Mary Kay Tax Worksheet Form

What is the Mary Kay Tax Worksheet

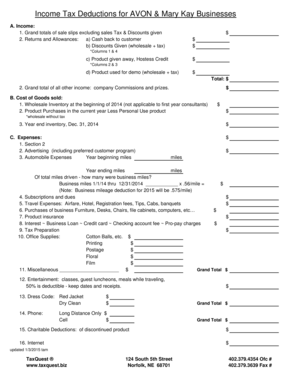

The Mary Kay Tax Worksheet is a specialized document designed for Mary Kay consultants to track their income and expenses throughout the tax year. This worksheet simplifies the process of preparing tax returns by providing a structured format to record earnings from sales, commissions, and bonuses, as well as deductible expenses related to the business. It is essential for ensuring accurate reporting and maximizing potential tax deductions.

How to use the Mary Kay Tax Worksheet

Using the Mary Kay Tax Worksheet involves several straightforward steps. Start by gathering all relevant financial documents, including sales receipts, invoices, and records of business-related expenses. Next, fill in the worksheet with your total income and categorize your expenses, such as product costs, marketing, and travel. This organized approach helps you maintain clarity and ensures that you capture all necessary information for your tax filing.

Steps to complete the Mary Kay Tax Worksheet

Completing the Mary Kay Tax Worksheet requires careful attention to detail. Follow these steps for effective completion:

- Gather all financial documents related to your Mary Kay business.

- Enter your total income from sales and commissions in the designated section.

- List all deductible expenses, categorizing them appropriately.

- Calculate your net income by subtracting total expenses from total income.

- Review the worksheet for accuracy before submission.

Legal use of the Mary Kay Tax Worksheet

The Mary Kay Tax Worksheet is legally recognized as a valid tool for documenting income and expenses for tax purposes. To ensure compliance with IRS regulations, it is important to maintain accurate records and complete the worksheet thoroughly. This document can serve as evidence in case of an audit, demonstrating your financial activities related to your Mary Kay business.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for Mary Kay consultants. Typically, the tax filing deadline for individuals in the United States is April 15. However, if you are self-employed, you may also need to make estimated tax payments throughout the year, with deadlines occurring quarterly. Keeping track of these dates helps avoid penalties and ensures timely submission of your tax returns.

Required Documents

To accurately complete the Mary Kay Tax Worksheet, several documents are necessary. These include:

- Sales receipts and commission statements

- Records of business expenses, such as receipts for products and marketing

- Bank statements showing business transactions

- Any relevant tax forms received from Mary Kay or the IRS

Examples of using the Mary Kay Tax Worksheet

Using the Mary Kay Tax Worksheet can vary based on individual circumstances. For instance, a consultant who primarily sells products online may focus on documenting shipping costs and online advertising expenses. Conversely, a consultant who conducts in-person parties might emphasize costs associated with venue rentals and refreshments. Tailoring the worksheet to your specific business model enhances its effectiveness in tax preparation.

Quick guide on how to complete mary kay tax worksheet 240332299

Effortlessly Prepare Mary Kay Tax Worksheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed documents that need to be signed, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without any delay. Manage Mary Kay Tax Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to edit and electronically sign Mary Kay Tax Worksheet with ease

- Obtain Mary Kay Tax Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to finalize your changes.

- Choose your delivery method for the form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Mary Kay Tax Worksheet and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mary kay tax worksheet 240332299

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mary kay tax worksheet and why do I need it?

The mary kay tax worksheet is a specialized document designed to help Mary Kay consultants accurately track their expenses and income for tax purposes. It simplifies the tax preparation process, ensuring you don't miss any deductions. Having this worksheet can save you time and potentially reduce your tax liability.

-

How much does the mary kay tax worksheet cost?

The mary kay tax worksheet is often available at no additional cost to Mary Kay consultants, but prices may vary depending on where you source it. Many tools and templates that offer customized versions can range from $10 to $50. Investing in an effective worksheet can streamline your tax filing process and pay for itself through potential savings.

-

Can the mary kay tax worksheet integrate with other financial tools?

Yes, the mary kay tax worksheet can often be integrated with various accounting and tax software solutions. This allows for seamless data transfer, which enhances accuracy and saves time during tax season. By using it alongside your existing financial tools, you can ensure all your earnings and deductions are organized.

-

What features should I look for in a mary kay tax worksheet?

A good mary kay tax worksheet should include features like detailed expense tracking, income logs, and auto-calculation of totals. Look for templates that allow for customization according to your business needs. Additionally, features like summaries and tips for maximizing deductions are beneficial.

-

How can the mary kay tax worksheet benefit my business?

Using a mary kay tax worksheet can streamline your financial management and make tax season much less stressful. It helps you organize your income and expenses, ensuring that you maximize deductions. This proactive approach to your bookkeeping can ultimately enhance your profitability.

-

Is there any support available for using the mary kay tax worksheet?

Many providers of the mary kay tax worksheet offer customer support or tutorials to help you get started. This can include video guides, FAQs, or a dedicated support line. Taking advantage of these resources ensures you're utilizing the worksheet to its full potential.

-

How frequently should I update my mary kay tax worksheet?

It's best to update your mary kay tax worksheet regularly, ideally weekly or monthly, to stay on top of your expenses and income. Frequent updates can help prevent any last-minute rush during tax season. Maintaining accurate and timely records also aids in clearer financial analysis for your business.

Get more for Mary Kay Tax Worksheet

- New mexico business personal property form

- Aetna appeal form

- The american society of diagnostic form

- Les schwab tire centers and form

- Medical malpractice insurance for new york physicians and form

- Mason county ems amp trauma council form

- Managed care reinsurance claim form

- Hepatitis b vaccine documentation form

Find out other Mary Kay Tax Worksheet

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT