Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv Form

What is the FPE UK DT?

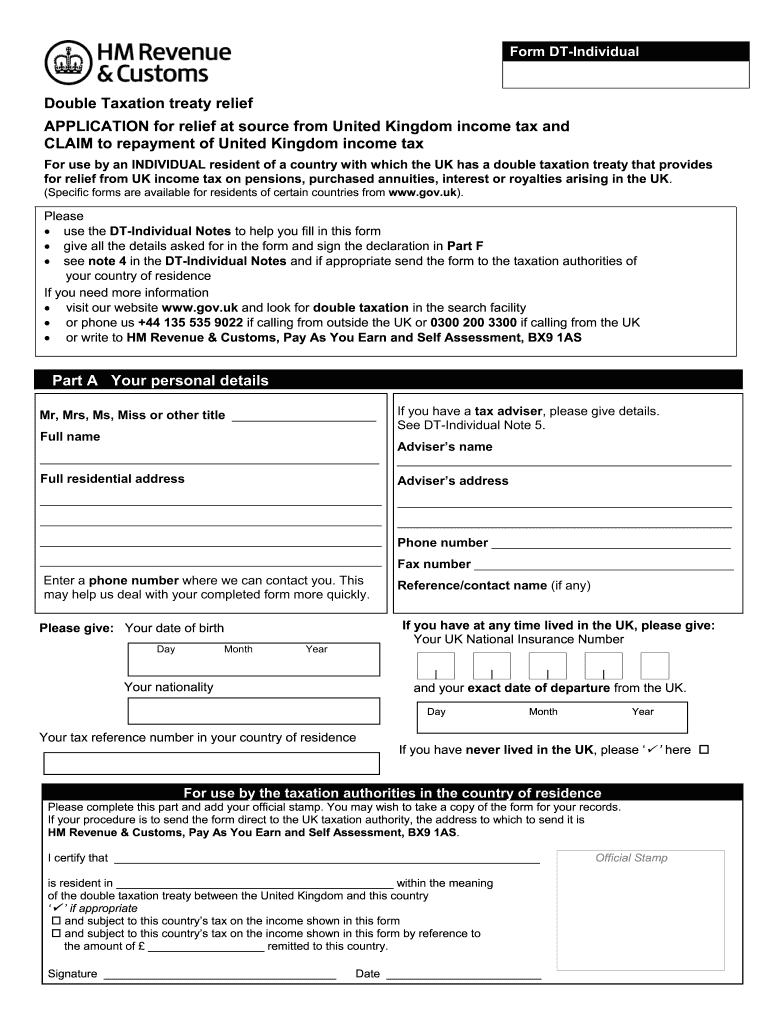

The FPE UK DT, or the form DT individual, is a document used for claiming relief from double taxation in the United Kingdom. This form is particularly relevant for individuals who may be subject to taxation in both the UK and another country. It serves to ensure that taxpayers do not pay tax on the same income in multiple jurisdictions, thereby promoting fairness in international taxation. Understanding the purpose of this form is essential for individuals who earn income abroad or have foreign investments.

Steps to Complete the FPE UK DT

Completing the FPE UK DT involves a series of straightforward steps that ensure the form is filled out accurately. Here are the key steps:

- Gather necessary documentation, including proof of income and tax residency.

- Fill out personal information, including your name, address, and tax identification number.

- Provide details about the income you are claiming relief for, including the amount and source.

- Indicate the country where the income was earned and any taxes paid there.

- Sign and date the form to certify that the information provided is accurate.

Required Documents for the FPE UK DT

When submitting the FPE UK DT, it is crucial to include specific documents to support your claim. Required documents may include:

- Proof of income, such as payslips or bank statements.

- Tax residency certificate from the foreign country.

- Documentation of taxes paid in the foreign jurisdiction.

- Any additional forms or statements that may be relevant to your tax situation.

Legal Use of the FPE UK DT

The FPE UK DT is legally binding when completed and submitted correctly. It complies with the regulations set forth by HM Revenue and Customs (HMRC) regarding double taxation relief. To ensure legal validity, it is important to follow all guidelines and provide accurate information. Misrepresentation or failure to provide necessary documentation can lead to penalties or denial of relief.

Form Submission Methods

The FPE UK DT can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission via the HMRC website, which is the quickest method.

- Mailing a paper copy of the completed form to the appropriate HMRC address.

- In-person submission at designated HMRC offices, if necessary.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the FPE UK DT can result in significant penalties. These may include:

- Fines for late submission or inaccurate information.

- Denial of double taxation relief, leading to potential double taxation.

- Increased scrutiny from tax authorities, which may result in audits.

Quick guide on how to complete fpe uk dt khguf fn hgjdk hgedgehv

Complete Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your papers swiftly without delays. Manage Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv with ease

- Find Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and electronically sign Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fpe uk dt khguf fn hgjdk hgedgehv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dt individual in airSlate SignNow?

The term 'dt individual' refers to the individual licensing options provided by airSlate SignNow. This plan is designed for users who need a simple and effective way to manage document signing and workflows on an individual basis, making it ideal for freelancers or small business owners.

-

What features does the dt individual plan offer?

With the dt individual plan, users have access to essential features such as unlimited document signing, customizable templates, and real-time tracking. Additionally, this plan supports secure cloud storage, allowing users to manage their documents efficiently and with peace of mind.

-

How much does the dt individual plan cost?

The dt individual plan is competitively priced, providing excellent value for users looking to simplify their eSigning processes. For the most accurate pricing information and any available promotions, it's best to visit the airSlate SignNow pricing page.

-

Can I integrate dt individual with other apps?

Yes, airSlate SignNow's dt individual plan supports integration with various apps such as Google Drive, Salesforce, and Microsoft Office. This seamless integration enhances productivity, allowing users to manage their documents directly from their preferred platforms.

-

What are the benefits of using dt individual over other eSigning solutions?

The dt individual plan stands out due to its user-friendly interface and cost-effectiveness. It streamlines the signing process and helps individuals maintain better control over their documents, making it a preferred choice for those looking for efficiency without compromising quality.

-

Is there a mobile app available for dt individual users?

Absolutely! airSlate SignNow offers a mobile app that allows dt individual users to manage their documents and eSign on-the-go. This flexibility ensures that you can stay productive, regardless of your location or device.

-

How secure is the dt individual eSigning process?

Security is a priority for airSlate SignNow. The dt individual plan utilizes industry-leading encryption and compliance measures to ensure that all documents are signed and stored securely. Users can trust that their sensitive information is well-protected throughout the signing process.

Get more for Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv

Find out other Fpe Uk Dt Khguf Fn Hgjdk Hgedgehv

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple