Application for Refund Motor Vehicles Manitoba 2013-2026

Understanding the Application for Refund of Provincial Sales Tax Paid on a Motor Vehicle in Manitoba

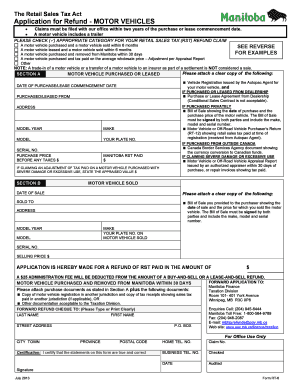

The application for refund of provincial sales tax paid on a motor vehicle in Manitoba is a formal request submitted to reclaim the provincial sales tax (PST) that has been paid on a vehicle. This process is essential for individuals who qualify for a refund due to specific circumstances, such as purchasing a vehicle that is exempt from PST or if the tax was paid in error. Understanding the eligibility criteria and the reasons for applying is crucial for a successful refund application.

Steps to Complete the Application for Refund of Provincial Sales Tax Paid on a Motor Vehicle

Completing the application for refund of provincial sales tax paid on a motor vehicle requires careful attention to detail. Begin by gathering all necessary documentation, including proof of purchase, payment receipts, and any relevant identification. Follow these steps:

- Obtain the application form, often referred to as the RT-6 form.

- Fill in your personal information accurately, including your name, address, and contact details.

- Provide details about the vehicle, such as the make, model, and VIN (Vehicle Identification Number).

- Clearly state the reason for the refund request, citing applicable exemptions or errors.

- Attach all required documents to support your claim.

- Review the completed application for accuracy before submission.

Required Documents for the Application for Refund

To ensure a smooth application process, it is important to include all required documents. The following items are typically necessary:

- Proof of purchase, such as a bill of sale or invoice.

- Payment receipts showing the PST paid.

- Identification documents, such as a driver's license or government-issued ID.

- Any additional documentation that supports your eligibility for a refund.

Form Submission Methods for the Application for Refund

The application for refund of provincial sales tax can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission through the official provincial tax website, if available.

- Mailing the completed application and supporting documents to the designated tax office.

- In-person submission at local tax offices or designated government service centres.

Eligibility Criteria for the Application for Refund

To qualify for a refund of provincial sales tax paid on a motor vehicle, applicants must meet specific eligibility criteria. Common reasons include:

- Purchasing a vehicle that is exempt from PST, such as certain types of vehicles for disabled individuals.

- Paying PST in error during the vehicle purchase process.

- Returning a vehicle that was purchased with PST paid and receiving a refund from the dealer.

Legal Use of the Application for Refund

The application for refund of provincial sales tax paid on a motor vehicle must adhere to legal standards to ensure its validity. This includes:

- Providing accurate and truthful information throughout the application.

- Signing the application to confirm the authenticity of the information provided.

- Understanding that submitting false information can result in penalties or denial of the refund.

Quick guide on how to complete application for refund motor vehicles manitoba

Effortlessly Prepare Application For Refund Motor Vehicles Manitoba on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and keep it securely stored online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hassle. Handle Application For Refund Motor Vehicles Manitoba on any device using airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to Edit and eSign Application For Refund Motor Vehicles Manitoba with Ease

- Obtain Application For Refund Motor Vehicles Manitoba and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal significance as a traditional signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For Refund Motor Vehicles Manitoba and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for refund motor vehicles manitoba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application process for a refund of provincial sales tax paid on a motor vehicle in Manitoba?

The application for refund of provincial sales tax paid on a motor vehicle in Manitoba involves filling out the appropriate forms, which you can usually find on the Manitoba government website. Ensure that you have all necessary documentation, including proof of tax payment and any relevant vehicle details. Submitting your application online through eSign solutions like airSlate SignNow can simplify the process.

-

How much does it cost to submit an application for refund of provincial sales tax paid on a motor vehicle in Manitoba?

Generally, there is no fee to submit an application for refund of provincial sales tax paid on a motor vehicle in Manitoba. However, professional assistance or expedited services may come with costs, which can be signNowly reduced with airSlate SignNow's affordable eSignature solutions for document management.

-

What documents are needed for the application for refund of provincial sales tax paid on a motor vehicle in Manitoba?

To complete the application for refund of provincial sales tax paid on a motor vehicle in Manitoba, you'll need documentation such as your original sales receipt, a copy of the vehicle registration, and the completed refund application form. Using airSlate SignNow, you can easily gather and sign these documents electronically.

-

How long does it take to process an application for refund of provincial sales tax paid on a motor vehicle in Manitoba?

The processing time for an application for refund of provincial sales tax paid on a motor vehicle in Manitoba can vary, but it typically takes several weeks. To ensure a smooth process, consider using airSlate SignNow to submit your application electronically and track its status efficiently.

-

Can I apply for a refund if I purchased my vehicle from another province?

Yes, you can apply for a refund of provincial sales tax paid on a motor vehicle in Manitoba even if the vehicle was purchased from another province. Make sure to include all supporting documents related to the purchase along with your application for refund of provincial sales tax paid on a motor vehicle in Manitoba to avoid delays.

-

Are there any specific eligibility requirements for the refund application in Manitoba?

Eligibility for the application for refund of provincial sales tax paid on a motor vehicle in Manitoba typically requires that the vehicle be registered in Manitoba and that the sales tax was paid at the time of purchase. It's recommended to review the provincial guidelines closely or consult with professionals using platforms like airSlate SignNow for clarity.

-

Is there a way to track the status of my refund application in Manitoba?

Yes, once you submit your application for refund of provincial sales tax paid on a motor vehicle in Manitoba, you can often track its status through the Manitoba government’s online portal. Utilizing airSlate SignNow can also provide notifications and reminders for updates throughout the process.

Get more for Application For Refund Motor Vehicles Manitoba

- Florida supreme court approved family law form 12995b supervisedsafety focused parenting plan 0209 florida supreme court

- So that the order of protection is valid you must replace this page with cover sheet order of protection state of indiana form

- So that the order of protection is valid after you print you must replace this page with the cover sheet order of protection form

- State of california indoor lighting cecnrcilti01e revised 0515 california energy commission certificate of installation indoor form

- City of aztec request for quotation rfq date may 23 2014 rfq 140413 due date june 11 2014 time 200 pm return to city of aztec form

- Para los condados que presentan una peticin de dependencia por separado para cada menor o para los condados que utilizan el form

- Jv 535 s findings and orders limiting right to make educational decisions for the child appointing educational representative form

- Outreach form template

Find out other Application For Refund Motor Vehicles Manitoba

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form