State of Ct Form 1096

What is the State of Ct Form 1096?

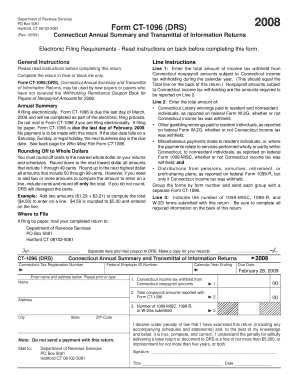

The State of Ct Form 1096 is a tax form used in Connecticut for reporting certain types of income. This form serves as a summary of the information reported on other forms, such as the 1099 series. It is essential for businesses and individuals who have made payments that require reporting to the state. Understanding the purpose of this form is crucial for compliance with state tax regulations.

How to Use the State of Ct Form 1096

Using the State of Ct Form 1096 involves several steps. First, gather all necessary information regarding payments made to contractors or other entities. Next, complete the form by entering the total amounts paid and the number of recipients. Ensure that the information aligns with the corresponding 1099 forms. Finally, submit the completed form to the Connecticut Department of Revenue Services by the specified deadline.

Steps to Complete the State of Ct Form 1096

Completing the State of Ct Form 1096 requires careful attention to detail. Follow these steps:

- Collect all relevant 1099 forms and payment records.

- Fill in the payer's information, including name, address, and federal identification number.

- Enter the total amount paid to recipients and the total number of forms submitted.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the State of Ct Form 1096

The State of Ct Form 1096 is legally required for reporting income payments. It ensures that the state has accurate records of income distributed to individuals and entities. Failure to file this form can lead to penalties and interest charges. It is important to comply with all state regulations regarding the use and submission of this form.

Filing Deadlines / Important Dates

Filing deadlines for the State of Ct Form 1096 are crucial for compliance. Typically, the form must be submitted by the end of January following the tax year in which payments were made. It is important to stay informed about any changes to filing dates, as they can vary from year to year. Late submissions may incur penalties, so timely filing is essential.

Form Submission Methods

The State of Ct Form 1096 can be submitted through various methods. Options include:

- Online submission through the Connecticut Department of Revenue Services website.

- Mailing the completed form to the appropriate address.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete state of ct form 1096

Easily Prepare State Of Ct Form 1096 on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and without holdups. Manage State Of Ct Form 1096 on any device through airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign State Of Ct Form 1096 Effortlessly

- Locate State Of Ct Form 1096 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and press the Done button to secure your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign State Of Ct Form 1096 and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of ct form 1096

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 1096 and how does it relate to airSlate SignNow?

CT 1096 is a form used for reporting Connecticut income tax withholding. Businesses using airSlate SignNow can easily eSign and send this document, ensuring compliance with state requirements while saving time and resources.

-

How much does airSlate SignNow cost for businesses needing to file CT 1096?

airSlate SignNow offers pricing plans that are flexible and cost-effective, catering to various business needs. Specific pricing for businesses looking to eSign CT 1096 can be found on our website, highlighting options that provide excellent value.

-

What are the key features that assist in processing CT 1096 with airSlate SignNow?

airSlate SignNow includes features such as document templates, real-time tracking, and secure storage, all of which streamline the process of preparing and submitting CT 1096. The platform enhances efficiency and reduces errors in document management.

-

How can I ensure my CT 1096 is securely signed using airSlate SignNow?

AirSlate SignNow employs top-notch security measures including encryption and multi-factor authentication to ensure that your CT 1096 is securely signed. This means sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with my existing accounting software for CT 1096 submissions?

Yes, airSlate SignNow integrates seamlessly with many popular accounting and payroll software, making it easier to manage and submit your CT 1096. This integration allows for a more streamlined process from document creation to signing.

-

What benefits does airSlate SignNow offer for handling CT 1096 compared to traditional methods?

Using airSlate SignNow to handle CT 1096 provides numerous benefits, including speed, efficiency, and reduced paper use. Businesses can quickly eSign and store documents electronically, leading to a quicker turnaround time for tax reporting.

-

Is there customer support available for questions about CT 1096 and airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist with any queries related to CT 1096. Our team is available via chat, email, and phone to ensure you have the help you need.

Get more for State Of Ct Form 1096

- Child s name cause in form

- Order dismissing proceeding supplemental ingov form

- So that the order of protection is valid in form

- Petition to modify an order for protection and request for a form

- Child s name cause in 390790455 form

- Agreement optional form

- Response to petition of employer for injunction prohibiting violence or threats of violence against employee in form

- Ps 31152 5 form

Find out other State Of Ct Form 1096

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors