Form 8822

What is the Form 8822

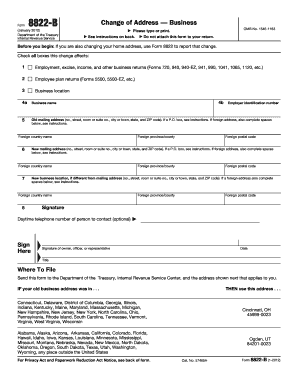

The Form 8822 is a tax form used by individuals to notify the Internal Revenue Service (IRS) of a change of address. This form is essential for ensuring that the IRS has your current address on file, which is important for receiving tax refunds, notices, and other important correspondence. The form can be used by individual taxpayers, including those who are married and filing jointly. It is important to complete this form accurately to avoid any potential issues with your tax records.

How to use the Form 8822

To use the Form 8822, you need to fill out the required information accurately. This includes your old address, your new address, and your personal details such as your name and Social Security number. After completing the form, you can submit it to the IRS by mail. It is crucial to ensure that the information provided is correct to prevent delays in processing your change of address. Additionally, if you are filing jointly, both spouses must sign the form.

Steps to complete the Form 8822

Completing the Form 8822 involves several steps:

- Obtain the Form 8822 from the IRS website or a tax professional.

- Fill in your personal information, including your name, Social Security number, and date of birth.

- Provide your old address and your new address.

- If applicable, include your spouse’s information if you are filing jointly.

- Sign and date the form.

- Mail the completed form to the address specified in the instructions.

Legal use of the Form 8822

The Form 8822 is legally recognized as a valid method for notifying the IRS of a change of address. When completed and submitted correctly, it ensures that your tax records are updated, which is essential for compliance with federal tax laws. It is important to keep a copy of the submitted form for your records. Failure to notify the IRS of an address change may result in missed communications regarding tax obligations or refunds.

Filing Deadlines / Important Dates

There are no specific deadlines for submitting Form 8822; however, it is advisable to file it as soon as you change your address. Timely submission helps ensure that the IRS can reach you regarding any tax-related matters. If you are expecting a tax refund, submitting the form promptly can help prevent delays in receiving your refund at your new address.

Form Submission Methods

The Form 8822 must be submitted by mail. The IRS does not currently accept this form electronically. After completing the form, ensure you send it to the correct address provided in the instructions. It is recommended to use a secure mailing method to confirm that your form is delivered safely to the IRS.

Quick guide on how to complete form 8822

Complete Form 8822 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 8822 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and electronically sign Form 8822 with ease

- Locate Form 8822 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Form 8822 to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8822

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8822 and why is it important?

Form 8822 is a change of address form required by the IRS for individuals and businesses. It ensures that you receive important tax documents and correspondence at your new address, making it crucial for maintaining accurate tax records.

-

How can airSlate SignNow help with completing form 8822?

airSlate SignNow streamlines the process of completing form 8822 by allowing users to easily fill out and eSign the document online. This eliminates the hassle of printing, signing, and scanning, making it more efficient and user-friendly.

-

Are there any costs associated with using airSlate SignNow to manage form 8822?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you only pay for the features you need while providing the convenience of managing form 8822 electronically.

-

What features does airSlate SignNow offer for managing form 8822?

With airSlate SignNow, you can complete, eSign, and securely store form 8822 online. Key features include customizable templates, document tracking, and automated workflows which enhance efficiency and accuracy.

-

Can I integrate airSlate SignNow with other applications for managing form 8822?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRMs like Salesforce. This allows you to manage form 8822 along with other documents seamlessly across different platforms.

-

Is airSlate SignNow secure for handling sensitive documents like form 8822?

Absolutely! airSlate SignNow prioritizes security by implementing advanced encryption measures and complying with industry standards. Your form 8822 and other sensitive documents are protected throughout the signing process.

-

How does airSlate SignNow improve the workflow for submitting form 8822?

By using airSlate SignNow, the workflow for submitting form 8822 is signNowly improved. You can quickly prepare, sign, and send the form electronically, reducing turnaround times and ensuring timely submissions.

Get more for Form 8822

- Indian river state college swimming form

- Vince and joes form

- Security guards service job application form

- New sites for ultimate security ltd form

- Sexual harassment acknowledgement form

- Certificate of origin korea us trade agreement fill form

- Certifying official documents for foreign use form

- Private bird hunting area application pwd 348 texas form

Find out other Form 8822

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT