Www Uslegalforms Comtax532943 Irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms

Understanding the 2022 IRS Form 720

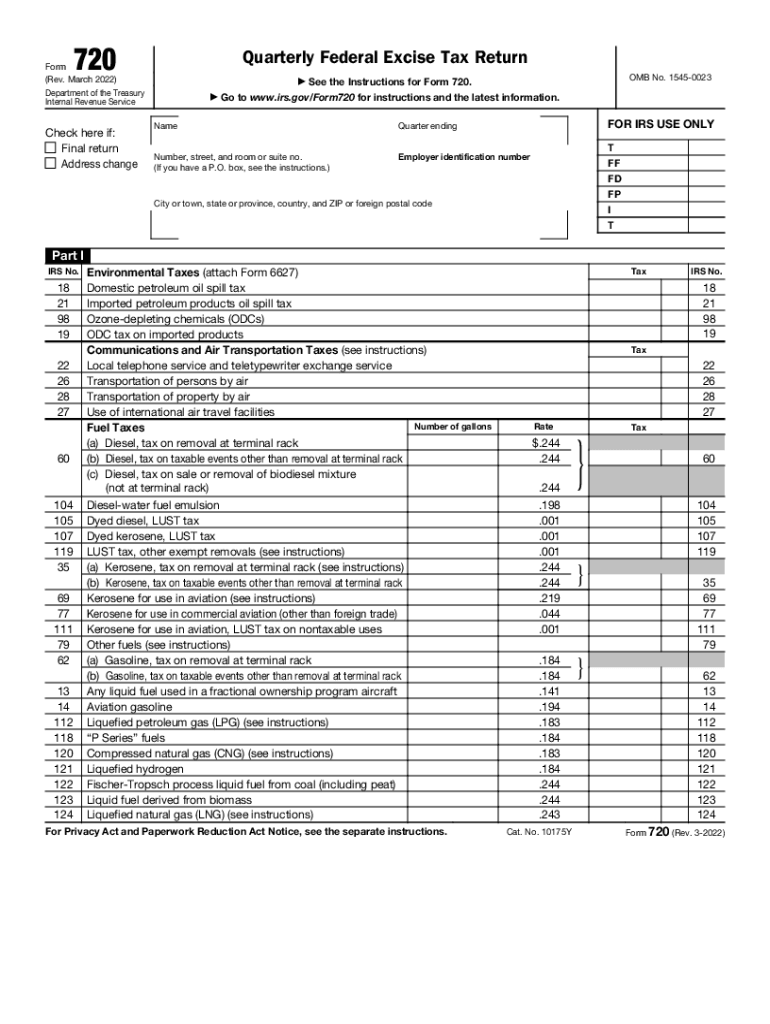

The 2022 IRS Form 720 is a federal excise tax form used to report and pay certain types of excise taxes. This form is essential for businesses that engage in activities subject to federal excise tax, such as the sale of specific goods or services. Understanding the purpose and requirements of this form is crucial for compliance with federal tax regulations. The form includes various sections that require detailed information about the taxpayer, the type of excise tax being reported, and the amounts owed. Proper completion of the 2022 Form 720 ensures that businesses meet their tax obligations and avoid potential penalties.

Steps to Complete the 2022 Form 720

Completing the 2022 Form 720 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including financial records related to the excise taxes applicable to your business. Next, accurately fill out the taxpayer information section, ensuring that your name, address, and taxpayer identification number are correct. Then, identify the specific excise taxes being reported and calculate the amounts owed for each category. Finally, review the completed form for accuracy before submitting it to the IRS. Properly following these steps will help facilitate a smooth filing process.

Filing Deadlines for the 2022 Form 720

Filing deadlines for the 2022 Form 720 are critical for compliance. Generally, this form is due quarterly, with specific deadlines for each quarter. For the first quarter, the deadline is typically April 30, for the second quarter, July 31, for the third quarter, October 31, and for the fourth quarter, January 31 of the following year. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes. Marking these dates on your calendar will help ensure timely submissions.

Required Documents for Filing the 2022 Form 720

When preparing to file the 2022 Form 720, certain documents are necessary to ensure accurate reporting. These documents may include financial statements, sales records, and any previous tax filings related to excise taxes. Additionally, businesses should maintain documentation that supports the amounts reported on the form, such as invoices and receipts for taxable transactions. Having these documents organized and readily available will facilitate a smoother filing process and support compliance with IRS requirements.

Penalties for Non-Compliance with the 2022 Form 720

Failure to comply with the requirements of the 2022 Form 720 can result in significant penalties. The IRS may impose fines for late filings or for failing to pay the excise taxes owed. Additionally, interest may accrue on any unpaid taxes, increasing the overall amount due. Understanding these potential penalties highlights the importance of timely and accurate submissions. Businesses should take compliance seriously to avoid unnecessary financial burdens.

Digital vs. Paper Version of the 2022 Form 720

Filing the 2022 Form 720 can be done either digitally or via paper submission. Digital filing offers several advantages, including faster processing times and reduced risk of errors. Electronic submissions are typically more secure and allow for easier tracking of the filing status. Conversely, paper submissions may be preferred by those who are less comfortable with technology. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted by the appropriate deadlines.

IRS Guidelines for Completing Form 720

The IRS provides specific guidelines for completing the 2022 Form 720, which are crucial for ensuring compliance. These guidelines outline the necessary information required for each section of the form, including how to calculate the excise taxes owed. It is important to refer to the IRS instructions for the form, as they provide detailed explanations and examples that can assist in accurate completion. Following these guidelines will help minimize errors and ensure that the form meets IRS standards.

Quick guide on how to complete wwwuslegalformscomtax532943 irs 720 2021irs 720 2021 2022 fill out tax template onlineus legal forms

Complete Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow supplies you with all the features needed to create, edit, and eSign your documents promptly without delays. Manage Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms effortlessly

- Find Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with the tools offered by airSlate SignNow specifically designed for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Set aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwuslegalformscomtax532943 irs 720 2021irs 720 2021 2022 fill out tax template onlineus legal forms

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the form 720 for 2022 and why is it important?

The form 720 for 2022 is a tax form used to report and pay federal excise taxes. It is essential for businesses to accurately complete this form to comply with IRS regulations and avoid penalties. Understanding how to properly file the form 720 for 2022 can save time and ensure tax obligations are met.

-

How can airSlate SignNow help me with the form 720 for 2022?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send documents, including the form 720 for 2022. With its intuitive interface, you can quickly obtain necessary signatures, streamline your filing process, and ensure compliance with tax regulations. This efficiency helps you focus on running your business.

-

What features does airSlate SignNow offer for handling the form 720 for 2022?

airSlate SignNow offers features such as customizable templates, in-app editing, and secure electronic signatures for the form 720 for 2022. These tools enable users to prepare, sign, and send documents seamlessly while ensuring that all important information is captured. This enhances the overall user experience.

-

Is there a free trial available for airSlate SignNow users looking to file form 720 for 2022?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's capabilities, including filing the form 720 for 2022. This trial period helps potential customers experience the user-friendly interface and essential features before committing to a subscription. It's a great way to determine if it meets your business needs.

-

What is the pricing structure for airSlate SignNow related to form 720 for 2022?

airSlate SignNow offers various subscription plans that cater to businesses of all sizes, providing an affordable solution for managing documents like the form 720 for 2022. Pricing is based on the features and the number of users, making it flexible for different business needs. You can review the pricing options on our website for details.

-

Can I integrate airSlate SignNow with other software for managing form 720 for 2022?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to streamline your workflows when managing the form 720 for 2022. This means you can connect with accounting software and CRMs to enhance the efficiency of document management and keep your data synchronized across platforms.

-

What security measures does airSlate SignNow have for documents like form 720 for 2022?

airSlate SignNow prioritizes document security, implementing measures such as data encryption and secure cloud storage for documents, including the form 720 for 2022. These security features protect sensitive information and ensure that all transactions remain confidential and compliant with industry regulations. You can trust that your documents are safe with us.

Get more for Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms

Find out other Www uslegalforms comtax532943 irs 720 2021IRS 720 Fill Out Tax Template OnlineUS Legal Forms

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter