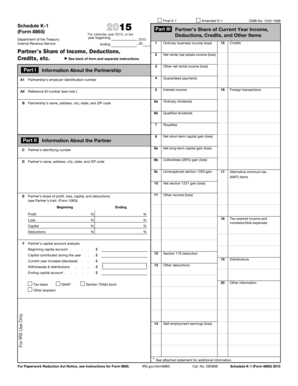

Form 8865 Schedule K 1 Partner's Share of Income, Deductions, Credits, Etc Irs 2015

What is the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

The Form 8865 Schedule K-1 is a crucial document used by partners in a partnership to report their share of income, deductions, credits, and other tax-related items to the IRS. It is specifically designed for U.S. taxpayers who are partners in foreign partnerships. This form allows partners to accurately report their income and ensure compliance with U.S. tax laws. Each partner receives a Schedule K-1 that details their individual share of the partnership's financial activities.

Steps to Complete the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

Completing the Form 8865 Schedule K-1 involves several steps to ensure accurate reporting. First, gather all necessary financial information from the partnership, including income, deductions, and credits. Then, fill out the form by entering your personal information and the partnership's details. It's important to report your share of income and any deductions accurately. After completing the form, review it for errors before submission. Finally, ensure you provide a copy of the Schedule K-1 to the IRS along with your tax return.

How to Obtain the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

You can obtain the Form 8865 Schedule K-1 from the IRS website or through your partnership. The IRS provides the form in PDF format, which can be downloaded and printed. If you are a partner in a partnership, the partnership is typically responsible for providing you with a completed Schedule K-1. Ensure that you receive this document in a timely manner to facilitate your tax filing process.

Legal Use of the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

The legal use of the Form 8865 Schedule K-1 is essential for compliance with U.S. tax regulations. This form must be accurately completed and filed to report your share of partnership income and deductions. Failure to submit this form can lead to penalties and interest charges from the IRS. It is important to understand that the information reported on the Schedule K-1 directly affects your individual tax return, making its accurate completion critical for legal compliance.

IRS Guidelines for the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

The IRS provides specific guidelines for completing and filing the Form 8865 Schedule K-1. These guidelines include instructions on how to report various types of income, deductions, and credits. It is essential to follow the IRS instructions carefully to avoid errors that could result in penalties. Additionally, the IRS outlines the filing deadlines and requirements for submitting the form, which partners must adhere to for compliance.

Filing Deadlines / Important Dates for the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

Filing deadlines for the Form 8865 Schedule K-1 are crucial for partners to keep in mind. Typically, the form must be filed by the due date of the partnership's tax return, which is usually March 15 for calendar year partnerships. If the partnership files for an extension, the deadline may be extended. It is important for partners to be aware of these dates to ensure timely filing and avoid penalties.

Penalties for Non-Compliance with the Form 8865 Schedule K-1 Partner's Share Of Income, Deductions, Credits, Etc IRS

Non-compliance with the Form 8865 Schedule K-1 can result in significant penalties imposed by the IRS. These penalties may include fines for failing to file the form or for inaccuracies in reporting income and deductions. Additionally, late filing can incur interest charges on any unpaid taxes. To avoid these penalties, it is essential to complete and file the form accurately and on time.

Quick guide on how to complete 2015 form 8865 schedule k 1 partners share of income deductions credits etc irs

Effortlessly Prepare Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs on Any Gadget

Digital document administration has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow supplies you with all the tools required to create, modify, and eSign your paperwork quickly and without delays. Manage Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs across any platform using airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

How to modify and eSign Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs with ease

- Locate Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your updates.

- Select how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8865 schedule k 1 partners share of income deductions credits etc irs

Create this form in 5 minutes!

People also ask

-

What is Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc IRS?

Form 8865 Schedule K 1 is an IRS document used by partners in a partnership to report their share of income, deductions, and credits. This form is essential for accurately reporting tax liabilities and ensuring compliance with IRS regulations. Understanding how to properly fill out this form can signNowly affect your taxes.

-

How can airSlate SignNow help me with Form 8865 Schedule K 1?

airSlate SignNow provides businesses with a streamlined platform to manage and eSign Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc IRS efficiently. Our solution simplifies the document management process, allowing partners to collaborate in real-time and ensure that all necessary forms are completed and signed promptly.

-

What features does airSlate SignNow offer for handling tax documents?

With airSlate SignNow, you gain access to a variety of features tailored for tax documents, including customizable templates, secure cloud storage, and easy electronic signatures. These features make the management of IRS forms like Form 8865 Schedule K 1 quick and efficient, reducing the chances of errors and ensuring compliance.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers flexible pricing plans that are designed to fit the budgets of small businesses. By investing in a cost-effective solution, businesses can save time and resources while ensuring accurate handling of important tax documents like Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc IRS.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage documents like Form 8865 Schedule K 1 within your existing workflow. These integrations enhance productivity by allowing you to automate various processes associated with tax documentation.

-

What benefits does eSigning Form 8865 Schedule K 1 provide?

eSigning Form 8865 Schedule K 1 accelerates the signing process, reduces paper usage, and enhances security. By using airSlate SignNow, partners can ensure that their signatures are secure and easily verified, all while streamlining the overall process of handling important IRS documents.

-

How does airSlate SignNow protect my data when handling tax forms?

airSlate SignNow prioritizes data security and uses advanced encryption protocols to protect sensitive information contained in tax forms, such as Form 8865 Schedule K 1. With stringent security measures in place, businesses can confidently manage their IRS documents without worrying about data bsignNowes.

Get more for Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs

- Ut occupancy form

- Complex will with credit shelter marital trust for large estates utah form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497427629 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497427630 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497427631 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497427632 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497427633 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497427634 form

Find out other Form 8865 Schedule K 1 Partner's Share Of Income, Deductions, Credits, Etc Irs

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now