Ap 209 Form

What is the AP 209?

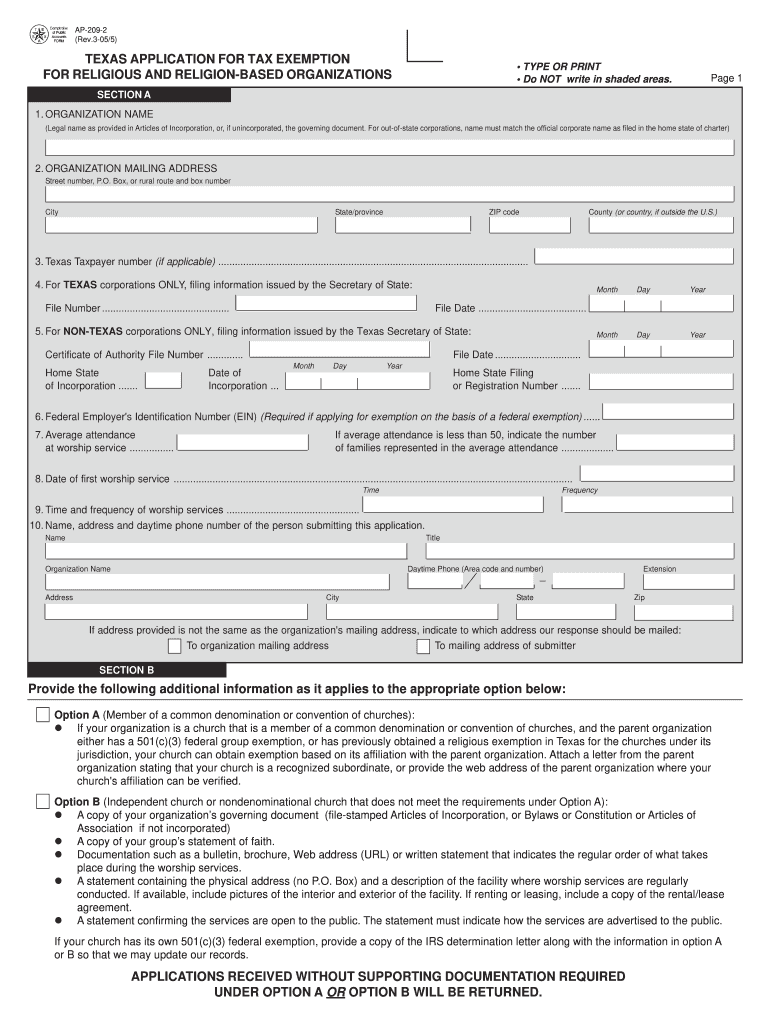

The AP 209 form is a specific document used in various administrative processes. It is essential for individuals and businesses to understand its purpose and implications. This form typically relates to certain applications, claims, or notifications required by governmental or regulatory bodies. Knowing the details of the AP 209 can help ensure compliance and facilitate smoother interactions with these entities.

How to Use the AP 209

Using the AP 209 form involves several steps to ensure it is filled out correctly and submitted appropriately. Begin by reviewing the requirements for the specific application or process associated with the form. Gather all necessary information and documentation before starting. Once you have everything ready, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before submission.

Steps to Complete the AP 209

Completing the AP 209 form requires attention to detail. Follow these steps for a successful submission:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation, such as identification or supporting documents.

- Fill out the form, ensuring all information is accurate and complete.

- Review your entries for any mistakes or missing information.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the AP 209

The legal use of the AP 209 form is essential for its validity. To be considered legally binding, the form must meet specific criteria set forth by relevant laws and regulations. This includes ensuring that all signatures are properly executed and that the form is submitted within the required timeframes. Understanding the legal implications of the AP 209 can help individuals and businesses avoid potential disputes or issues.

Key Elements of the AP 209

Several key elements are crucial when dealing with the AP 209 form. These include:

- Accurate identification of the applicant or entity submitting the form.

- Clear description of the purpose of the form and the specific request being made.

- Signature and date fields that must be completed to validate the submission.

- Any additional documentation or evidence required to support the application.

Form Submission Methods

The AP 209 form can typically be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission through designated portals.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Examples of Using the AP 209

Understanding real-world applications of the AP 209 form can provide valuable context. For instance, it may be used in scenarios such as:

- Applying for specific permits or licenses required by local authorities.

- Submitting claims for benefits or assistance from government programs.

- Notifying relevant agencies about changes in business operations or ownership.

Quick guide on how to complete ap 209

Complete Ap 209 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Ap 209 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Ap 209 smoothly

- Obtain Ap 209 and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ap 209 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ap 209

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ap 209 and why is it important?

Form ap 209 is a critical document used in various business transactions to ensure proper authorization and compliance. By utilizing form ap 209, businesses can streamline their processes and maintain accurate records, which is essential for operational efficiency.

-

How does airSlate SignNow simplify the use of form ap 209?

airSlate SignNow provides an intuitive platform for electronically signing and managing form ap 209, reducing paperwork and enhancing speed. With its user-friendly interface, users can easily fill out, sign, and send form ap 209 within minutes.

-

What are the pricing options for using airSlate SignNow with form ap 209?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes that require form ap 209 handling. By choosing the right plan, users can enjoy cost-effective access to features tailored for electronic signatures and document management.

-

Can I customize form ap 209 using airSlate SignNow?

Yes, airSlate SignNow allows users to customize form ap 209 by adding fields, branding, and instructions to meet their specific needs. This customization ensures that the form remains relevant and serves its intended purpose effectively.

-

Is airSlate SignNow secure for handling form ap 209?

Absolutely, airSlate SignNow employs robust security measures to protect sensitive information while handling form ap 209. The platform uses encryption and secure storage to maintain the integrity and confidentiality of all documents.

-

What integrations does airSlate SignNow offer for form ap 209?

airSlate SignNow seamlessly integrates with various third-party applications, making it easy to automate workflows involving form ap 209. Users can connect with tools such as CRM systems, Google Drive, and others to enhance their document management capabilities.

-

What benefits can businesses expect from using form ap 209 with airSlate SignNow?

Using form ap 209 with airSlate SignNow offers businesses increased efficiency, reduced turnaround times, and improved collaboration. The electronic signature feature further enhances the process by allowing quick approvals and secure transactions.

Get more for Ap 209

- Kentucky permanent custody form

- Oklahoma tax commission return form

- Apply for yourself or someone else a blue badge will cost 10 form

- 1040 nr schedule oi form

- Cao change mind form 549358695

- International fuel tax agreement ifta tax return information and instructions

- Print or type the information in ink

- North carolina emergency services form

Find out other Ap 209

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free