Grand Rapids Tax for Gr 1040x 2014

What is the Grand Rapids Tax For Gr 1040x

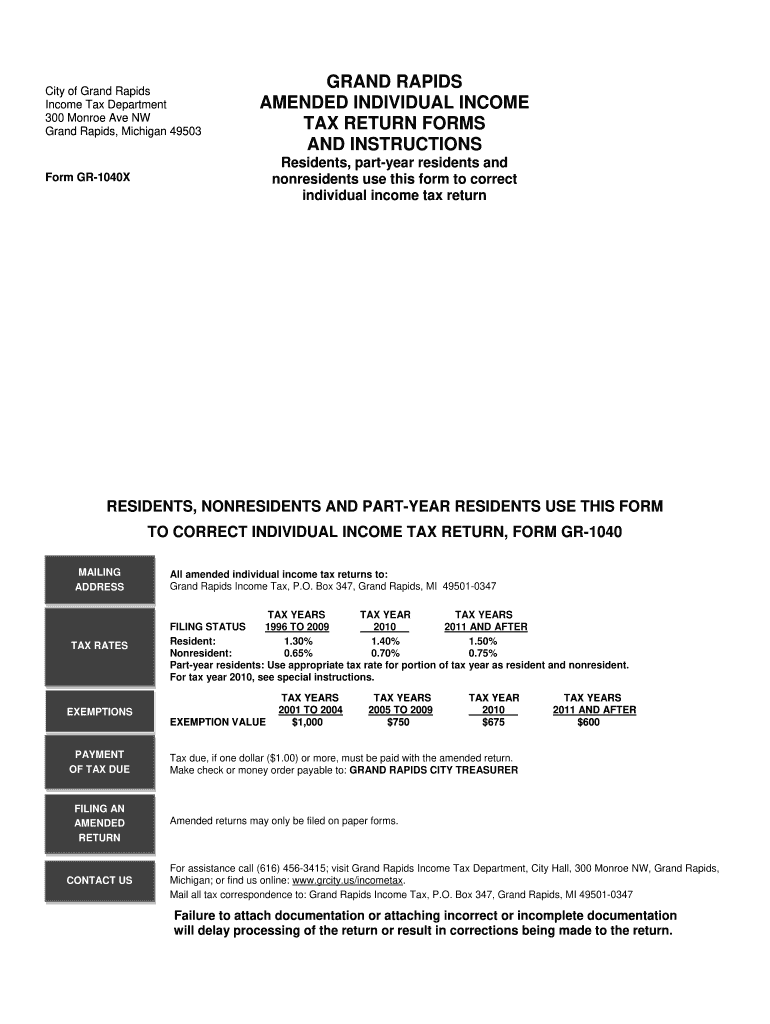

The Grand Rapids Tax for GR 1040X is a specific tax form used for amending individual income tax returns in Grand Rapids, Michigan. This form allows taxpayers to correct errors on their original tax returns, such as misreported income, deductions, or credits. It is essential for ensuring that tax filings are accurate and compliant with local regulations. By using the GR 1040X, taxpayers can make necessary adjustments and potentially receive refunds or reduce tax liabilities.

How to use the Grand Rapids Tax For Gr 1040x

Using the Grand Rapids Tax for GR 1040X involves several straightforward steps. First, obtain the form from the appropriate tax authority or website. Next, fill out the form with accurate information, including the changes being made and the reasons for those changes. It is important to provide supporting documentation for any adjustments. Once completed, review the form for accuracy before submitting it to ensure compliance with local tax laws.

Steps to complete the Grand Rapids Tax For Gr 1040x

Completing the Grand Rapids Tax for GR 1040X requires careful attention to detail. Here are the essential steps:

- Obtain the GR 1040X form from the local tax authority.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Clearly state the changes you are making, providing specific details and amounts.

- Attach any necessary documentation that supports your amendments.

- Review the completed form for accuracy and completeness.

- Submit the form either online, by mail, or in person, as per the local guidelines.

Legal use of the Grand Rapids Tax For Gr 1040x

The Grand Rapids Tax for GR 1040X is legally recognized as a valid method for amending tax returns. To ensure its legal standing, it must be completed accurately and submitted within the designated time frames established by the state. Compliance with local tax regulations is crucial, as any discrepancies may lead to penalties or delays in processing. Utilizing this form appropriately helps maintain transparency and accuracy in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Grand Rapids Tax for GR 1040X are critical for taxpayers to meet. Generally, amended returns must be filed within three years of the original filing date or within one year of the date of tax payment, whichever is later. Staying aware of these deadlines helps avoid potential penalties and ensures that any refunds are processed in a timely manner. It is advisable to check with the local tax authority for any updates or changes to these deadlines.

Required Documents

When completing the Grand Rapids Tax for GR 1040X, certain documents are necessary to support your amendments. These may include:

- Original tax return that is being amended.

- Any W-2s, 1099s, or other income statements relevant to the tax year.

- Documentation for deductions or credits being claimed.

- Any correspondence from the tax authority regarding previous filings.

Having these documents on hand ensures a smoother process and helps substantiate the changes being made on the form.

Quick guide on how to complete grand rapids tax for gr 1040x

Complete Grand Rapids Tax For Gr 1040x seamlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Grand Rapids Tax For Gr 1040x on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The easiest way to modify and eSign Grand Rapids Tax For Gr 1040x effortlessly

- Find Grand Rapids Tax For Gr 1040x and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Grand Rapids Tax For Gr 1040x and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct grand rapids tax for gr 1040x

Create this form in 5 minutes!

How to create an eSignature for the grand rapids tax for gr 1040x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing grand rapids tax for gr 1040x?

The process for filing grand rapids tax for gr 1040x involves gathering your tax documents, completing the 1040x form, and submitting it to the tax authorities. You can utilize airSlate SignNow to eSign your completed forms and send them electronically, making it quick and efficient.

-

How does airSlate SignNow simplify the grand rapids tax for gr 1040x filing?

AirSlate SignNow simplifies the grand rapids tax for gr 1040x filing by providing a user-friendly interface to create, edit, and eSign your documents. This eliminates the hassles of paperwork and ensures that you can complete your forms accurately and swiftly.

-

Are there any costs associated with using airSlate SignNow for grand rapids tax for gr 1040x?

Yes, there are pricing plans associated with using airSlate SignNow for grand rapids tax for gr 1040x. However, the platform is designed to be cost-effective, offering various packages to fit different business needs while delivering high value for your investment.

-

Can I integrate airSlate SignNow with other financial software for grand rapids tax for gr 1040x?

Absolutely! AirSlate SignNow seamlessly integrates with popular financial and tax software, allowing you to streamline your grand rapids tax for gr 1040x filing process. This integration enhances efficiency by eliminating duplicate data entry and improving overall workflow.

-

What are the key benefits of using airSlate SignNow for grand rapids tax for gr 1040x?

Using airSlate SignNow for grand rapids tax for gr 1040x offers numerous benefits, including increased speed in document processing, enhanced security for sensitive information, and the convenience of managing documents from anywhere. This ensures you stay compliant and organized while saving time.

-

Is airSlate SignNow secure for handling sensitive grand rapids tax for gr 1040x documents?

Yes, airSlate SignNow prioritizes the security of your documents when handling grand rapids tax for gr 1040x. The platform employs industry-standard encryption and secure storage options to protect your data against unauthorized access.

-

How can I get support while using airSlate SignNow for grand rapids tax for gr 1040x?

AirSlate SignNow provides dedicated customer support to assist you with any issues you may encounter while filing your grand rapids tax for gr 1040x. Whether you prefer live chat, email, or phone support, you can signNow out for immediate assistance.

Get more for Grand Rapids Tax For Gr 1040x

- Radiologic technology associate degree application packet form

- Releasehold harmless agreement form clevelandstatecc

- Clinical laboratory scientist sdsu college of sciences form

- Vfd parent signature page twu form

- Release assumption risk waiver form template

- Benefit request ampamp change formsapply for benefitsoffice

- Las positas college request form

- Aa as ca course substitution or waiver form las positas

Find out other Grand Rapids Tax For Gr 1040x

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online