De 3bhw 2010

What is the De 3bhw

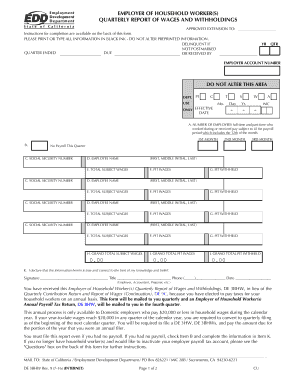

The De 3bhw form is a specific document used in various administrative and legal contexts. It serves as a formal request or declaration, often required by government agencies or organizations. Understanding its purpose is essential for individuals and businesses alike, as it ensures compliance with regulatory requirements. The form is designed to capture necessary information that may pertain to tax obligations, business operations, or personal declarations.

How to use the De 3bhw

Using the De 3bhw form involves several straightforward steps. First, gather all necessary information that the form requires, which may include personal identification details, financial data, or other relevant documentation. Next, fill out the form accurately, ensuring that all fields are completed to avoid delays. After completing the form, review it for any errors before submission. Depending on the requirements, you may need to submit it online, by mail, or in person to the appropriate authority.

Steps to complete the De 3bhw

Completing the De 3bhw form requires careful attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand what information is required.

- Gather all necessary documents and data before starting to fill out the form.

- Complete each section of the form, ensuring accuracy in your entries.

- Review the form for any mistakes or omissions.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the De 3bhw

The legal use of the De 3bhw form is crucial for ensuring that the information provided is recognized by relevant authorities. Compliance with legal standards is necessary for the form to be considered valid. This includes adherence to eSignature laws and regulations, which dictate how electronic signatures and submissions are handled. Utilizing a reliable digital platform can enhance the legal standing of your submission, ensuring that it meets all required legal frameworks.

Key elements of the De 3bhw

Several key elements define the De 3bhw form and its effectiveness. These elements include:

- Identification Information: Personal or business details that identify the signer.

- Signature Requirements: Specifications regarding how signatures must be captured and validated.

- Submission Guidelines: Instructions on how and where to submit the completed form.

- Compliance Statements: Declarations that affirm adherence to relevant laws and regulations.

Who Issues the Form

The De 3bhw form is typically issued by governmental agencies or specific organizations that require the information contained within it. Depending on the context, this may include federal, state, or local authorities. It is important to verify the issuing body to ensure that you are using the correct version of the form and following the appropriate procedures for submission.

Quick guide on how to complete de 3bhw

Complete De 3bhw effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage De 3bhw on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

The simplest way to alter and eSign De 3bhw with ease

- Obtain De 3bhw and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign De 3bhw and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de 3bhw

Create this form in 5 minutes!

How to create an eSignature for the de 3bhw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the de 3bhw feature in airSlate SignNow?

The de 3bhw feature in airSlate SignNow allows users to effortlessly send and eSign documents using a streamlined process. This feature simplifies document management and enhances workflow efficiency, making it an essential tool for businesses. With de 3bhw, you can manage your documents with ease and flexibility.

-

How much does airSlate SignNow with de 3bhw cost?

airSlate SignNow offers competitive pricing plans that include access to the de 3bhw feature. Plans are designed to fit various business needs and budgets, making it a cost-effective solution. You can choose from monthly or yearly subscriptions tailored to your requirements.

-

What are the key benefits of using de 3bhw in airSlate SignNow?

The key benefits of using de 3bhw in airSlate SignNow include enhanced document security, improved collaboration, and faster turnaround times. This feature allows businesses to streamline their signing processes while ensuring that their documents are secure. As a result, you can save time and reduce operational costs.

-

Can I integrate airSlate SignNow with other tools using de 3bhw?

Yes, airSlate SignNow with de 3bhw offers seamless integrations with various third-party applications, including CRM, project management, and cloud storage tools. This flexibility allows you to enhance your workflow and keep all your tools connected. Integration is straightforward and helps maximize productivity.

-

How secure is the de 3bhw feature in airSlate SignNow?

The de 3bhw feature in airSlate SignNow is built with robust security measures to protect your documents and data. It includes encryption and secure access protocols to ensure that your information remains confidential. You can trust that airSlate SignNow prioritizes security for all users.

-

Is there a mobile app available for de 3bhw users?

Yes, airSlate SignNow provides a mobile app that allows de 3bhw users to send and eSign documents on the go. The app is user-friendly and designed to replicate the desktop experience, providing functionality without compromise. Stay productive wherever you are with the mobile solution.

-

What types of documents can I manage with de 3bhw in airSlate SignNow?

With de 3bhw in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports numerous file formats, making it a versatile solution for any business's document needs. This flexibility ensures that all your document types are accommodated.

Get more for De 3bhw

- Control number ar p023 pkg form

- Nondisclosure agreement nda templates confidentiality form

- Control number tn008d form

- South carolina minor name change minor name change form

- Mississippi adult name change adult name change form

- Between hereinafter referred to as quotsellerquot and form

- Colorado notice to owner formfree downloadable template

- For and in consideration of the sum of seller agrees to sell and form

Find out other De 3bhw

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free