Internal Revenue Service 2021

What is the Internal Revenue Service

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing the internal revenue laws of the United States. It oversees the collection of taxes, the issuance of tax refunds, and the enforcement of tax laws. The IRS plays a crucial role in ensuring compliance with federal tax regulations, which affects individuals, businesses, and other entities across the country.

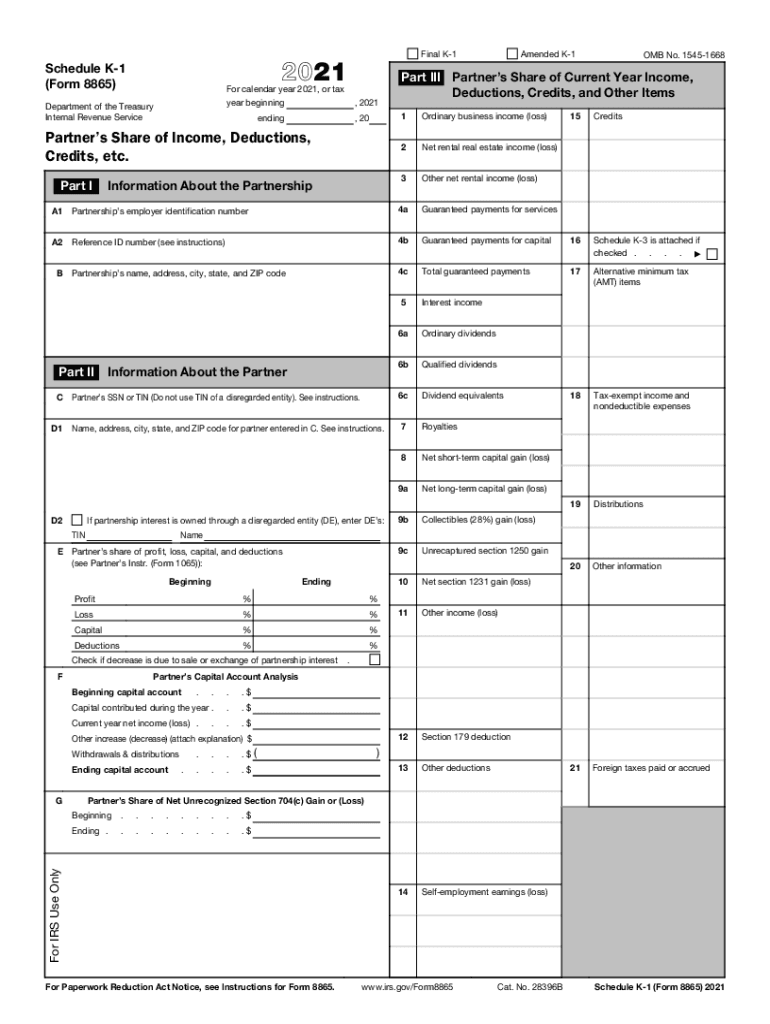

Steps to complete the Internal Revenue Service Form

Completing the 2021 Internal Revenue Service form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documentation, including income statements, deductions, and credits. Next, carefully fill out the form, following the provided instructions to avoid errors. After completing the form, review it thoroughly for any mistakes or missing information. Finally, submit the form either electronically or by mail, ensuring that you meet the relevant filing deadlines.

Required Documents

To accurately complete the 2021 Internal Revenue Service form, specific documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses

- Previous year’s tax return for reference

- Any relevant schedules or forms related to specific credits or deductions

Having these documents on hand will streamline the process and help ensure that all income and deductions are reported correctly.

Form Submission Methods

There are several methods to submit the 2021 Internal Revenue Service form. Taxpayers can choose to file online using approved e-filing software, which often provides a guided experience. Alternatively, forms can be mailed directly to the IRS, ensuring that they are sent to the correct address based on the taxpayer's location and the type of form being submitted. In-person submissions are generally not available, as the IRS encourages electronic filing for efficiency and security.

Filing Deadlines / Important Dates

Filing deadlines for the 2021 Internal Revenue Service form are crucial for compliance. Typically, individual tax returns are due on April 15 of the following year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It's important to be aware of any extensions or changes to deadlines, particularly for specific circumstances such as natural disasters or other emergencies that may affect filing requirements.

Penalties for Non-Compliance

Failure to comply with the requirements of the 2021 Internal Revenue Service form can result in significant penalties. These may include fines for late filing or payment, as well as interest on any unpaid taxes. In severe cases, non-compliance can lead to legal action or enforced collection measures by the IRS. Understanding these potential consequences underscores the importance of timely and accurate filing.

Quick guide on how to complete 2021 internal revenue service

Complete Internal Revenue Service seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly option to conventional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to adjust and eSign Internal Revenue Service effortlessly

- Obtain Internal Revenue Service and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from a device of your choice. Adjust and eSign Internal Revenue Service and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 internal revenue service

Create this form in 5 minutes!

People also ask

-

What is the 2021 internal revenue service form and why is it important?

The 2021 internal revenue service form is a critical document that individuals and businesses must file to report their financial activities and tax obligations for the tax year 2021. Accurate completion of this form ensures compliance with IRS regulations and helps avoid penalties. Having the right eSignature solution simplifies the process of submitting necessary documentation.

-

How can airSlate SignNow help me manage my 2021 internal revenue service form?

airSlate SignNow provides an efficient platform to electronically sign, send, and manage your 2021 internal revenue service form. Its user-friendly interface allows for easy uploads, ensuring your documents are handled securely and swiftly. This streamlines your workflow, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow with the 2021 internal revenue service form?

airSlate SignNow offers various pricing plans designed to suit different business needs, even for handling the 2021 internal revenue service form. Whether you're a small business or a large corporation, you can find a plan that provides essential features at a competitive rate. Choose a plan that fits your budget and enjoy the benefits of effortless document management.

-

Are there any integrations available for working with the 2021 internal revenue service form?

Yes, airSlate SignNow integrates seamlessly with numerous applications, making it easier to manage your 2021 internal revenue service form. Whether you use cloud storage, accounting software, or CRM systems, these integrations help streamline processes and keep your documents organized. This connectivity enhances overall productivity.

-

Can I track my 2021 internal revenue service form with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your 2021 internal revenue service form. You'll receive real-time notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

What features does airSlate SignNow offer for completing the 2021 internal revenue service form?

airSlate SignNow offers features such as customizable templates, bulk sending, and easy editing, which are beneficial when completing the 2021 internal revenue service form. This ensures that your forms are filled out correctly and efficiently. Moreover, users can securely sign documents from any device, enhancing flexibility.

-

Is airSlate SignNow secure for handling sensitive 2021 internal revenue service form data?

Yes, security is a top priority for airSlate SignNow when handling your 2021 internal revenue service form data. The platform utilizes advanced encryption methods and complies with industry standards to protect your documents. You can trust that your sensitive tax information is safe and secure.

Get more for Internal Revenue Service

- Agreement invention 497330455 form

- Release and waiver of liability given in favor of owner of stable and owner of horses kept at stable by those who ride horses form

- Disclaimer form sample 497330457

- Finders agreement form

- Writing courts form

- Sale goods 497330460 form

- Notice quit 497330461 form

- Sample tax letter form

Find out other Internal Revenue Service

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form