Exemptions Exemption Form

Understanding the Bartending Agreement

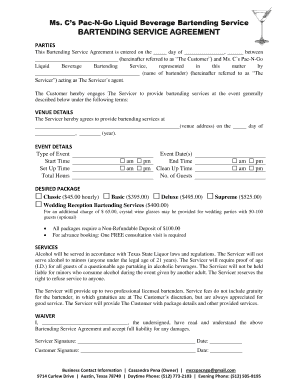

A bartending agreement is a legal document that outlines the terms and conditions between a bartender and an establishment. This agreement typically includes details such as the bartender's duties, compensation, work schedule, and any specific policies the establishment may have. It serves to protect both the bartender and the employer by clearly defining expectations and responsibilities.

Key Elements of a Bartending Agreement

When drafting a bartending agreement, several key elements should be included to ensure clarity and legal compliance:

- Parties Involved: Clearly identify the bartender and the establishment.

- Job Responsibilities: Outline the specific duties expected from the bartender.

- Compensation: Detail the pay structure, including hourly wages, tips, and any bonuses.

- Schedule: Specify work hours, shifts, and any expectations regarding availability.

- Termination Conditions: Define the circumstances under which either party may terminate the agreement.

- Compliance with Laws: Ensure that the agreement adheres to local, state, and federal laws regarding employment and alcohol service.

Legal Use of the Bartending Agreement

For a bartending agreement to be legally binding, it must meet certain criteria. Both parties should voluntarily agree to the terms, and the agreement should be signed by both the bartender and the employer. Additionally, the document should comply with relevant labor laws and regulations in the jurisdiction where the establishment operates. This includes considerations for minimum wage, overtime pay, and any applicable licensing requirements for serving alcohol.

Steps to Complete the Bartending Agreement

Completing a bartending agreement involves several important steps:

- Draft the agreement using clear and concise language.

- Review the agreement with both parties to ensure mutual understanding.

- Make any necessary amendments based on feedback.

- Have both parties sign the document, preferably in the presence of a witness.

- Keep copies of the signed agreement for both the bartender and the establishment.

Examples of Using the Bartending Agreement

Examples of situations where a bartending agreement is beneficial include:

- A new bar opening that requires hiring multiple bartenders.

- A seasonal bar that hires temporary staff for events or peak seasons.

- A restaurant expanding its beverage service and needing specialized bartenders.

Eligibility Criteria for Bartenders

To enter into a bartending agreement, individuals typically need to meet certain eligibility criteria, which may include:

- Minimum age requirements, usually at least twenty-one years old in most states.

- Completion of any required training or certification programs related to alcohol service.

- Possession of a valid identification and, if necessary, a bartending license.

Quick guide on how to complete exemptions exemption

Complete Exemptions Exemption effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Exemptions Exemption on any device using the airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Exemptions Exemption without any hassle

- Locate Exemptions Exemption and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Exemptions Exemption and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemptions exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bartending agreement?

A bartending agreement is a legal contract that outlines the terms and conditions between a bartender and an establishment. It typically includes details like compensation, responsibilities, and work hours. By using a bartending agreement, both parties can ensure clarity and avoid misunderstandings.

-

How can airSlate SignNow help with creating a bartending agreement?

airSlate SignNow provides an easy-to-use platform for drafting and signing your bartending agreement. With customizable templates and an intuitive interface, you can create a professional document quickly. Additionally, our eSignature feature allows you to finalize the agreement electronically and securely.

-

What features does airSlate SignNow offer for a bartending agreement?

With airSlate SignNow, you can access features like document templates, eSigning, and document sharing. These tools are designed to streamline the process of managing your bartending agreement. You will also benefit from cloud storage, making it easy to retrieve or modify your agreements anytime.

-

Is airSlate SignNow cost-effective for managing bartending agreements?

Yes, airSlate SignNow is a cost-effective solution for managing your bartending agreements. Our pricing plans are designed to fit businesses of all sizes, providing access to all essential features without breaking the bank. This allows you to focus more on your business rather than paperwork.

-

Can I customize my bartending agreement using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your bartending agreement to fit your specific needs. You can edit clauses, add specific requirements, and tailor the document to align with your business practices. This flexibility ensures that your bartending agreement meets all necessary legal and operational standards.

-

What are the benefits of using airSlate SignNow for bartending agreements?

Using airSlate SignNow for your bartending agreements simplifies the process of document management. Key benefits include faster turnaround times for signatures, enhanced security for sensitive data, and easy access to all your agreements from any device. This streamlines operations and enhances overall efficiency.

-

Does airSlate SignNow integrate with other software for bartending agreements?

Yes, airSlate SignNow offers seamless integrations with various popular software tools. Whether you use CRM systems, accounting software, or project management platforms, our solution can easily connect with them. This integration capability helps you manage your bartending agreements alongside other business processes.

Get more for Exemptions Exemption

Find out other Exemptions Exemption

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online