8852 Form

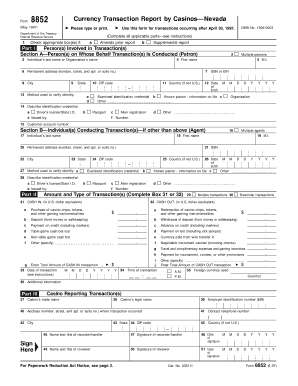

What is the 8852?

The form 8852, officially known as the IRS Form 8852, is a tax form used by eligible taxpayers to request a change in their tax status. Specifically, it is utilized by certain business entities that wish to elect to be treated as a corporation for federal tax purposes. This form is essential for those looking to take advantage of specific tax benefits associated with corporate status.

How to use the 8852

To effectively use the 8852 form, taxpayers must first determine their eligibility. This involves reviewing the qualifications outlined by the IRS. Once eligibility is confirmed, taxpayers can fill out the form by providing necessary information, including the entity's name, address, and details about the tax year in question. It is crucial to ensure that all information is accurate to avoid delays in processing.

Steps to complete the 8852

Completing the IRS form 8852 involves several key steps:

- Gather necessary information about your business entity.

- Review the eligibility criteria to ensure compliance.

- Fill out the form accurately, providing all required details.

- Sign and date the form to validate your submission.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the 8852

The legal use of the form 8852 is governed by IRS regulations. Proper completion and submission of this form ensure that the election to change tax status is recognized by the IRS. It is important for taxpayers to retain copies of the submitted form and any correspondence with the IRS for their records, as this documentation may be necessary for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 8852 form are critical for compliance. Generally, the form must be submitted by the due date of the tax return for the year in which the election is to take effect. Taxpayers should keep track of these dates to avoid penalties and ensure that their election is processed in a timely manner.

Required Documents

When completing the IRS form 8852, certain documents may be required to support the information provided. These documents can include:

- Tax identification numbers for the business entity.

- Previous tax returns, if applicable.

- Any relevant correspondence from the IRS.

Who Issues the Form

The form 8852 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through various tax preparation resources.

Quick guide on how to complete 8852

Easily prepare 8852 on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an excellent environmentally-friendly option to standard printed and signed documents, as you can access the appropriate form and securely save it digitally. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly without any holdups. Manage 8852 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign 8852 effortlessly

- Find 8852 and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Select important sections of your documents or conceal confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign 8852 and guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8852

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8852 and why is it important?

Form 8852 is used by businesses to make an election to treat a qualified subchapter S subsidiary as a corporation. This form is crucial for companies that want to streamline their tax reporting and take advantage of potential tax benefits.

-

How can airSlate SignNow help me with Form 8852?

With airSlate SignNow, you can easily send and eSign Form 8852, ensuring that your document is processed quickly and securely. Our platform provides a user-friendly interface that simplifies the signing process, allowing you to focus on other important business tasks.

-

Is airSlate SignNow affordable for filing Form 8852?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to handle Form 8852 and other essential documents. We provide various pricing plans tailored to fit different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 8852?

airSlate SignNow offers features such as document templates, customizable workflows, and in-app signing to streamline the management of Form 8852. Our platform also includes audit trails for compliance and security, giving you peace of mind during the signing process.

-

Can I integrate airSlate SignNow with other tools for Form 8852?

Absolutely! airSlate SignNow allows you to integrate seamlessly with various business tools and applications, making it easier to manage Form 8852 alongside your existing systems. This integration enhances your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 8852?

Using airSlate SignNow for Form 8852 provides several benefits, including increased efficiency, reduced paper usage, and faster turnaround times. Our platform helps you save time and resources, allowing you to focus on growing your business.

-

Is it secure to eSign Form 8852 through airSlate SignNow?

Yes, airSlate SignNow employs top-notch security measures to ensure that your eSignature on Form 8852 is protected. Our platform complies with industry standards, providing encryption and secure storage for all your important documents.

Get more for 8852

- Hipaa revocation form 208358098

- Bank of ireland transaction dispute form

- Real estate agent form

- Mileage reimbursement form labbbcom

- State of connecticut hartford ct 06106 5032 cert 126 form

- Lavelles diagnostic imaging form

- Collocation inquiry baltimore gas and electric form

- 1 schools of higher learning form

Find out other 8852

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe