PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 Form

What is the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

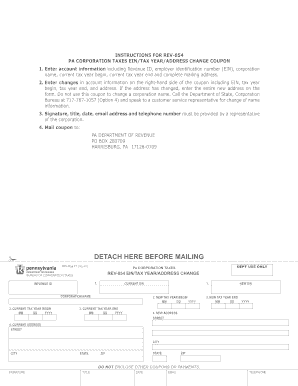

The PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 is a form used by businesses in Pennsylvania to update their address information with the Department of Revenue. This form is essential for ensuring that all correspondence, tax documents, and notifications are sent to the correct address. It is particularly important for corporations that have changed their principal place of business or mailing address, as it helps maintain compliance with state tax regulations.

How to use the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

To use the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854, businesses must accurately fill out the form with the new address details. It is important to include the corporation's name, old address, new address, and any relevant identification numbers. Once completed, the form should be submitted to the Pennsylvania Department of Revenue. This can typically be done online, by mail, or in person, depending on the specific requirements outlined by the department.

Steps to complete the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

Completing the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 involves several key steps:

- Obtain the form from the Pennsylvania Department of Revenue website or through official channels.

- Fill in the corporation's name and identification number accurately.

- Provide the old address that needs to be updated.

- Enter the new address where all future correspondence should be sent.

- Review the form for accuracy and completeness.

- Submit the form according to the preferred method (online, mail, or in person).

Legal use of the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

The PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 is legally binding when filled out and submitted correctly. This means that the information provided must be accurate and truthful, as any discrepancies can lead to compliance issues with the Pennsylvania Department of Revenue. Businesses should retain a copy of the submitted form for their records, as it serves as proof of the address change.

Key elements of the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

Key elements of the PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 include:

- Corporation Name: The legal name of the business entity.

- Old Address: The previous address on file with the Department of Revenue.

- New Address: The updated address where correspondence should be sent.

- Identification Number: The unique identifier assigned to the corporation.

- Signature: The form must be signed by an authorized representative of the corporation.

Quick guide on how to complete pa corporation taxes eintax yearaddress change coupon rev 854

Complete PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 without hassle

- Locate PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document administration needs in just a few clicks from any device of your choice. Edit and eSign PA Corporation Taxes EINTax YearAddress Change Coupon REV 854 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa corporation taxes eintax yearaddress change coupon rev 854

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form rev 854?

Form rev 854 is a standardized document used for various business applications, especially in compliance and legal contexts. Utilizing airSlate SignNow, you can easily fill out, send, and eSign form rev 854, streamlining your workflow and enhancing efficiency.

-

How can I create and customize form rev 854 using airSlate SignNow?

Creating and customizing form rev 854 with airSlate SignNow is simple. You can use our intuitive drag-and-drop interface to add fields, text, and branding to the form, ensuring it meets your specific requirements while remaining professional and compliant.

-

What are the pricing options for using airSlate SignNow with form rev 854?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Each plan allows you to manage and eSign documents, including form rev 854, at competitive rates, making it an affordable choice for businesses of all types.

-

Can I integrate form rev 854 with other software applications?

Yes, airSlate SignNow allows seamless integration with various software applications. You can connect form rev 854 with your existing CRM, project management, or document storage systems, ensuring a smooth workflow and data consistency across platforms.

-

What are the benefits of using airSlate SignNow for form rev 854?

Using airSlate SignNow for form rev 854 offers numerous benefits, including time savings, enhanced security, and reduced paper waste. Digital signatures ensure legal compliance, while the ease of access means your team can complete documents quickly from anywhere.

-

Is airSlate SignNow compliant with electronic signature laws when using form rev 854?

Absolutely. airSlate SignNow complies with various electronic signature laws, including the U.S. ESIGN Act and eIDAS regulations in Europe. When you eSign form rev 854 through our platform, you can trust that it meets all legal requirements for secure digital transactions.

-

How secure is my data when using form rev 854 with airSlate SignNow?

Your data security is a top priority with airSlate SignNow. When working with form rev 854, the platform employs advanced encryption protocols and complies with industry standards. This ensures that all your sensitive information remains secure and confidential.

Get more for PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

- San juan college center for workforce development application for admission san juan college center for workforce development form

- Spokane community college radiologic technology application packet spokane community college radiologic technology application form

- Mclennan community colleges admissions amp registration checklist application and menigitis vaccination information mclennan

- Federal regulations require enterprise state community college to determine whether a student is maintaining satisfactory form

- The state of delaware maintains strict confidentiality and security of employee records in compliance with federal and state form

- Clark university health services graduate immunization record name date of birth student id cell phone email department form

- Meredith college application for tuition remission for employee retiree meredith college application for tuition remission for form

- Blank job application form templates ampamp samples pdf wordblank job application form templates ampamp samples pdf

Find out other PA Corporation Taxes EINTax YearAddress Change Coupon REV 854

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors