to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 2663 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic it 2663 instructions for using airSlate SignNow?

To get started with airSlate SignNow, you need to sign up for an account. Once logged in, you can upload your documents and follow the it 2663 instructions for adding signers, creating signature fields, and sending documents for eSignature. Our user-friendly interface makes it easy to navigate through these steps.

-

How does pricing work for airSlate SignNow when following it 2663 instructions?

The pricing for airSlate SignNow varies based on the plan you choose. For detailed it 2663 instructions regarding our pricing structure, you can visit our pricing page or contact support. We offer flexible plans designed to cater to businesses of all sizes.

-

What features are included with airSlate SignNow as per the it 2663 instructions?

airSlate SignNow includes features such as document templates, customizable workflows, and robust security measures. According to the it 2663 instructions, you can also integrate with various applications, making it easier to manage your signing processes efficiently.

-

How can I benefit from using airSlate SignNow as guided by the it 2663 instructions?

Using airSlate SignNow allows businesses to streamline their document signing processes, enhancing productivity and saving time. By following the it 2663 instructions, users can quickly set up workflows that minimize paper usage and reduce turnaround times for agreements.

-

What integrations are available with airSlate SignNow according to the it 2663 instructions?

airSlate SignNow integrates seamlessly with various applications such as Google Workspace, Salesforce, and Zapier. The it 2663 instructions guide you on how to connect these tools, enabling smoother workflows and better document management.

-

Is there a mobile app for airSlate SignNow that aligns with the it 2663 instructions?

Yes, airSlate SignNow offers a mobile app that allows users to manage documents on the go. The it 2663 instructions include details on how to download and use the app for signing documents directly from your mobile device.

-

Can I customize my document templates following the it 2663 instructions?

Absolutely! airSlate SignNow allows you to create and customize document templates to fit your business needs. Following the it 2663 instructions, you can easily set up reusable templates that save signNow time during the signing process.

Get more for It 2663 Instructions

Find out other It 2663 Instructions

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form