L4 Form

What is the L4 Form

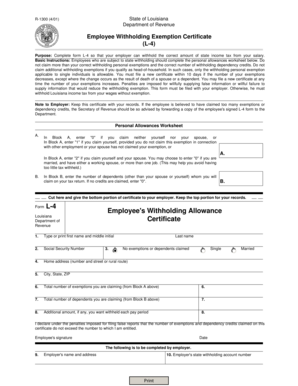

The L4 form is a tax document used in Louisiana for reporting employee withholding allowances. It is essential for employers to accurately determine the amount of state income tax to withhold from employees' wages. This form is particularly relevant for individuals who want to claim exemptions or adjust their withholding amounts based on their personal tax situation. Understanding the purpose and functionality of the L4 form is critical for both employers and employees to ensure compliance with state tax laws.

Steps to Complete the L4 Form

Completing the L4 form involves several straightforward steps. First, gather necessary personal information, including your name, address, and Social Security number. Next, you will need to indicate your filing status and any exemptions you wish to claim. Carefully review the instructions provided on the form to ensure you are filling it out correctly. Once completed, sign and date the form to validate it. Finally, submit the L4 form to your employer, who will use it to adjust your withholding accordingly.

Legal Use of the L4 Form

The L4 form is legally recognized as a valid document for tax withholding purposes in Louisiana. To ensure its legal standing, it must be completed accurately and submitted to the appropriate employer. Compliance with state regulations regarding the form is essential to avoid potential penalties. Additionally, employers are required to keep the L4 forms on file for record-keeping and audit purposes, reinforcing the importance of proper documentation.

How to Obtain the L4 Form

The L4 form can be obtained through various channels. It is available for download from the Louisiana Department of Revenue's official website. Alternatively, employers may provide copies of the form to their employees. It is also possible to request a physical copy from local tax offices or through tax preparation services. Ensuring you have the most current version of the form is crucial for accurate filing.

Filing Deadlines / Important Dates

Filing deadlines for the L4 form typically align with the start of the tax year or when an employee begins a new job. It is advisable for employees to submit the form as soon as they start employment to ensure correct withholding from their first paycheck. Additionally, any changes to personal circumstances that affect withholding should be communicated through a new L4 form promptly. Staying informed about these deadlines helps prevent issues with tax compliance.

Examples of Using the L4 Form

There are various scenarios in which the L4 form is utilized. For instance, a new employee may complete the form to establish their withholding preferences. An employee who recently married may need to adjust their withholding status by submitting a new L4 form. Additionally, individuals claiming exemptions due to specific circumstances, such as being a student or having multiple jobs, can use the L4 form to communicate their needs to their employer. Each of these examples highlights the form's role in ensuring accurate tax withholding.

Quick guide on how to complete l4 form 202046809

Complete L4 Form effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage L4 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest method to alter and eSign L4 Form with ease

- Obtain L4 Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate generating new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Alter and eSign L4 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l4 form 202046809

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l4 form and how can airSlate SignNow help?

The l4 form is an essential document used for various business purposes, including tax filings or employee records. With airSlate SignNow, you can easily create, send, and eSign l4 forms, ensuring a streamlined workflow and quick turnaround.

-

Is airSlate SignNow suitable for managing l4 forms?

Absolutely! airSlate SignNow is tailored to support the management of l4 forms among other documents. It provides useful features like templates and automated workflows that enhance the efficiency of handling these forms.

-

What are the pricing plans for using airSlate SignNow for l4 forms?

airSlate SignNow offers flexible pricing plans to fit various business needs, allowing you to manage l4 forms affordably. You can choose from different tiers based on the number of users and features required, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other software for handling l4 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications. This flexibility allows you to efficiently handle l4 forms within your existing tools, making your workflow even smoother.

-

What are the benefits of using airSlate SignNow for l4 forms?

Using airSlate SignNow for l4 forms offers signNow benefits such as increased efficiency, reduced errors, and faster processing times. The eSignature feature ensures that your forms are completed electronically, saving time and resources.

-

Is it safe to use airSlate SignNow for l4 forms?

Yes, airSlate SignNow prioritizes security, employing encryption and compliance measures to protect sensitive information within your l4 forms. You can trust that your documents are safe and secure throughout the signing process.

-

How can I track the status of my l4 forms in airSlate SignNow?

With airSlate SignNow's user-friendly dashboard, you can easily track the status of your l4 forms in real-time. This feature allows you to see who has viewed or signed the document, giving you full visibility into your workflow.

Get more for L4 Form

- Pennsylvania military family relief program application form

- Tdi application form

- Cmh scdhhsgov form

- Bhns new appointment forms black hills neurosurgery

- Black hills neurosurgery amp spine form

- Career shadow day wcsedu williamson county schools form

- Group health large and small employer requirements checklist form

- Condition of rental property checklistinstructions form

Find out other L4 Form

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement