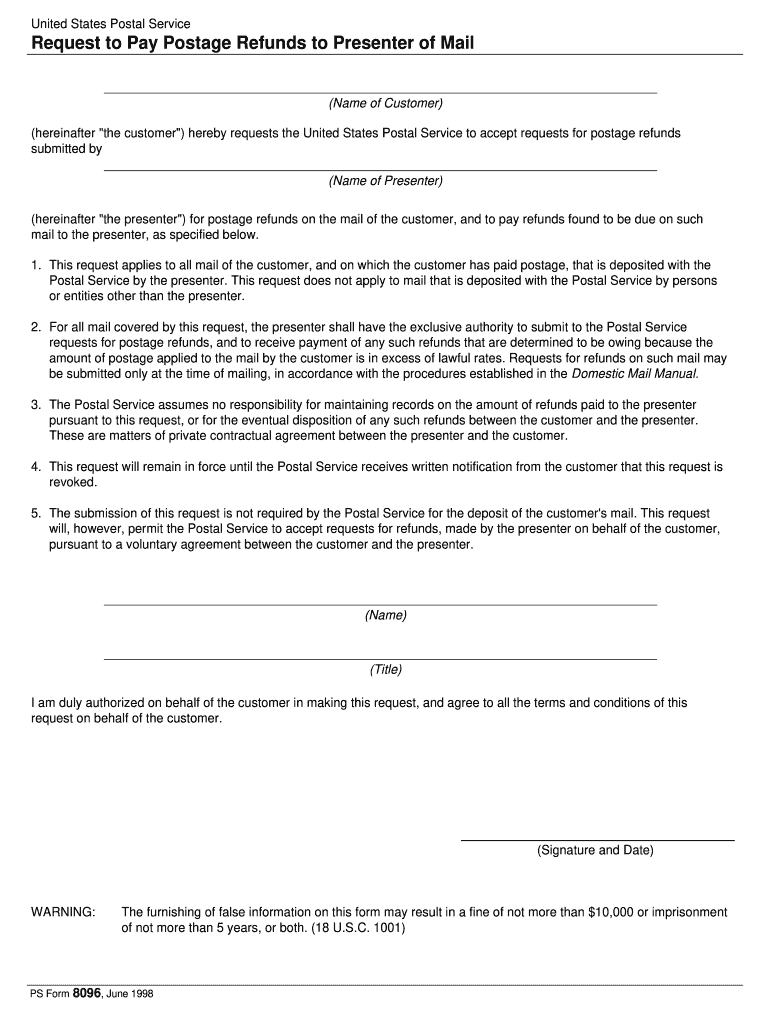

Form 8096

What is the Form 8096

The Form 8096, also known as the 8096 presenter file, is a document utilized primarily for tax purposes within the United States. It is designed to facilitate the reporting and declaration of specific financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to comply with federal tax regulations. Understanding the purpose and requirements of the Form 8096 is crucial for ensuring accurate and timely submissions.

How to Use the Form 8096

Using the Form 8096 involves several key steps to ensure proper completion and submission. Begin by gathering all necessary financial documents that pertain to the information required 8096. This includes income statements, expense records, and any other relevant financial data. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before submitting it to the IRS. Utilizing electronic signature solutions, like signNow, can streamline this process and enhance the security of your submission.

Steps to Complete the Form 8096

Completing the Form 8096 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Obtain the latest version of the Form 8096 from the IRS website or other reliable sources.

- Read the instructions carefully to understand the information required 8096.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Input the financial data as prompted, ensuring accuracy in all figures.

- Review the completed form for any mistakes or omissions.

- Sign and date the form, using an electronic signature if submitting online.

- Submit the form according to the guidelines provided, whether electronically or via mail.

Legal Use of the Form 8096

The legal use of the Form 8096 is governed by federal tax laws and regulations. It is important to ensure that the information provided is accurate and truthful to avoid penalties or legal repercussions. The form must be submitted within the designated filing deadlines to maintain compliance. Utilizing a reliable electronic signature platform, such as signNow, can help ensure that your submission meets all legal requirements, including adherence to the ESIGN and UETA acts.

Required Documents

Before filling out the Form 8096, it is essential to gather all required documents to support the information being reported. This may include:

- Income statements, such as W-2s or 1099s.

- Expense records, including receipts and invoices.

- Previous tax returns for reference.

- Any relevant financial statements that provide context to the information required 8096.

Filing Deadlines / Important Dates

Staying informed about filing deadlines for the Form 8096 is critical for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, specific circumstances may alter this date, such as weekends or holidays. It is advisable to check the IRS website for the most current information regarding any extensions or changes to these deadlines.

Quick guide on how to complete form 8096

Complete Form 8096 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly without any holdups. Handle Form 8096 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to adjust and eSign Form 8096 with ease

- Find Form 8096 and then click Get Form to begin.

- Leverage the tools we offer to fill out your form.

- Mark important sections of your documents or cover sensitive details with the tools that airSlate SignNow supplies specifically for this task.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8096 and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8096

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the information required 8096 for setting up airSlate SignNow?

To set up airSlate SignNow, the information required 8096 includes your email address, preferred password, and company details. This initial setup process is quick and helps in customizing your experience. Once registered, you can start sending and eSigning documents effortlessly.

-

How does airSlate SignNow handle the information required 8096 for compliance?

airSlate SignNow takes compliance seriously and ensures that the information required 8096 meets industry standards for security and privacy. The platform uses encryption and follows compliance regulations like GDPR and HIPAA. This guarantees that your sensitive documents are well-protected.

-

What are the pricing options for airSlate SignNow related to the information required 8096?

The pricing for airSlate SignNow varies based on the features you need, and the information required 8096 will help determine your plan. The platform offers flexible subscriptions designed for different business sizes, and each plan includes eSigning and document management capabilities. You can choose a tier that best suits your requirements.

-

Can I integrate airSlate SignNow with other applications using the information required 8096?

Yes, airSlate SignNow supports various integrations with popular applications, and the information required 8096 enables seamless connectivity. By submitting the required data, you can easily link your accounts for improved workflow efficiency. This integration helps streamline document processes across different platforms.

-

What are the main features of airSlate SignNow as per the information required 8096?

AirSlate SignNow offers a variety of features that cater to your document management needs, including eSigning, templates, and automated workflows. The information required 8096 provides insights into specific functionalities that can enhance your productivity. With its user-friendly interface, it's easy to create and manage documents.

-

How does airSlate SignNow ensure that the information required 8096 is securely stored?

AirSlate SignNow employs advanced security measures to ensure that the information required 8096 is securely stored in their system. Data is encrypted in transit and at rest, and robust access controls are in place. Customers can confidently use the platform knowing their information is protected.

-

Is there customer support for issues related to the information required 8096?

Yes, airSlate SignNow offers comprehensive customer support to assist with any issues regarding the information required 8096. Whether you have questions about setup, features, or compliance, their dedicated support team is ready to help. You can signNow out via chat, email, or phone.

Get more for Form 8096

- Butt hurt form

- Hawaiiindd form

- Robert morris college chicago transcript request form

- Supplementary protection certificates for pharmaceutical and form

- Imodoc form

- Po box 100547 florence sc 29502 form

- Eformsstategoveditdocumentjf 57 pd performance discussion for not ordinarily resident

- Application for reinstatement of lapsed state of delaware form

Find out other Form 8096

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple