Lst Exemption Form

What is the Lst Exemption Form

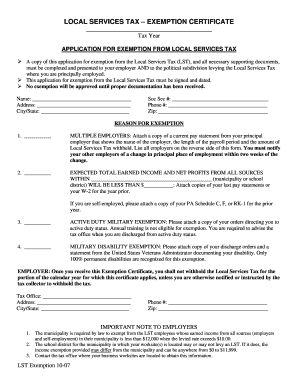

The Lst Exemption Form is a crucial document used primarily for tax purposes in the United States. It allows eligible individuals or businesses to claim an exemption from certain taxes, thereby reducing their overall tax liability. This form is typically utilized by those who meet specific criteria set forth by the IRS or state tax authorities. Understanding the purpose and function of the Lst Exemption Form is essential for ensuring compliance and optimizing tax benefits.

Steps to complete the Lst Exemption Form

Completing the Lst Exemption Form involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary information: Collect all required documentation, including identification details and financial information relevant to the exemption.

- Fill out the form: Carefully enter all required fields, ensuring that the information is accurate and complete.

- Review the form: Double-check all entries for errors or omissions to avoid delays in processing.

- Sign the form: Ensure that the form is signed appropriately, as an unsigned form may be deemed invalid.

- Submit the form: Follow the designated submission method, whether online, by mail, or in-person, as per the guidelines.

Legal use of the Lst Exemption Form

The legal use of the Lst Exemption Form is governed by specific regulations that outline eligibility criteria and submission processes. It is important to adhere to these regulations to ensure that the form is legally binding. The form must be completed accurately and submitted within the designated timeframes to avoid penalties. Additionally, maintaining records of the submitted form and any supporting documents is advisable for future reference and compliance verification.

Eligibility Criteria

Eligibility for using the Lst Exemption Form varies based on specific tax regulations and individual circumstances. Generally, individuals or businesses that meet certain income thresholds or qualify under particular tax codes may be eligible. It is essential to review the criteria outlined by the IRS or relevant state authorities to determine if you qualify for the exemption. Failure to meet these criteria may result in the denial of the exemption and potential penalties.

Form Submission Methods

The Lst Exemption Form can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online: Many jurisdictions allow for electronic submission of the form through secure portals, providing a quick and efficient option.

- By mail: Traditional mailing is still an option, where the completed form is sent to the appropriate tax office.

- In-person: Some individuals may prefer to submit the form in person at local tax offices, allowing for immediate confirmation of receipt.

Required Documents

When completing the Lst Exemption Form, it is important to have the necessary documents ready to support your claim. Required documents may include:

- Proof of identity: Such as a driver's license or Social Security card.

- Financial records: Documentation that verifies income and expenses relevant to the exemption.

- Previous tax returns: To provide context and support for your current exemption claim.

Quick guide on how to complete lst exemption form

Complete Lst Exemption Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without complications. Manage Lst Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to amend and eSign Lst Exemption Form with ease

- Find Lst Exemption Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Lst Exemption Form to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lst exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the lst exemption form and how is it used?

The lst exemption form is a critical document used to claim exemptions from certain taxes or fees. It simplifies the process for businesses and individuals by providing a clear framework to avoid unnecessary payments. Understanding how to fill out and submit this form can greatly benefit organizations seeking to optimize their financial responsibilities.

-

How can airSlate SignNow help me with the lst exemption form?

airSlate SignNow streamlines the process of completing and signing the lst exemption form electronically. With our easy-to-use platform, you can quickly fill out, eSign, and send the form without the hassles of printing and mailing. This not only saves time but also enhances security by ensuring that your documents are securely stored and easily accessible.

-

Are there any costs associated with using airSlate SignNow for the lst exemption form?

Using airSlate SignNow for the lst exemption form is a cost-effective solution compared to traditional methods. We offer various pricing plans to cater to different business needs, ensuring you get the features required for efficient document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the lst exemption form?

airSlate SignNow offers a host of features to simplify managing the lst exemption form, including customizable templates, automated workflows, and secure cloud storage. Our platform allows you to track the status of your forms in real-time and send reminders for pending signatures. These features collectively enhance productivity and reduce paperwork.

-

Can I integrate airSlate SignNow with other software to handle the lst exemption form?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to incorporate the lst exemption form into your existing workflows. Whether you use CRM systems, document management tools, or cloud storage solutions, our platform can connect to streamline your processes efficiently.

-

Is there customer support available for issues related to the lst exemption form?

Absolutely! airSlate SignNow provides comprehensive customer support for all users navigating the lst exemption form. Our dedicated team is available to assist you with any questions or issues you might encounter. You can signNow out via chat, email, or phone for prompt assistance.

-

What benefits can I expect from using airSlate SignNow for the lst exemption form?

Using airSlate SignNow for the lst exemption form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. The ability to eSign directly within the platform eliminates the delays associated with traditional paper forms. Additionally, the tracking features ensure you stay updated on your document's progress.

Get more for Lst Exemption Form

Find out other Lst Exemption Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast