Form it 360 1 New York Change of City Resident in 2023

What is the Form IT-360.1 New York Change of City Resident In?

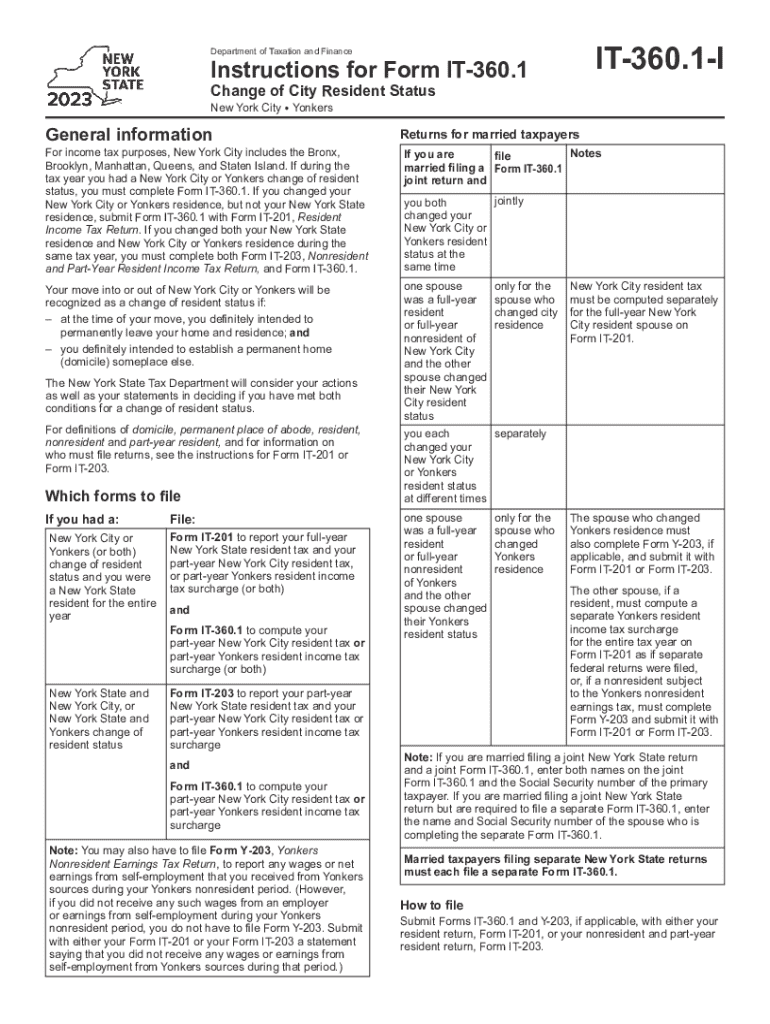

The Form IT-360.1 is a New York State tax form used by individuals who are changing their city of residence within New York. This form is essential for reporting changes in residency to the New York State Department of Taxation and Finance. It helps ensure that taxpayers are assessed the correct local taxes based on their new residency status. The form captures information about the taxpayer's previous and new addresses, the dates of the move, and other relevant details necessary for accurate tax calculations.

How to Use the Form IT-360.1 New York Change of City Resident In

To effectively use the Form IT-360.1, taxpayers should first ensure they have the correct version of the form, which can be obtained from the New York State Department of Taxation and Finance website. After acquiring the form, individuals should fill in their personal details, including their Social Security number, previous city of residence, new city of residence, and the date of the move. It is crucial to provide accurate information to avoid any discrepancies in tax assessments. Once completed, the form should be submitted according to the specified submission methods.

Steps to Complete the Form IT-360.1 New York Change of City Resident In

Completing the Form IT-360.1 involves several key steps:

- Obtain the form from the New York State Department of Taxation and Finance.

- Fill in your personal information, including your name, Social Security number, and contact details.

- Provide your previous city of residence and your new city of residence.

- Indicate the date you moved to your new city.

- Review your entries for accuracy.

- Sign and date the form to certify that the information provided is correct.

Following these steps carefully will help ensure that your residency change is processed smoothly.

Required Documents for the Form IT-360.1 New York Change of City Resident In

When submitting the Form IT-360.1, it is important to include any necessary supporting documents. Typically, taxpayers may need to provide proof of residency, such as:

- A copy of a utility bill showing your name and new address.

- Lease agreements or mortgage documents for your new residence.

- Any official correspondence that reflects your change of address.

Having these documents ready can facilitate the processing of your form and help resolve any potential issues.

Filing Deadlines for the Form IT-360.1 New York Change of City Resident In

It is important to be aware of the filing deadlines associated with the Form IT-360.1. Typically, the form should be filed within a certain period after changing your residency, often by the end of the tax year in which the move occurred. Taxpayers should check the New York State Department of Taxation and Finance for specific dates and any updates to filing requirements. Missing the deadline may result in penalties or complications with tax assessments.

Legal Use of the Form IT-360.1 New York Change of City Resident In

The Form IT-360.1 serves a legal purpose in ensuring that taxpayers comply with New York State tax laws regarding residency. Properly completing and submitting this form helps to maintain accurate tax records and ensures that individuals are taxed appropriately based on their current residency status. Failure to file the form can lead to legal implications, including potential fines or increased tax liabilities.

Quick guide on how to complete form it 360 1 new york change of city resident in

Effortlessly prepare Form IT 360 1 New York Change Of City Resident In on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Handle Form IT 360 1 New York Change Of City Resident In on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Form IT 360 1 New York Change Of City Resident In with ease

- Obtain Form IT 360 1 New York Change Of City Resident In and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 360 1 New York Change Of City Resident In and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 360 1 new york change of city resident in

Create this form in 5 minutes!

How to create an eSignature for the form it 360 1 new york change of city resident in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 360 1 form and how does it work?

The 360 1 form is a digital document that allows users to collect and manage signatures efficiently. With airSlate SignNow, you can create, send, and eSign 360 1 forms seamlessly, ensuring a smooth workflow for your business. This form is designed to streamline the signing process, making it easier for all parties involved.

-

What are the key features of the 360 1 form in airSlate SignNow?

The 360 1 form in airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage. Users can easily edit the form to fit their needs and monitor the signing process to ensure timely completion. These features enhance productivity and improve the overall user experience.

-

How much does it cost to use the 360 1 form with airSlate SignNow?

Pricing for using the 360 1 form with airSlate SignNow varies based on the subscription plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your investment. For detailed pricing information, visit our website or contact our sales team.

-

What are the benefits of using the 360 1 form for my business?

Using the 360 1 form can signNowly enhance your business operations by reducing paperwork and speeding up the signing process. It allows for greater efficiency, improved accuracy, and better compliance with legal standards. Additionally, it helps in saving time and resources, allowing your team to focus on more critical tasks.

-

Can I integrate the 360 1 form with other applications?

Yes, airSlate SignNow allows for seamless integration of the 360 1 form with various applications such as CRM systems, cloud storage services, and productivity tools. This integration capability enhances your workflow by connecting different platforms, making it easier to manage documents and signatures in one place.

-

Is the 360 1 form secure for sensitive information?

Absolutely! The 360 1 form is designed with security in mind, utilizing encryption and secure storage to protect sensitive information. airSlate SignNow complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

-

How can I track the status of my 360 1 form?

With airSlate SignNow, you can easily track the status of your 360 1 form in real-time. The platform provides notifications and updates on when the document is viewed, signed, or completed, allowing you to stay informed and manage your documents effectively.

Get more for Form IT 360 1 New York Change Of City Resident In

- Nc warranty form

- Quitclaim deed from corporation to two individuals north carolina form

- General warranty deed nc form

- Nc warranty general form

- General warranty deed from husband and wife to a trust north carolina form

- General warranty deed nc 497316801 form

- Quitclaim deed from husband to himself and wife north carolina form

- Quitclaim deed from husband and wife to husband and wife north carolina form

Find out other Form IT 360 1 New York Change Of City Resident In

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation