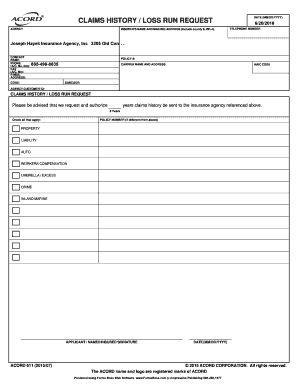

Claims History Loss Run Request Apartment Insurance Form

Understanding the Claims History Loss Run Request for Apartment Insurance

The Claims History Loss Run Request is a crucial document for apartment insurance, providing a detailed account of any claims made on a property. This report is essential for landlords and property managers seeking to understand their insurance history. It typically includes information about the number of claims, the types of claims, and the amounts paid out. By reviewing this history, property owners can assess their risk profile and make informed decisions regarding their insurance coverage.

Steps to Complete the Claims History Loss Run Request for Apartment Insurance

Completing the Claims History Loss Run Request involves several straightforward steps:

- Gather necessary information, including the property address and policy details.

- Contact the insurance provider to request the loss run report.

- Provide any required identification or documentation to verify your request.

- Submit the request through the preferred method, whether online, by mail, or in person.

- Wait for the insurance company to process your request and send the report.

Legal Use of the Claims History Loss Run Request for Apartment Insurance

The Claims History Loss Run Request serves a legal purpose in the insurance process. It is often required by underwriters when assessing risk for new policies or renewals. Ensuring that this document is accurate and complete is essential, as discrepancies can lead to issues with coverage or claims in the future. Additionally, having a clear record of past claims can help in negotiating better terms with insurers.

How to Obtain the Claims History Loss Run Request for Apartment Insurance

Obtaining the Claims History Loss Run Request is a straightforward process. Property owners can reach out directly to their insurance provider, either through customer service or their online portal. It is important to have all relevant information at hand to expedite the process. Some insurance companies may require a formal request letter, while others may allow for a simple verbal request. Be sure to follow up if you do not receive the report within the expected timeframe.

Key Elements of the Claims History Loss Run Request for Apartment Insurance

When reviewing the Claims History Loss Run Request, several key elements should be noted:

- Claim Date: The date when each claim was filed.

- Claim Amount: The total amount paid out for each claim.

- Claim Type: The nature of each claim, such as property damage or liability.

- Status: The current status of each claim, whether open or closed.

Examples of Using the Claims History Loss Run Request for Apartment Insurance

Utilizing the Claims History Loss Run Request can provide valuable insights for property owners. For instance, if a property has a history of frequent claims, it may indicate underlying issues that need addressing. Conversely, a clean claims history can enhance a property’s appeal to potential insurers, potentially leading to lower premiums. By analyzing this report, landlords can make strategic decisions regarding property maintenance and insurance options.

Quick guide on how to complete claims history loss run request apartment insurance

Complete Claims History Loss Run Request Apartment Insurance effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Claims History Loss Run Request Apartment Insurance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Claims History Loss Run Request Apartment Insurance with ease

- Find Claims History Loss Run Request Apartment Insurance and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with the tools available from airSlate SignNow specifically designed for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or by downloading it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Claims History Loss Run Request Apartment Insurance to guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claims history loss run request apartment insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss claim run and how does it work with airSlate SignNow?

A loss claim run is a streamlined process for filing and managing claims related to losses in your business. With airSlate SignNow, you can easily create, send, and eSign loss claim documents, ensuring quick and efficient handling of your claims. Our platform simplifies the workflow, enabling you to track your claims in real-time.

-

How does airSlate SignNow help in expediting loss claim runs?

airSlate SignNow accelerates loss claim runs by allowing you to prepare and share documents electronically. With instant eSigning capabilities, your documents are finalized faster, reducing delays typically associated with manual signatures. This efficiency translates to quicker resolutions for your claims.

-

What features does airSlate SignNow offer for managing loss claim runs?

Our platform offers a variety of features that enhance your loss claim run process, including templates for common claims, customizable workflows, and automated reminders for follow-ups. These tools ensure that you never miss deadlines and maintain compliance throughout the claim process.

-

Are there any integrations available with airSlate SignNow for loss claim runs?

Yes, airSlate SignNow easily integrates with various third-party applications, such as CRMs and document management systems, to streamline your loss claim runs. These integrations allow for seamless data flow and improved tracking of your claim submissions, enhancing overall efficiency.

-

Is airSlate SignNow cost-effective for small businesses managing loss claim runs?

Absolutely! airSlate SignNow provides a cost-effective solution that meets the needs of small businesses handling loss claim runs. Our pricing plans are competitive, and many features are available at no additional cost, making it accessible for businesses of all sizes.

-

What benefits can I expect from using airSlate SignNow for loss claim runs?

By using airSlate SignNow for your loss claim runs, you can expect faster processing times, reduced paperwork, and improved accuracy in your claims. The platform promotes better communication among stakeholders, ensuring that everyone involved is updated throughout the claims process.

-

Can airSlate SignNow be used for multiple types of loss claims?

Yes, airSlate SignNow is versatile and can be used for various types of loss claims, whether related to property, inventory, or other business losses. The platform's template library allows you to customize documents specifically for each type of claim, enhancing your operational workflow.

Get more for Claims History Loss Run Request Apartment Insurance

- Pdf international student waiver application form student health and

- Verification v5 form

- Igrf application cover sheet umd grad school form

- Independent verification form

- Free online survey maker easily create beautiful surveystypeform

- New hire packet edmonds community college form

- Consent to participate ampamp release form northeastern college of

- Form appt commxps

Find out other Claims History Loss Run Request Apartment Insurance

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free