BSPPersonal Loan Application FormA4 Bank South Pacific

Understanding the BSP Loan Application Form

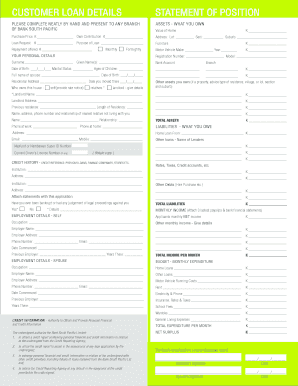

The BSP loan application form is a crucial document for individuals seeking financial assistance from Bank South Pacific. This form collects essential information about the applicant's financial status, employment details, and purpose of the loan. Completing this form accurately is vital, as it helps the bank assess the applicant's eligibility for the loan and determine the appropriate loan amount and terms.

Steps to Complete the BSP Loan Application Form

Filling out the BSP loan application form involves several key steps:

- Gather Required Information: Collect personal details, including your name, address, social security number, and employment information.

- Specify Loan Details: Indicate the type of loan you are applying for, the amount needed, and the intended use of the funds.

- Provide Financial Information: Include details about your income, expenses, and any existing debts to give the bank a clear picture of your financial situation.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it to confirm your application.

Legal Use of the BSP Loan Application Form

The BSP loan application form is legally binding once signed. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions or denial of the loan. The form must comply with relevant financial regulations, ensuring that both the lender and borrower are protected under the law.

Eligibility Criteria for the BSP Loan Application Form

To qualify for a loan through the BSP loan application form, applicants must meet specific eligibility criteria. Generally, this includes:

- Being at least eighteen years old.

- Having a steady source of income.

- Demonstrating a good credit history.

- Providing collateral if required by the loan type.

Meeting these criteria increases the likelihood of loan approval and favorable terms.

Required Documents for Submission

When submitting the BSP loan application form, applicants typically need to provide several supporting documents, including:

- Proof of identity, such as a government-issued ID.

- Recent pay stubs or income statements.

- Bank statements for the last few months.

- Documentation of any existing debts or financial obligations.

Having these documents ready can expedite the application process and improve the chances of approval.

Application Process and Approval Time

The application process for the BSP loan typically involves the following stages:

- Submission: After completing the form and gathering necessary documents, submit your application to the bank.

- Review: The bank will review your application and assess your financial information.

- Approval: If approved, you will receive a loan offer detailing the terms and conditions.

The approval time can vary, but it generally takes a few days to a couple of weeks, depending on the bank's policies and the completeness of your application.

Quick guide on how to complete bsppersonal loan application forma4 bank south pacific

Complete BSPPersonal Loan Application FormA4 Bank South Pacific effortlessly on any device

Digital document management has become widely accepted by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage BSPPersonal Loan Application FormA4 Bank South Pacific on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most effective way to modify and eSign BSPPersonal Loan Application FormA4 Bank South Pacific with ease

- Locate BSPPersonal Loan Application FormA4 Bank South Pacific and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with specific tools offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign BSPPersonal Loan Application FormA4 Bank South Pacific and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bsppersonal loan application forma4 bank south pacific

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BSP loan application form?

The BSP loan application form is a document used to apply for loans at Bank of the Philippine Islands (BSP). It requires specific information about the applicant and the loan purpose. Completing this form accurately ensures a smooth application process.

-

How can airSlate SignNow assist with the BSP loan application form?

AirSlate SignNow simplifies the submission of the BSP loan application form by allowing users to eSign and send documents quickly. Our platform ensures that all forms are completed accurately and shared securely. This speeds up the loan application process signNowly.

-

Is there a cost associated with using airSlate SignNow for the BSP loan application form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost includes features that enhance the efficiency of sending and signing the BSP loan application form. Businesses can choose a plan that fits their budget while benefiting from our services.

-

What features does airSlate SignNow provide for the BSP loan application form?

AirSlate SignNow offers a user-friendly interface, eSignature capabilities, and the ability to track the status of your BSP loan application form. Additional features like document templates and secure cloud storage enhance the user experience, making application management seamless.

-

Can I integrate airSlate SignNow with other tools for the BSP loan application form?

Yes, airSlate SignNow integrates with various applications to streamline the process of managing the BSP loan application form. You can connect it with CRM systems, cloud storage services, and other productivity tools. This integration aids in reducing manual work and improving collaboration.

-

What are the benefits of using airSlate SignNow for the BSP loan application form?

Using airSlate SignNow for the BSP loan application form provides quick turnaround times and enhances document security. The platform is designed to simplify workflows, ensuring that all necessary signatures are obtained efficiently. This helps in expediting the loan approval process.

-

How secure is my information when using airSlate SignNow for the BSP loan application form?

AirSlate SignNow prioritizes the security of your information, encrypting data during transmission and at rest. We comply with industry-standard security protocols to protect sensitive information contained in the BSP loan application form. Users can confidently send documents knowing their data is safe.

Get more for BSPPersonal Loan Application FormA4 Bank South Pacific

- Wwwmasslooporgwp contentuploadsmassachusetts application for health and dental coverage and form

- Masshealth appeal form

- Dash diet plan pdf form

- Spt consent for minor specialized physical therapy form

- Wyoming immunization registry wyir form

- Soc817finalpdf checklist of health and safety standards for approval of caregiver home cdss ca form

- Rat seoul virus exposure questionnaire please return to form

- Hearing diagnostic report form

Find out other BSPPersonal Loan Application FormA4 Bank South Pacific

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free