8777729633 Form

Understanding the UWM Payoff Request

The UWM payoff request, also known as the United Wholesale Mortgage payoff request, is a formal document used to obtain the total amount needed to pay off a mortgage loan. This request is essential for homeowners who are selling their property, refinancing, or paying off their mortgage early. The payoff amount typically includes the remaining principal balance, interest accrued up to the payoff date, and any applicable fees.

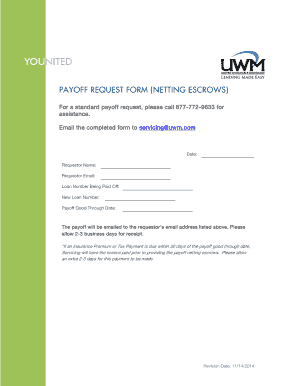

Steps to Complete the UWM Payoff Request

Completing the UWM payoff request involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your loan number, property address, and personal identification details. Next, fill out the payoff request form with the required information, ensuring all fields are completed accurately. Once the form is filled out, review it for any errors before submitting it to UWM. You can typically submit the request via email, fax, or through an online portal, depending on UWM's submission guidelines.

Legal Use of the UWM Payoff Request

The UWM payoff request is a legally binding document, provided it is completed and submitted according to the established guidelines. It is important to ensure that all information is accurate and that the request is sent to the appropriate department within UWM. Compliance with legal requirements ensures that the payoff request is processed efficiently, and the payoff amount is calculated correctly. This document may also be used in legal proceedings to establish the amount owed on the mortgage.

Required Documents for the UWM Payoff Request

When submitting a UWM payoff request, certain documents may be required to verify your identity and the details of your mortgage. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Loan documents or statements that detail the mortgage terms.

- Any prior correspondence with UWM regarding the mortgage.

Having these documents ready can help expedite the processing of your payoff request.

Who Issues the UWM Payoff Request

The UWM payoff request is issued by United Wholesale Mortgage, a leading mortgage lender in the United States. Homeowners or their representatives typically initiate the request to obtain the necessary payoff amount. UWM processes these requests to provide borrowers with the accurate financial information needed to manage their mortgage obligations effectively.

Examples of Using the UWM Payoff Request

The UWM payoff request can be utilized in various scenarios. For instance, if a homeowner is selling their property, they may need to request a payoff to determine how much will be owed at closing. Similarly, if a borrower is refinancing their mortgage, they will need the payoff amount to ensure that the new loan covers the existing debt. Additionally, those looking to pay off their mortgage early can use this request to find out the total amount needed to settle their account.

Quick guide on how to complete 8777729633

Accomplish 8777729633 seamlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, providing easy access to the correct form and secure online storage. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without interruptions. Manage 8777729633 on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 8777729633 with ease

- Find 8777729633 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal standing as a conventional ink signature.

- Verify all details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Adjust and electronically sign 8777729633 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8777729633

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a UWM payoff request?

A UWM payoff request is a formal process to obtain the outstanding balance on a loan from UWM. This request provides borrowers with the necessary information to settle their loans effectively, ensuring that they understand the total amount needed to pay off their debts.

-

How can airSlate SignNow help with UWM payoff requests?

AirSlate SignNow allows users to efficiently manage and eSign UWM payoff requests digitally. With our easy-to-use platform, you can streamline the process, ensuring that all necessary documentation is sent promptly and securely.

-

Is there a fee associated with submitting a UWM payoff request?

Typically, there are no fees directly associated with submitting a UWM payoff request through airSlate SignNow. However, it’s always best to check with your lender or UWM for any specific fees that may apply during the payoff process.

-

Can I track the status of my UWM payoff request?

Yes, airSlate SignNow provides tracking capabilities for your UWM payoff request. You can easily monitor the status of the request and receive notifications when the document has been processed or completed.

-

What types of documents can be included in a UWM payoff request?

When making a UWM payoff request, you can include any relevant documentation such as your loan statement and identification. AirSlate SignNow allows you to upload and eSign these documents seamlessly to ensure all necessary paperwork is included.

-

Is airSlate SignNow secure for handling UWM payoff requests?

Absolutely. AirSlate SignNow utilizes robust security measures, including encryption and secure cloud storage, to protect your UWM payoff request and personal information. You can trust us to keep your data safe throughout the eSigning process.

-

What benefits does airSlate SignNow offer for UWM payoff requests?

Using airSlate SignNow for UWM payoff requests provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our platform simplifies the request process, allowing you to focus on closing your financial matters without delays.

Get more for 8777729633

- Florida supreme court approved family law form 12927 notice of

- Florida supreme court approved family law form 12960 motion for

- If you are a victim of any act of domestic violence or have reasonable cause to believe that you are in form

- Florida supreme court approved family law form 12981a1

- Florida supreme court approved family law form 12981c2

- Petition to determine paternity and for related form

- Florida supreme court approved family law form 12983c answer

- Forms for pro se dissolution of marriage in seminoleeighteenth

Find out other 8777729633

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement