Mi1040cr Form

What is the Mi1040cr

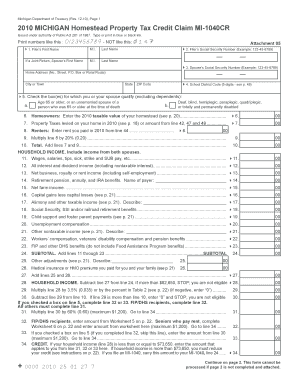

The Mi1040cr is the Michigan Homestead Property Tax Credit Claim form, designed for residents of Michigan to claim a credit on their property taxes. This form allows eligible homeowners to receive a reduction in their property tax burden based on their income and the amount of property taxes they pay. It is particularly beneficial for low-income individuals and families, helping to alleviate some of the financial pressures associated with homeownership.

How to use the Mi1040cr

Using the Mi1040cr involves several steps to ensure accurate completion. First, gather all necessary information, including your income details, property tax statements, and any relevant identification numbers. Next, fill out the form by providing personal information, such as your name, address, and social security number. Be sure to calculate your credit based on the guidelines provided in the form instructions. Finally, submit the completed form to the Michigan Department of Treasury by the specified deadline.

Steps to complete the Mi1040cr

Completing the Mi1040cr requires careful attention to detail. Follow these steps:

- Collect your income documentation, including W-2s and any other relevant tax forms.

- Obtain your property tax statement to determine the amount paid.

- Fill out the personal information section at the top of the form.

- Calculate your total household resources and determine eligibility for the credit.

- Complete the credit calculation section, ensuring all figures are accurate.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for the Mi1040cr, applicants must meet specific eligibility criteria. Generally, you must be a Michigan resident who owns and occupies a homestead property. Your household income must fall below a certain threshold, which is adjusted annually. Additionally, the property must be your primary residence, and you must have paid property taxes on it. Understanding these criteria is essential to ensure that you can successfully claim the credit.

Form Submission Methods

The Mi1040cr can be submitted through various methods to accommodate different preferences. You can file the form online using the Michigan Department of Treasury's e-file system, which offers a convenient and quick option. Alternatively, you may print the completed form and mail it to the appropriate address provided in the instructions. In-person submissions are also accepted at designated state offices, allowing for direct assistance if needed.

Key elements of the Mi1040cr

Several key elements are essential to the Mi1040cr form. These include:

- Personal Information: Your name, address, and social security number.

- Income Details: A comprehensive overview of your household income.

- Property Tax Information: The amount of property taxes paid during the tax year.

- Credit Calculation: A section to calculate the potential credit based on provided figures.

Quick guide on how to complete mi1040cr

Complete Mi1040cr effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Mi1040cr on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and electronically sign Mi1040cr with ease

- Find Mi1040cr and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in a few clicks from a device of your choosing. Modify and electronically sign Mi1040cr and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi1040cr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form mi 1040cr used for?

The form mi 1040cr is used to claim a Michigan homestead property tax credit. This form allows eligible Michigan residents to reduce their tax burden based on their income and property taxes, ultimately providing financial relief and facilitating better money management.

-

How can airSlate SignNow help with filling out the form mi 1040cr?

airSlate SignNow simplifies the process of completing the form mi 1040cr by allowing users to fill out, sign, and send the document electronically. With its user-friendly interface, individuals can ensure all necessary information is correctly entered and securely submitted, making tax preparation more efficient.

-

What features does airSlate SignNow offer for managing the form mi 1040cr?

airSlate SignNow provides features such as customizable templates, secure signatures, and document tracking for managing the form mi 1040cr. These tools help streamline the form completion process, ensuring that users can quickly and accurately handle their tax documents.

-

Is airSlate SignNow cost-effective for submitting the form mi 1040cr?

Yes, airSlate SignNow offers a cost-effective solution for individuals looking to submit the form mi 1040cr. With various pricing plans, users can choose a package that fits their budget while benefiting from essential features that facilitate document management and eSigning.

-

Can I integrate airSlate SignNow with other software while using the form mi 1040cr?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various applications, making it easier for users to manage the form mi 1040cr alongside their existing software. This functionality enhances workflow efficiency by allowing for automated data transfer and better document handling.

-

What benefits does eSigning the form mi 1040cr provide?

Using airSlate SignNow to eSign the form mi 1040cr offers numerous benefits, including faster processing times and enhanced security. By eliminating the need for physical signatures, users can expedite their tax submission process and reduce the risk of document loss.

-

Is my data secure when using airSlate SignNow for the form mi 1040cr?

Yes, airSlate SignNow prioritizes user data security with advanced encryption methods while handling the form mi 1040cr. Users can confidently complete and submit their documents, knowing that their sensitive information is protected throughout the process.

Get more for Mi1040cr

- Patrol cleveland form

- The national registry form

- North broadway united methodist church childrens ministry information sheet

- Akron veterinary internal medicine ampamp oncology330 666 form

- Senior project mentor evaluation form avon lake city schools

- Tax certification statement for management company pennsylvania form

- Abcte application addendum application for a temporary teaching permit form

- Schuylkill county public defender form

Find out other Mi1040cr

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online