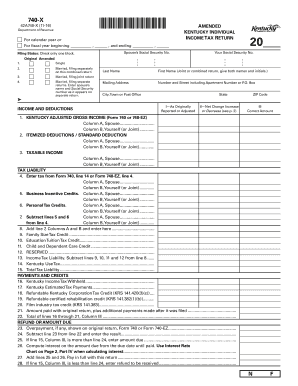

740 X Form 2016

What is the 740 X Form

The 740 X Form is a tax amendment form used by individuals in the United States to correct or change previously filed tax returns. This form allows taxpayers to report any adjustments to their income, deductions, or credits that may have been overlooked or misreported on their original filings. By using the 740 X Form, taxpayers can ensure their tax records are accurate and compliant with Internal Revenue Service (IRS) regulations.

How to use the 740 X Form

Using the 740 X Form involves several steps to ensure proper completion and submission. First, gather all necessary documentation related to the original tax return, including any supporting documents for the changes being made. Next, accurately fill out the form, clearly indicating the changes in the appropriate sections. It is essential to provide a detailed explanation of why the amendment is necessary. Once completed, the form can be submitted either electronically or by mail, depending on the specific requirements set by the IRS.

Steps to complete the 740 X Form

Completing the 740 X Form involves a systematic approach:

- Review the original tax return and identify the areas needing correction.

- Obtain the 740 X Form from the IRS website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly state the changes being made, providing specific details and reasons for each adjustment.

- Attach any necessary documentation that supports your amendments.

- Sign and date the form before submission.

Legal use of the 740 X Form

The 740 X Form is legally recognized as a valid means for taxpayers to amend their tax returns in the United States. It is crucial for individuals to ensure that all information provided on the form is accurate and truthful, as any discrepancies can lead to penalties or legal issues. The IRS allows the use of this form to promote transparency and compliance in tax reporting, making it an essential tool for rectifying past mistakes.

Filing Deadlines / Important Dates

Timely filing of the 740 X Form is important to avoid penalties. Generally, the form must be submitted within three years of the original return's due date or within two years of the date the tax was paid, whichever is later. It is advisable to keep track of these deadlines to ensure compliance and avoid potential interest charges on any unpaid taxes resulting from the amendments.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 740 X Form. It can be filed electronically through the IRS e-file system if eligible, which provides a faster processing time. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location and whether a refund is expected. In-person submission is typically not available for this form, making electronic and mail options the primary methods for filing.

Quick guide on how to complete 740 x 2016 2018 form

Your assistance manual on how to prepare your 740 X Form

If you're interested in learning how to complete and submit your 740 X Form, here are some straightforward instructions on how to make tax filing less challenging.

To begin, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and return to modify answers as needed. Simplify your tax administration with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to complete your 740 X Form in just a few minutes:

- Create your account and start working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through variants and schedules.

- Click Get form to open your 740 X Form in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding electronic signature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Take advantage of this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can increase errors and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 740 x 2016 2018 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How can we simplify [math]\frac{1+x+x^2+x^3+…+x^{2018}}{1+x^3+x^6+…+x^{2016}}[/math]?

Let [math]a_n[/math] be a progression that is defined by [math]a_n=x^{n-1}[/math], where x is some real number. This progression can be easily proven to be geometric:[math]\frac{a_{n+1}}{a_n}=\frac{x^n}{x^{n-1}}=x[/math]The first term, [math]a_1[/math], would be [math]a_1=x^{1-1}=x^0=1[/math] (we know from the laws of exponents that [math]x^0=1[/math] for every real number; except zero)The second term, [math]a_2[/math], would be [math]a_2=x^{2-1}=x[/math].The third term, [math]a_3=x^{3-1}=x^2[/math], and by that same logic, [math]a_4[/math] would be [math]x^3[/math], and so on and so forth… till we signNow [math]a_{2019}[/math], which can be computed by the formula, too: [math]a_{2019}=x^{2019-1}=x^{2018}[/math].Let the sum of the first 2019 terms in our progression [math]a_n[/math] be denoted by T, so T would be:[math]T\:=\:a_1+a_2+a_3+a_4\:+...\:+\:a_{2019}\:=\:1+x+x^2+x^3+...+x^{2018}[/math]T is actually equal to the numerator of the fraction we’ve been given to simplify! Since [math]a_n[/math] is a geometric progression, there’s actually a way to greatly simplify T, using the formula for the sum of a geometric progression (Geometric progression - Wikipedia):[math]T=\frac{a_1\left(1-x^{2019}\right)}{1-x}=\frac{1-x^{2019}}{1-x}[/math]In the same way, we can define a second progression, [math]b_n[/math], as [math]b_n=x^{3\left(n-1\right)}[/math]. It can be easily proven to be geometric, too (with a ratio of [math]x^3)[/math]just as we’ve proven [math]a_n[/math] to be so. By simple plugging, we can see that:[math]b_1=x^{3\cdot 0}=x^0=1[/math][math]b_2=x^{3\left(2-1\right)}=x^{3\cdot 1}=x^3[/math][math]b_3=x^{3\left(3-1\right)}=x^{3\cdot 2}=x^6[/math][math]b_{673}=x^{3\left(673-1\right)}=x^{3\cdot 672}=x^{2016}[/math]So, if we denote the sum of the first 673 terms of progression[math] b_n [/math]as G, we can see that: [math]G\:=\:b_1+b_2+b_3+...+b_{673}=1+x^3+x^6+...+x^{2016}[/math], which is equal to the denominator of the given fraction. Since [math]b_n[/math] is a geometric progression, we can simplify G in the same way we simplified T:[math]G=\frac{b_1\left(1-x^{{3\cdot }^{673}}\right)}{1-x^3}=\frac{1-x^{2019}}{1-x^3}[/math]And so, we can bring our fraction to the following state:[math]\frac{1+x+x^2+x^3+\dots +x^{2018}}{1+x^3+x^6+\dots +x^{2016}}\:=\:\frac{T}{G}=\frac{\frac{1-x^{2019}}{1-x}}{\frac{1-x^{2019}}{1-x^3}}=\frac{1-x^3}{1-x}[/math]Using the difference of cubes formula, [math]a^3-b^3=\left(a-b\right)\left(a^2+ab+b^2\right)[/math], we can simplify it to be:[math]\frac{1-x^3}{1-x}\:=\:\frac{\left(1-x\right)\left(1+x+x^2\right)}{1-x}\:=1+x+x^{2\:}[/math]

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How much will be the fee to fill out the XAT form?

The XAT Registration fee is Rs. 1700(late fee Rs. 2000). This is had increased from last year.If you want to apply for XLRI programmes then pay additional Rs.300 (late fee Rs. 500)The last date for registration is 30th Nov 2018. The exam is on 6th Jan 2019.All the best

Create this form in 5 minutes!

How to create an eSignature for the 740 x 2016 2018 form

How to create an electronic signature for your 740 X 2016 2018 Form online

How to make an eSignature for the 740 X 2016 2018 Form in Chrome

How to create an eSignature for putting it on the 740 X 2016 2018 Form in Gmail

How to generate an electronic signature for the 740 X 2016 2018 Form from your smartphone

How to make an electronic signature for the 740 X 2016 2018 Form on iOS devices

How to create an electronic signature for the 740 X 2016 2018 Form on Android devices

People also ask

-

What is the 740 X Form and how can it benefit my business?

The 740 X Form is a customizable document template designed for streamlined signing and document management. By utilizing the 740 X Form, businesses can enhance their workflow efficiency and ensure secure electronic signatures, making document handling faster and more effective.

-

How much does it cost to use the 740 X Form with airSlate SignNow?

Pricing for the 740 X Form within airSlate SignNow varies based on your subscription plan. We offer different tiers that cater to various business sizes and needs, ensuring that you find a cost-effective solution that includes the features you require for the 740 X Form.

-

Can I integrate the 740 X Form with other applications?

Yes, the 740 X Form can be easily integrated with a variety of applications, enhancing its functionality. airSlate SignNow supports integrations with popular tools like Google Drive, Salesforce, and Microsoft Office, allowing for seamless document management and signing processes.

-

What features are included with the 740 X Form?

The 740 X Form comes with a range of features including customizable fields, automated workflows, and real-time tracking. These features enhance the overall signing experience and ensure that your documents are handled efficiently and securely.

-

Is the 740 X Form secure for sensitive information?

Absolutely! The 740 X Form is designed with security in mind, utilizing encryption and compliance with industry standards to protect sensitive information. This makes it a reliable choice for businesses that need to manage confidential documents safely.

-

How can the 740 X Form improve my team's productivity?

By using the 740 X Form, your team can expedite the signing process, reducing the time spent on paperwork. Its intuitive design and automation features allow for quick document sharing and signing, which ultimately boosts overall productivity.

-

Is there a trial available for the 740 X Form?

Yes, airSlate SignNow offers a free trial for the 740 X Form, allowing you to explore its features and benefits before committing. This trial gives you an opportunity to see how the 740 X Form can fit into your business operations.

Get more for 740 X Form

- Fire service application form pdf

- Adams county inmate search form

- Chp 398 form

- Takeout cfd 600 form

- K 5 permit application food service establishments edited 110309doc form

- Baltimore county temporary food permit online payment form

- Instructions for handwritten forms guidelines

- Filing requirements corporate income ampamp franchise tax form

Find out other 740 X Form

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast