1120 S Capital 2021

What is the 1120 S Capital

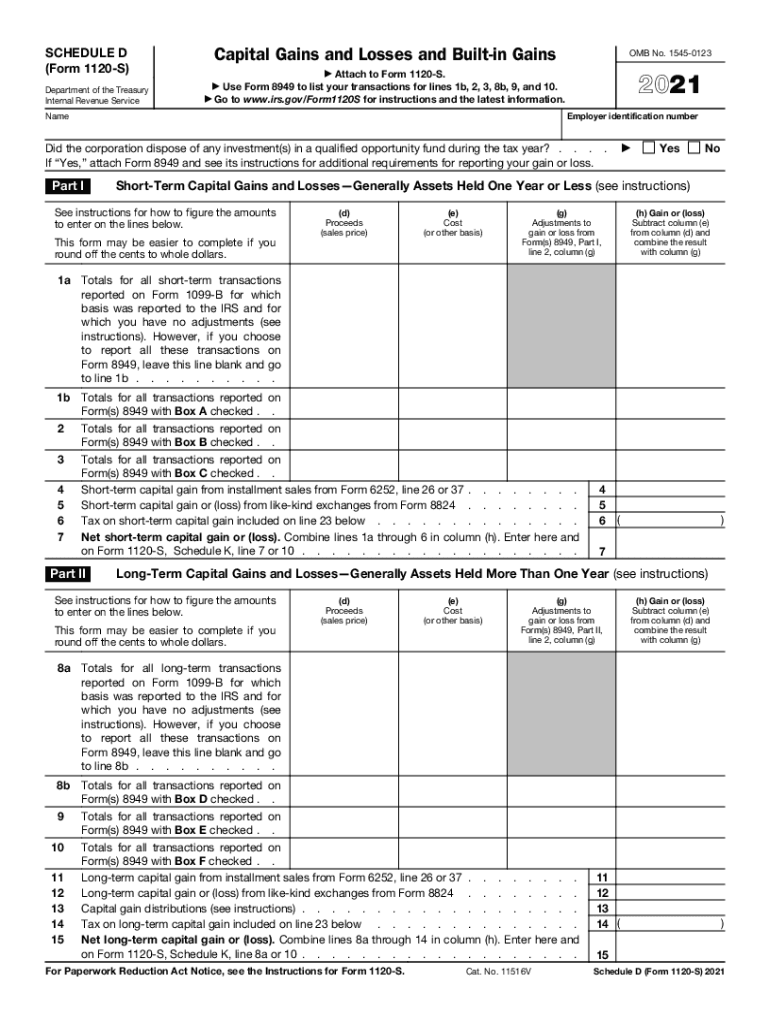

The 1120 S Capital refers to the capital gains and losses reported by S corporations on IRS Form 1120-S. This form is essential for S corporations to report income, deductions, and credits, allowing shareholders to report their share of the corporation's income on their personal tax returns. Understanding the components of this form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the 1120 S Capital

Completing the 1120 S Capital involves several key steps:

- Gather necessary financial records, including income statements and expense reports.

- Calculate total capital gains and losses for the tax year.

- Fill out the appropriate sections of IRS Form 1120-S, specifically focusing on the capital gains and losses section.

- Ensure all calculations are accurate and supported by documentation.

- Review the completed form for any errors before submission.

IRS Guidelines

The IRS provides specific guidelines for reporting capital gains and losses on Form 1120-S. It is essential to follow these guidelines to ensure compliance. Key points include:

- Report all capital transactions accurately, including both short-term and long-term gains.

- Use the correct tax rates applicable to the gains reported.

- Maintain records of all transactions for at least three years in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 1120-S are crucial for compliance. Generally, the form must be filed by the 15th day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the 1120 S Capital accurately, several documents are required:

- Financial statements, including balance sheets and income statements.

- Records of all capital transactions, including purchase and sale agreements.

- Previous year’s tax returns for reference.

- Any additional documentation that supports deductions or credits claimed.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the 1120 S Capital can result in significant penalties. These may include:

- Monetary fines for late filing or inaccurate reporting.

- Interest on unpaid taxes.

- Potential audits that could lead to further scrutiny of the corporation's financial practices.

Digital vs. Paper Version

When completing the 1120 S Capital, businesses can choose between digital and paper submission. The digital version allows for easier calculations and faster submission, while the paper version may be preferred by those who are not comfortable with technology. Both methods require adherence to IRS guidelines to ensure that the form is processed correctly.

Quick guide on how to complete 1120 s capital

Prepare 1120 S Capital effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage 1120 S Capital on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and electronically sign 1120 S Capital with ease

- Obtain 1120 S Capital and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize critical sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and electronically sign 1120 S Capital and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120 s capital

Create this form in 5 minutes!

People also ask

-

What is IRS Schedule D capital?

IRS Schedule D capital refers to the form used by investors to report capital gains and losses from the sale of securities and assets. It's essential for accurate tax reporting and can signNowly affect your overall tax liability. Understanding how to fill out IRS Schedule D capital is important for anyone engaging in investment activities.

-

How does airSlate SignNow support the completion of IRS Schedule D capital forms?

airSlate SignNow simplifies the eSigning and document workflow process, making it easy to send and sign IRS Schedule D capital forms. With our platform, you can securely share necessary documents and ensure timely signatures, which is crucial for meeting tax deadlines. Our user-friendly interface helps users navigate the form efficiently.

-

What pricing plans does airSlate SignNow offer for businesses handling IRS Schedule D capital?

airSlate SignNow offers flexible pricing plans tailored to business needs, making it a cost-effective solution for managing IRS Schedule D capital forms. Whether you're a small business or a large enterprise, airSlate SignNow provides options that fit various budgets. Additionally, you can take advantage of a free trial to assess the features before committing.

-

What features does airSlate SignNow provide for IRS Schedule D capital documents?

airSlate SignNow offers robust features such as template creation, real-time tracking, and document collaboration specifically for IRS Schedule D capital documents. Users can automate workflows and ensure compliance by utilizing our advanced signing options. These features streamline the process and reduce the risk of errors during tax season.

-

Can airSlate SignNow integrate with accounting software for IRS Schedule D capital management?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, which is beneficial for managing IRS Schedule D capital. These integrations facilitate easy access to your financial data, making it simpler to generate and submit required forms. By leveraging this connectivity, businesses can enhance their overall efficiency and accuracy in tax reporting.

-

What benefits does airSlate SignNow provide for businesses preparing IRS Schedule D capital?

Using airSlate SignNow helps businesses prepare IRS Schedule D capital forms more efficiently and securely. The platform enhances productivity by reducing paper usage and turnaround time for document signing. Additionally, the electronic records provide a clear audit trail, helping users maintain compliance with IRS regulations.

-

Is airSlate SignNow suitable for freelancers dealing with IRS Schedule D capital?

Absolutely, airSlate SignNow is an excellent tool for freelancers who need to manage IRS Schedule D capital forms. Its affordability and ease of use make it ideal for individual professionals handling their tax responsibilities. Freelancers can also benefit from the ability to send and sign documents on the go, ensuring they stay organized and compliant.

Get more for 1120 S Capital

Find out other 1120 S Capital

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer