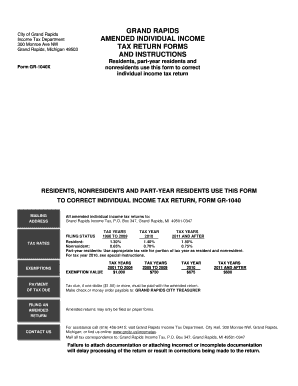

AMENDED INDIVIDUAL INCOME Grcity 2015-2026

What is the AMENDED INDIVIDUAL INCOME Grcity

The AMENDED INDIVIDUAL INCOME Grcity form is a tax document used by individuals to correct errors or make changes to their previously filed income tax returns. This form allows taxpayers to adjust their income, deductions, credits, or filing status. It is essential for ensuring that the information reported to the IRS is accurate and up-to-date, which can affect tax liabilities and potential refunds.

Steps to complete the AMENDED INDIVIDUAL INCOME Grcity

Completing the AMENDED INDIVIDUAL INCOME Grcity form involves several important steps:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes.

- Clearly indicate the changes you are making on the form, providing explanations where necessary.

- Ensure that all calculations are accurate, as errors can lead to delays or penalties.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form either electronically or via mail, depending on the submission options available.

Legal use of the AMENDED INDIVIDUAL INCOME Grcity

The legal use of the AMENDED INDIVIDUAL INCOME Grcity form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes. Compliance with IRS guidelines ensures that the amended return is legally recognized, which can help avoid potential penalties or legal issues related to tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the AMENDED INDIVIDUAL INCOME Grcity form are crucial for compliance. Typically, taxpayers have up to three years from the original filing date to submit an amended return. Additionally, if you are claiming a refund, it is essential to file within this timeframe to ensure you receive any potential refunds due.

Required Documents

When preparing to submit the AMENDED INDIVIDUAL INCOME Grcity form, it is important to gather the necessary documents, which may include:

- Your original tax return.

- Any supporting documentation for the changes, such as W-2s, 1099s, or receipts.

- Previous correspondence with the IRS regarding your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the AMENDED INDIVIDUAL INCOME Grcity form. It is important to review these guidelines to ensure that your amendments comply with federal tax laws. This includes understanding the types of changes that can be made, the required information to include, and the appropriate submission methods.

Quick guide on how to complete amended individual income grcity

Complete AMENDED INDIVIDUAL INCOME Grcity effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without any holdups. Manage AMENDED INDIVIDUAL INCOME Grcity on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign AMENDED INDIVIDUAL INCOME Grcity with ease

- Locate AMENDED INDIVIDUAL INCOME Grcity and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign AMENDED INDIVIDUAL INCOME Grcity to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amended individual income grcity

Create this form in 5 minutes!

How to create an eSignature for the amended individual income grcity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AMENDED INDIVIDUAL INCOME Grcity?

AMENDED INDIVIDUAL INCOME Grcity is a process for correcting previously filed individual income tax returns. It allows taxpayers to rectify errors, adjust claiming deductions, or report new information. Utilizing platforms like airSlate SignNow simplifies the process by enabling easy e-signing of amended tax documents.

-

How can airSlate SignNow help with AMENDED INDIVIDUAL INCOME Grcity?

airSlate SignNow streamlines the process of amending individual income taxes by providing a secure platform for document e-signing and sharing. Users can quickly send out amended documents for electronic signatures, ensuring a faster turnaround time. This efficiency is crucial when addressing AMENDED INDIVIDUAL INCOME Grcity needs.

-

What are the pricing options for airSlate SignNow related to AMENDED INDIVIDUAL INCOME Grcity?

airSlate SignNow offers various pricing plans tailored for users needing to manage AMENDED INDIVIDUAL INCOME Grcity efficiently. These plans include both monthly and annual subscriptions, with flexible options depending on usage. The cost-effective solutions facilitate easy document management without exceeding budgets.

-

What features of airSlate SignNow are ideal for AMENDED INDIVIDUAL INCOME Grcity?

Key features of airSlate SignNow that benefit users dealing with AMENDED INDIVIDUAL INCOME Grcity include customizable templates, real-time tracking, and secure cloud storage. The platform allows users to create, edit, and send documents easily, ensuring all amendments are tracked and stored securely for future reference.

-

Is it safe to use airSlate SignNow for AMENDED INDIVIDUAL INCOME Grcity documents?

Yes, airSlate SignNow employs advanced security measures to protect sensitive information related to AMENDED INDIVIDUAL INCOME Grcity. The platform features end-to-end encryption and complies with industry standards to guarantee data integrity. Users can confidently e-sign and share their amended documents.

-

Can I integrate airSlate SignNow with other applications for AMENDED INDIVIDUAL INCOME Grcity?

Absolutely! airSlate SignNow offers integrations with various applications that users may need for AMENDED INDIVIDUAL INCOME Grcity. This includes accounting software and tax preparation tools, allowing seamless data transfer and enhancing overall productivity during the amendment process.

-

What benefits does airSlate SignNow provide for handling AMENDED INDIVIDUAL INCOME Grcity?

The primary benefits of airSlate SignNow for AMENDED INDIVIDUAL INCOME Grcity include improved efficiency, reduced paperwork, and enhanced collaboration. Users can amend their tax documents quickly and professionally, minimizing delays and ensuring compliance with tax regulations. This ease of use signNowly reduces stress during tax season.

Get more for AMENDED INDIVIDUAL INCOME Grcity

- Form 3 202 17

- Mobile phone or device repair form please sign and include with device

- Annotated bibliography table form

- Asa official roster and waiver form clinton parks and recreation

- Cross disciplinary skills worksheet answer key form

- Saif corporation forms for blood borne pathogen exposures

- Ofi form 86c 5624239

- Cal grant gpa verification form fillable online

Find out other AMENDED INDIVIDUAL INCOME Grcity

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online