It 2104 Form

What is the IT 2104?

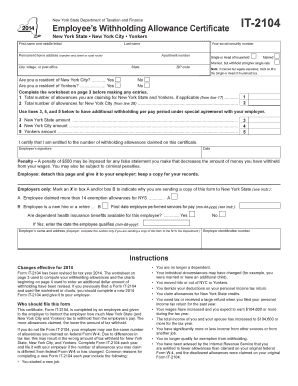

The IT 2104 is the Employee's Withholding Allowance Certificate used in the United States to determine the amount of state income tax withheld from an employee's paycheck. This form is essential for employees to communicate their withholding preferences to their employer, ensuring that the correct amount of taxes is deducted. By filling out the IT 2104, employees can claim allowances based on their personal circumstances, such as marital status and number of dependents, which can affect their tax liability.

Steps to Complete the IT 2104

Completing the IT 2104 involves several straightforward steps. First, gather necessary information, including your Social Security number and details about your dependents. Next, accurately fill out the form, ensuring that you select the correct allowances based on your situation. It is important to review the instructions provided with the form, as they outline how to calculate your allowances. After completing the form, submit it to your employer, who will use the information to adjust your tax withholdings accordingly.

Legal Use of the IT 2104

The IT 2104 is legally recognized as a valid document for establishing withholding allowances. To ensure compliance with state tax laws, it is crucial that the form is filled out accurately and submitted timely. The information provided on the IT 2104 must be true and complete, as providing false information can lead to penalties or legal repercussions. Employers are required to keep the completed forms on file for record-keeping and audit purposes.

IRS Guidelines

While the IT 2104 is specific to state withholding, it is important to align with IRS guidelines regarding tax withholding. The IRS provides resources and instructions that can help employees understand how to fill out the IT 2104 in conjunction with federal forms, such as the W-4. Adhering to both IRS and state guidelines ensures that employees are compliant with tax regulations and helps avoid under-withholding or over-withholding issues.

Filing Deadlines / Important Dates

Filing deadlines for the IT 2104 may vary by state, but it is generally advisable to submit the form as soon as employment begins or when personal circumstances change, such as marriage or the birth of a child. Employers often require the form to be submitted before the first paycheck is issued to ensure correct withholding. Keeping track of deadlines is essential to avoid any tax complications later in the year.

Who Issues the Form

The IT 2104 is issued by the state tax authority in the United States. Each state may have its own version of the form, but the purpose remains the same: to allow employees to specify their withholding allowances. It is important for employees to ensure they are using the correct version of the form for their specific state to comply with local tax laws.

Quick guide on how to complete it 2104 40119024

Prepare It 2104 effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Manage It 2104 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and electronically sign It 2104 without stress

- Obtain It 2104 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Recheck all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Leave behind the worry of lost or misplaced documents, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from a device of your choice. Alter and electronically sign It 2104 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 2104 40119024

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2104 fillable form used for?

The it 2104 fillable form is designed for employees in New York to report their withholding allowances. By using this form, individuals can ensure the correct amount of state income tax is withheld from their paychecks, making it a crucial tool for financial management.

-

How can I fill out the it 2104 fillable form using airSlate SignNow?

Filling out the it 2104 fillable form with airSlate SignNow is simple and efficient. You can access the form digitally, enter your information directly into the fillable fields, and save your progress, ensuring that your data is secure and easily accessible.

-

Is there a cost associated with using the it 2104 fillable form on airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, using the it 2104 fillable form is included in these plans. This allows businesses to manage and sign their documents without worrying about additional costs for each form.

-

What are the benefits of using the it 2104 fillable form over a paper version?

Using the it 2104 fillable form eliminates the hassle of printing and physically mailing paperwork. This digital approach enhances accuracy, reduces processing time, and provides easier access to your documents, leading to a more efficient workflow.

-

Can I integrate airSlate SignNow with other applications while using the it 2104 fillable form?

Yes, airSlate SignNow allows seamless integration with various applications and platforms. This enables users to manage the it 2104 fillable form alongside other essential tools, simplifying document management and enhancing overall productivity.

-

Is it possible to sign the it 2104 fillable form electronically?

Absolutely! With airSlate SignNow, you can electronically sign the it 2104 fillable form. This feature not only saves time but also ensures that signatures are legally binding and secure, making the process more efficient.

-

How secure is my personal information when using the it 2104 fillable form with airSlate SignNow?

Your privacy and security are a top priority for airSlate SignNow. When you use the it 2104 fillable form, robust encryption and secure servers are implemented to protect your personal information and ensure that your data remains confidential.

Get more for It 2104

Find out other It 2104

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word