Form 966 Certified Copy of Resolution

What is the Form 966 Certified Copy of Resolution

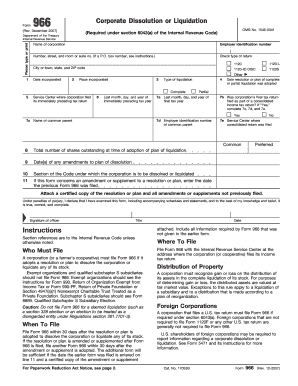

The Form 966, also known as the certified copy of resolution, is a document filed with the IRS by corporations to officially notify the agency of a corporate dissolution. This form is crucial for ensuring that the IRS is aware of a corporation's decision to dissolve and that all tax obligations are settled. It serves as a formal declaration of the corporation's intent to cease operations and outlines the resolutions adopted by the corporation's board of directors or shareholders regarding the dissolution.

Steps to Complete the Form 966 Certified Copy of Resolution

Completing the Form 966 involves several key steps to ensure accuracy and compliance with IRS requirements:

- Gather necessary information: Collect details such as the corporation's name, Employer Identification Number (EIN), and the date of dissolution.

- Prepare the resolution: Draft the resolution that outlines the decision to dissolve the corporation, including the approval from the board of directors or shareholders.

- Fill out the form: Complete the Form 966 with the gathered information and attach the certified copy of the resolution.

- Review for accuracy: Double-check all entries for correctness to avoid delays or issues with processing.

- Submit the form: Choose your preferred submission method, whether online or by mail, and send the completed form to the IRS.

Legal Use of the Form 966 Certified Copy of Resolution

The legal use of the Form 966 is to formally document a corporation's decision to dissolve and to notify the IRS of this action. Filing this form is essential to prevent any future tax liabilities and to ensure that the corporation is officially recognized as dissolved. It is important that the resolution is properly certified and that the form is submitted in accordance with IRS guidelines to maintain compliance with federal regulations.

Filing Deadlines / Important Dates

When filing the Form 966, it is important to adhere to specific deadlines to avoid penalties. Generally, the form should be filed within thirty days after the resolution to dissolve the corporation is adopted. Failure to file within this timeframe may result in complications regarding the corporation's tax status and potential penalties. It is advisable to consult IRS guidelines for any updates regarding deadlines or specific circumstances that may affect filing times.

Form Submission Methods (Online / Mail / In-Person)

The Form 966 can be submitted through various methods, depending on the preferences of the corporation. Options include:

- Online submission: Corporations may use electronic filing options available through authorized e-filing services.

- Mail: The completed form can be printed and sent to the appropriate IRS address via postal service.

- In-person: Corporations may also choose to deliver the form directly to an IRS office, though this method is less common.

Who Issues the Form

The Form 966 is issued by the Internal Revenue Service (IRS). It is a required document for corporations that are dissolving and must be completed in accordance with IRS regulations. The IRS provides guidelines on how to fill out the form and the necessary accompanying documentation to ensure proper processing.

Quick guide on how to complete form 966 certified copy of resolution

Effortlessly Manage Form 966 Certified Copy Of Resolution on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Form 966 Certified Copy Of Resolution on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Edit and eSign Form 966 Certified Copy Of Resolution Seamlessly

- Obtain Form 966 Certified Copy Of Resolution and click Get Form to begin.

- Use our provided tools to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 966 Certified Copy Of Resolution and ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 966 certified copy of resolution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 966 and why do I need it?

Form 966 is used to notify the IRS of a corporation's liquidation. If your business is planning to dissolve, understanding and completing Form 966 is crucial to ensure compliance with tax regulations. airSlate SignNow simplifies this process, making it easier to manage and eSign the necessary documents.

-

How can airSlate SignNow help me complete Form 966?

airSlate SignNow provides easy-to-use tools that allow you to fill out, sign, and send Form 966 seamlessly. The platform offers templates and guides to help you accurately complete the form, ensuring you don't miss any critical steps. With our electronic signature feature, you can expedite the process signNowly.

-

Is there a cost associated with filing Form 966 using airSlate SignNow?

Yes, while airSlate SignNow offers a range of plans, there may be costs associated with using the platform depending on your needs. However, the efficiency and convenience gained by using our solution often outweigh the expenses. We provide transparent pricing upfront to help you choose the best plan for your business.

-

Can I integrate Form 966 processing within my existing systems?

Absolutely! airSlate SignNow offers extensive integrations with various applications, allowing you to streamline your Form 966 processing workflow. Whether you use financial software or document management systems, our platform can connect and enhance your existing processes effortlessly.

-

What features does airSlate SignNow provide for managing Form 966?

airSlate SignNow includes features such as templates for Form 966, document tracking, automated reminders, and secure electronic signatures. These tools make it easy to manage your Form 966 paperwork with efficiency and accuracy. Plus, our user-friendly interface ensures you can navigate the entire process without hassle.

-

Is the eSigning of Form 966 legally binding?

Yes, eSigning Form 966 using airSlate SignNow is legally binding. Our platform complies with the ESIGN and UETA acts, ensuring your electronic signatures hold the same weight as traditional handwritten signatures. This gives you the confidence to complete your filings securely and on time.

-

How long does it take to eSign Form 966 with airSlate SignNow?

The time taken to eSign Form 966 varies based on the number of signers and additional documentation needed. However, with airSlate SignNow’s streamlined process, you can typically complete and send the form within minutes. The platform ensures minimal delays so you can focus on closing your business rather than paperwork.

Get more for Form 966 Certified Copy Of Resolution

Find out other Form 966 Certified Copy Of Resolution

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors