Rita Form 17

What is the Rita Form 17

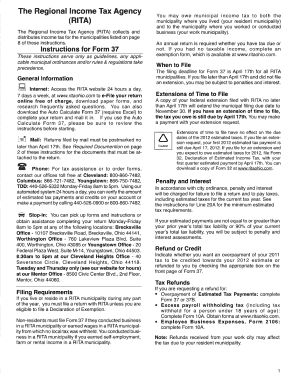

The Rita Form 17 is a regional income tax form used primarily by residents of Ohio. This form is essential for reporting income earned within the regional tax jurisdictions. It is particularly relevant for individuals who work in cities that impose local income taxes. The form collects information regarding the taxpayer's income, deductions, and tax liability, ensuring compliance with local tax regulations.

How to use the Rita Form 17

Using the Rita Form 17 involves several steps to ensure accurate reporting of income and tax obligations. First, gather all necessary financial documents, including W-2s and 1099s. Next, fill out the form by entering your personal information, income details, and any applicable deductions. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing electronic filing options can streamline the process and enhance accuracy.

Steps to complete the Rita Form 17

Completing the Rita Form 17 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents such as W-2 forms and other income statements.

- Enter your personal information, including name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy.

- Include any deductions or credits you are eligible for, which may reduce your tax liability.

- Calculate your total tax due based on the information provided.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, depending on your preference.

Legal use of the Rita Form 17

The Rita Form 17 is legally binding when completed and submitted according to the guidelines set forth by local tax authorities. To ensure its legal validity, it is crucial to provide accurate information and adhere to filing deadlines. Electronic submissions are recognized as legally binding, provided that they meet the requirements established by the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Form 17 typically align with the federal tax filing schedule. Taxpayers should be aware of the specific due dates for submission to avoid penalties. Generally, the form is due on the same day as federal income tax returns, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Who Issues the Form

The Rita Form 17 is issued by the Regional Income Tax Agency (RITA), which administers local income taxes for various municipalities in Ohio. RITA provides the necessary forms, instructions, and resources to assist taxpayers in fulfilling their local tax obligations. It is essential to use the most current version of the form to ensure compliance with any recent changes in tax laws or regulations.

Quick guide on how to complete rita form 17

Complete Rita Form 17 effortlessly on any device

Managing documents online has gained increased popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle Rita Form 17 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Rita Form 17 with ease

- Find Rita Form 17 and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring you to print new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Rita Form 17 and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rita form 17

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 17?

The rita form 17 is a specific document used for various business applications, including tax-related processes. With airSlate SignNow, you can easily create, edit, and send the rita form 17 for eSignature, streamlining your workflow.

-

How much does it cost to use airSlate SignNow for the rita form 17?

Pricing for using airSlate SignNow to manage the rita form 17 is competitive and designed to fit various business needs. You can choose from multiple subscription plans that cater to different usage levels, ensuring cost-effectiveness for your organization.

-

What features does airSlate SignNow offer for the rita form 17?

airSlate SignNow provides a variety of features for managing the rita form 17, including templates, customizable fields, and advanced eSignature capabilities. These tools help you efficiently handle documents while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software for the rita form 17?

Yes, airSlate SignNow allows for seamless integrations with various software solutions, enhancing your ability to manage the rita form 17. Whether you use CRM systems or document management tools, integration options are available to improve your workflow.

-

How does airSlate SignNow ensure the security of the rita form 17?

Security is a top priority at airSlate SignNow. When handling the rita form 17, your documents are safeguarded with robust encryption protocols and compliance with industry standards, giving you peace of mind that your data is protected.

-

What are the benefits of using airSlate SignNow for the rita form 17?

Using airSlate SignNow for the rita form 17 offers numerous benefits, including faster turnaround times, reduced printing and mailing costs, and improved document management. These advantages make it an efficient choice for businesses looking to enhance their signing process.

-

Can I track the status of my rita form 17 in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your rita form 17. You can easily monitor the status of your document and receive notifications when it has been viewed or signed, allowing for better management of your workflow.

Get more for Rita Form 17

- Pdf faculty ampamp staff separation checklist human resources form

- Get the veterans co op certification request form drexeledu

- Quotkeyquotquotacademic appeal letter helpquotquottitlequotquotsample appeal form

- Health and human performance divisionalfred university

- Form ssa 3288 social security

- 2021 form usps ps 3602 r fill online printable fillable

- Federal employee csrs and fers retirement formssf 2801 federal employee csrs and fers retirement formssf 2801 retirement

- Consent to enter judgment for possession tenant vacates consent to enter judgment for possession tenant vacates form

Find out other Rita Form 17

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors